Risk versus reward is the main theme for the Trustnet editorial team with a clear disparity between the bargain-hunting optimists and methodically cautious pessimists among the group.

Bonds and defensive multi-asset funds are coupled with racier areas such as China, UK smaller companies and biotechnology.

Below, head of editorial Gary Jackson, Trustnet editor Jonathan Jones, news editor Emma Wallis and reporters Matteo Anelli, Jean-Baptiste Andrieux and Matthew Cook give their fund picks for 2024.

Please note these are personal views and should not be taken as investment advice.

Gary Jackson, head of editorial at FE fundinfo

Last year, I went with the crowd in choosing bonds for my 2023 pick, opting for the Janus Henderson Strategic Bond fund in the expectation that an interest rate-induced recession would spark a fixed income rally. It’s now clear that this did not take place and bonds underperformed for the bulk of 2023 as equity markets were pushed higher by the surging ‘Magnificent Seven’ stocks.

Fund managers seem to be over their fears that central banks will force the economy into recession – the latest Bank of America Global Fund Manager survey found 74% of asset allocators are now expecting a ‘soft’ or ‘no’ landing. However, I’m sticking with the same fund for 2024.

John Pattullo and Jenna Barnard, managers of the Janus Henderson Strategic Bond fund, have a more pessimistic view than the average investor, stating in their latest quarterly outlook that the portfolio is positioned for a ‘hard’ landing, or recession. “We do appear to be early in our stance,” they added.

I’m on the same page as Pattullo and Barnard, maintaining some scepticism that central banks can pull off using aggressive rate rises to curb inflation without tipping into recession. But even if that view is wrong (again), there are still reasons to believe that 2024 can be a strong year for fixed income – such as the likelihood that interest rates have peaked, expectations that the economy will slow even if recession is avoided, attractive bond valuations and the possibility of some rate cuts.

Jonathan Jones, editor at Trustnet

I have ‘ummed and aahed’ about this for some time, wondering whether to take on some risk (China/small-caps) or go with the safe approach (bonds). However, despite my cautious nature, this year I am going for it.

I have officially taken the small-cap mantle from former Trustnet Magazine editor Anthony Luzio, who backed UK smaller companies for the past three years. It is something that, more often than not, rooted him at the bottom of our tables each year.

My selection is the WS Gresham House UK Micro Cap fund, the portfolio I am considering adding to my daughter’s junior ISA next year. Managed by FE fundinfo Alpha Manager Ken Wotton, it uses a private equity approach to investing in listed small-caps, leveraging the firm’s extensive expertise in unquote companies.

With such an uncertain future, it would be unwise to predict macroeconomics, but from a fundamentals perspective smaller companies (and the UK in particular) are extremely cheap and could therefore re-rate.

Earlier this month, Wotton wrote how UK smaller companies often perform well after a recession, so if we have one next year, they could catch up strongly towards the end of 2024. Even so, if we avoid recession, experts seem to believe there is no one left to sell the UK, so the downside could be somewhat limited.

With my own savings I will be holding this fund for many years. For the purposes of this exercise, here’s hoping I’ve timed it right.

Emma Wallis, news editor at Trustnet

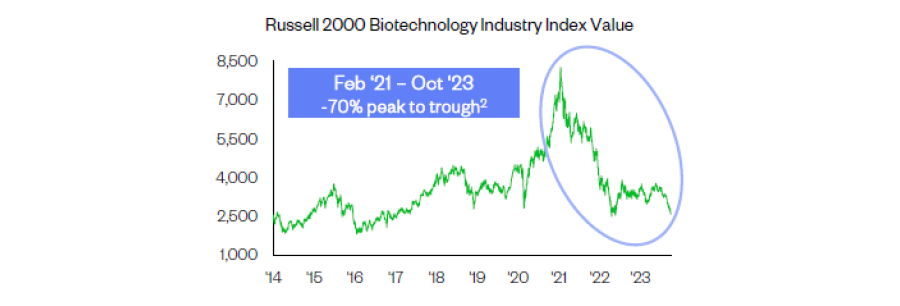

Biotech has rebounded strongly in the past six weeks, coming off the bottom of its second longest bear market in history from February 2021 to October 2023 on the back of one of the most aggressive rate hiking cycles in history. Valuations look attractive and innovation is flourishing on the back of developments in human genome sequencing.

