Bonds have rallied in the past couple of months but still have plenty of potential to generate strong returns, according to the experts, as yields have come down from their peak but are still relatively high.

Kris Atkinson, who manages the Fidelity Sustainable MoneyBuilder Income and Fidelity Short Dated Corporate Bond funds, said in 2024 “hopefully – finally – we get our day in the sun or year in the sun and fixed income should be cool again having been out of fashion for a number of years”.

Meanwhile, dispersion between regions, sectors and issuers is expected to increase, opening up opportunities for active managers. After a long bear market where macroeconomics and interest rates dominated the outlook, fundamental credit analysis should come back to the fore next year.

In 2024, Atkinson expects “more disruption, more volatility and more opportunity – both to generate alpha and to mess up”.

Michael Krautzberger, head of fundamental fixed income in EMEA at BlackRock, concurred. “It’s good to be liked in the asset class for the first time in three years,” he said. Although “it’s pretty obvious that we have a lot of room to rally,” bond investors need to be diversified, selective and agile. “As an active manager, I enjoy this environment,” he added.

Of course, interest rates and inflation will continue to exert a dominant influence on bond markets for some time yet. Indeed, most agree that rates have peaked, which was the spark required for the recent rally after a three-year bear market in fixed income.

Bonds rally after a three-year bear market

Source: FE Analytics

Jamie Niven, senior fund manager at Candriam, extended duration ahead of the rally. “We were more aggressively positioned in duration than at any point over the past five years,” he recalled.

“My positioning is less aggressive now having benefitted nicely from the recent move. My duration is closer to neutral as I believe we could consolidate around these levels or possibly even revert slightly with some pushback on recent market pricing from some central bankers. Thereafter I believe the rally can continue so I would look to re-increase duration again.”

Opinions diverge as to the likelihood of hard versus a soft landing, as well as when central banks will start cutting and by how much. Niven thinks the resulting uncertainty will lead to volatility.

“We expect volatility as the market shifts between pricing soft landing and something more akin to recession,” he said. “We think avoidance of a hard landing will result in spreads stable to marginally wider. A hard landing could see quite extreme widening given the starting point.”

Either way, Niven expects default rates to pick up and dispersion between credits to increase, even if a soft landing is achieved.

Most fund managers suggest central banks will start easing monetary policy as inflation falls back to target and developed markets experience below-trend growth, although market pricing has run ahead of central bank rhetoric.

Nonetheless, fund managers also predicted that interest rates and inflation will remain higher than before the financial crisis and that the neutral rate (at which interest rates neither stimulate nor restrict the economy) has drifted upwards.

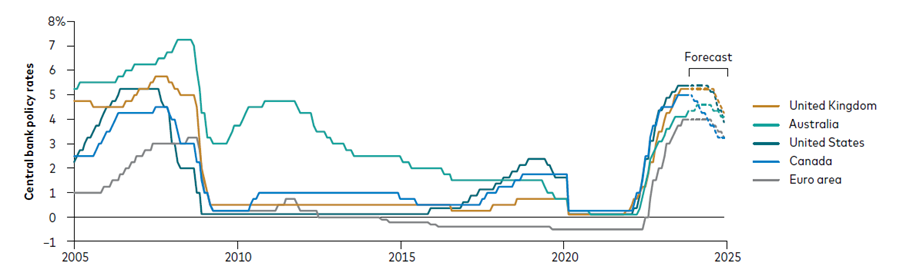

Joseph Davis, global chief economist at Vanguard, said: “Although policy rates are likely to be cut, we expect them to settle at a higher level than we’ve become accustomed to in recent years. By the end of 2025, we expect policy rates to be between 2.25% and 3.75% across major developed markets.”

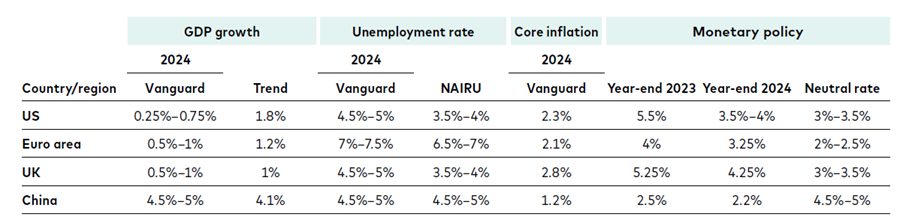

Vanguard’s forecasts for inflation and interest rates in 2024

Source: Vanguard

Rate cuts in 2024, but zero rates are behind us

Sources: Vanguard calculations based on data from Bloomberg, as at 30 November 2023

Western Asset’s chief investment officer Ken Leech disagrees. He expects inflation to fall back due to slowing growth and technology advancements and thinks the US Federal Reserve should react by cutting rates. Consequently, he recommends increasing duration.

“The Fed aims to keep rates high until inflation durably hits its target. However, historically the Fed has held off on rate cuts for too long. If the Fed repeats this mistake, sharper subsequent cuts would be needed. Either way, we believe overweighting duration is warranted,” Leech said.

While interest rates and yields are still relatively high, bonds provide an ample cushion to protect investors from any potential capital losses. Rate cuts would then trigger capital gains and the market has already begun to rally in anticipation of that.

Wei Li, global chief investment strategist at the BlackRock Investment Institute, said the “fixed income cushion” (which refers to how much rates need to move to offset a year of income) has “become more cushiony”.

“We’re getting abundant income across the spectrum,” Li added.