UK investors poured a record amount of cash into money market funds in 2023 as interest rates across the globe climbed, the latest Calastone figures show.

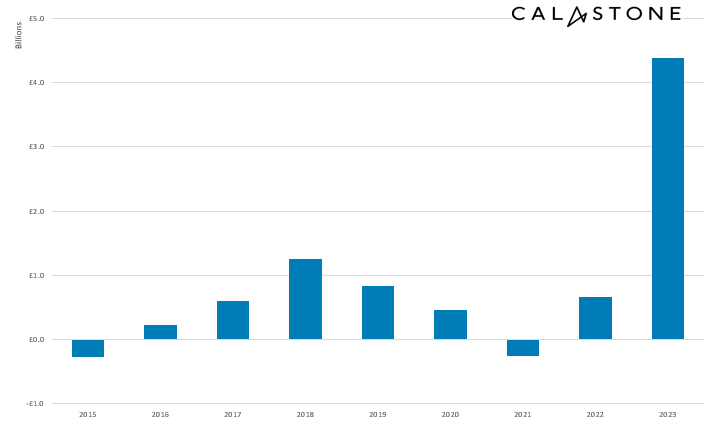

The group’s Fund Flow Index reveals that money market funds were the “big winners” of 2023 after capturing inflows of £4.4bn. This is more they took in during the previous eight years combined.

Investors had steered clear of money market funds for much of the recent past as ultra-low interest rates made them unattractive relative to higher-yielding assets.

Net flows to money market funds by calendar year

Source: Calastone Fund Flow Index – Dec 2023

However, Calastone head of global markets Edward Glyn added: “Money market funds are doing well for two reasons. First, they are a safe haven as they invest in very short-dated fixed income securities – such bonds redeem within weeks, so credit risk is minimal and yields are high just now.

“And secondly, the yield on money market funds is often well above what is available for cash on deposit at a bank, so they are drawing money away from the banking sector that might otherwise have idled in instant access savings.”

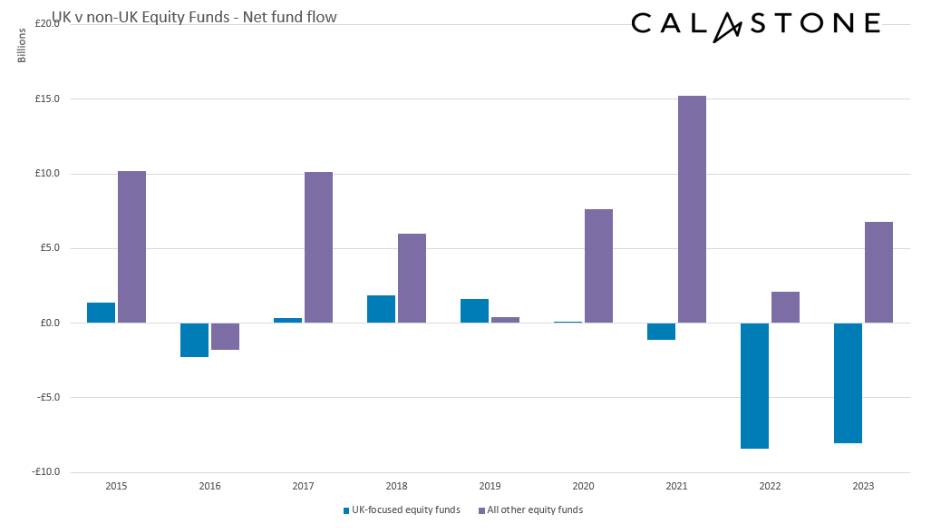

The picture was much different for equity funds, which suffered a net outflow for the second consecutive year because of continued aversion to the UK.

Investors pulled money from stocks in eight of 2023’s 12 months, on the back of volatile markets and economic uncertainty. In all, a net £1.2bn was redeemed from equity funds; this is an improvement on the £6.3bn that flowed out in 2022 but Calastone still labelled it “another tough year for the fund management industry”.

UK equity funds were highlighted for the consistent outflows. Last year was the third in a row when UK equity funds faced net redemptions while December 2023 was their 31st consecutive month of outflows.

So high were the outflows from UK equities that when their £8bn of redemptions are excluded from the 2023 total, there was a net inflow into all other kinds of equity funds.

Net flows to UK vs non-UK equity funds

Source: Calastone Fund Flow Index – Dec 2023

There was a bit of turnaround in December, when investors put £1.2bn into equity funds – this was the asset classes best month since April 2023 and the second-highest level in almost two-and-a-half years.

US and European equities were the main beneficiaries but global and emerging market funds also attracted inflows; UK strategies were the only geographical fund categories to have net outflows during the month.

Investors also put money into fixed income funds in December, to the tune of a net £283m inflow.

The picture for the whole of 2023 is mixed, however: a net inflow of £4.7bn between January and July put 2023 on course to be a record year for bond funds, but flows slowed over the summer and early autumn. Investors returned to the asset class “with relative caution” in November and December, but the asset class closed 2023 with a net inflow of £4.8bn - exactly in line with its long-run average.

Glyn said: “The past couple of months have seen a dramatic turnaround both in the markets and in fund flows as evidence of disinflation is showing up all over the place – and that means rates might next move downwards. Equities are back on the buy list and that very same fixed income trade – lock into high yield and look for capital gains – is back in vogue too.

“The outlook for 2024 is unusually unclear. Many central banks are reluctant to signal rate cuts are coming, though the markets are ignoring them for now. The extent of the economic slowdown in the UK and Europe, and whether the red-hot US can engineer a soft landing are also crucial to the outlook for asset prices – and fund flows.”