Merger and acquisition activity is gathering pace as pharmaceutical companies, which are facing a patent cliff from 2025-2030, acquire biotech innovators to replace lost revenue.

Source: RTW Investments

Investment trusts such as RTW Biotech Opportunities, which is trading at a 28% discount to net asset value, have the potential for a double whammy if their underlying assets rally and the discount narrows. If rates have indeed peaked, that should be a tailwind for biotech stocks as well as the investment trust sector.

What particularly impressed me about RTW Investments is that the life sciences specialist has built a couple of companies from scratch.

Rocket Pharmaceuticals (the trust’s biggest position with a 16% weighting) is now the second largest gene therapy company in the world. RTW established Rocket in 2015 by collaborating with teams working on gene therapies in academic institutions and took it public in 2018.

Two years later, RTW founded JiXing in Shanghai to bring innovative medicines to patients in China with serious diseases. The trust has a 9% position JiXing and it is also leveraging RTW’s wider expertise by investing in an RTW-managed royalty financing strategy.

The biotech sector is volatile and should only be a small sliver in an adventurous investor’s portfolio, but with valuations in the bottom quartile of their historical range, I believe biotech has more upside than downside going forward.

Matteo Anelli, reporter at Trustnet

Sorry for the boring choice everyone, but I’ll stick with my Royal London Sustainable World Trust. It brought me luck the first time around, hopefully it’ll do the same this year.

It didn’t beat the MSCI World index over the past 12 months, but that doesn’t bother me too much. My hypothetical £1,000 would now be worth £1,112.17 and I’m content with that. Maybe I should be more greedy and aspire to make better returns elsewhere, but this time last year many were excited about Chinese growth – had I gone with an average China fund, I would now be left with £855.61.

Performance of funds vs indices over 12 months

Source: FE Analytics

So, because I’m only allowed to pick one fund and not a whole portfolio, the only way to diversify somewhat (and have a better chance of not losing money) is to go with a multi-asset fund.

Royal London Sustainable World Trust has a few things I like: it has solid environmental, sustainability and governance (ESG) screenings and could benefit if sentiment turns more positive on this area, it is valuation-aware at a time when so much of the market isn’t, and its fixed income allocation has more potential upside by holding corporate bonds that can be unrated, small in size or less liquid.

Jean-Baptiste Andrieux, reporter at Trustnet

The market had high expectations of Chinese equities at this time last year as China was about to finally lift its Covid restrictions. Yet, the much awaited rebound never materialised and Chinese equities recorded a third consecutive year of negative returns as a result.

Worse, economic data coming out of China has been weak, troubles in the property sector have intensified and the country is drifting into deflation.

In short, the picture for Chinese equities is all but rosy and the market is, therefore, not expecting much (if anything) from China in 2024. As a born contrarian, this is precisely the reason why I am keen on backing a Chinese equity fund this year.

And because I believe it is important to put your money where your mouth is, I will pick a fund I personally hold: Fidelity China Special Situations.

With a bias toward small- and mid-caps, some unlisted holdings and the use of gearing, this investment trust certainly makes for a risky cocktail, but that also means a greater potential upside if the Chinese market comes back with a vengeance next year.

Matthew Cook, reporter at Trustnet

For my first fund suggestion as a Trustnet reporter, I've decided that caution is the best policy and placed my investment flag in the multi-asset fund Troy Trojan.

During my first few weeks at Trustnet I have noticed market uncertainty seems to loom over the world, so I've chosen a well-established fund that prioritises stability.

Managed by Alpha Manager Sebastian Lyon and Charlotte Yonge, the £5.4bn fund encompasses four pillars: quality stocks, index-linked bonds, gold, and cash.

Around 10% of the portfolio's allocation to gold provides exposure to its potential while maintaining a balanced exposure to other asset classes. With gold tipped to continue its rally over 2024, I hope that Troy will not be a Trojan horse.

The Troy Trojan fund has a proven track record of consistently delivering returns that have outperformed equities with a significantly lower level of volatility.

While the fund may not match the short-term performance of the broader equity market due to the manager's cautious approach, it offers stability and the potential for long-term growth. So investors might benefit from a seasoned portfolio manager coupled with a new reporter exercising his beginner's luck.