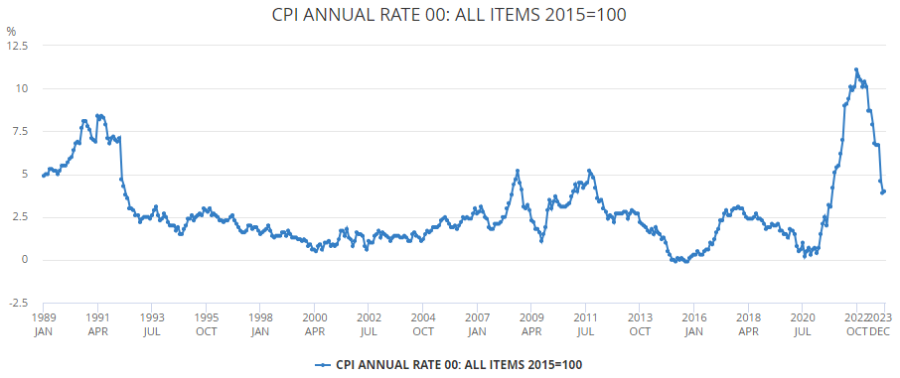

UK inflation – measured by the consumer prices index (CPI) – rose to 4% in December, up slightly from the 3.9% reading the month before, according to data from the Office for National Statistics, following the same pattern as the US and Europe, where price rises were also steeper towards the end of the year.

The largest contribution to the monthly change came from alcohol and tobacco, after the government announced higher taxes in the Autumn Statement. It was partially offset by a price fall in food and non-alcoholic beverages.

Core CPI – excluding energy, food, alcohol and tobacco – also remained relatively high in the final month of 2023 at 5.1%, the same reading as November, as services inflation remained elevated.

Source: The Office for National Statistics

Experts were quick to warn that the battle against high inflation was never going to be a straight line, with Richard Carter, head of fixed interest research at Quilter Cheviot, noting that the situation remains “precarious”.

The news comes after the UK economy was left on the cusp of a technical recession, following weak GDP figures for December. This had prompted some to believe the Bank of England would cut rates sooner to protect the economy. Inflation figures could quieten this view.

“Progress is likely to be slow, so the Bank may resist making rate cuts until inflation returns to a more palatable level,” said Carter, adding that events in the Red Sea could have a further impact on consumer prices in the coming weeks.

Michael Browne, chief investment officer at Martin Currie, said the latest “surprisingly high” figures are a setback but the overarching trajectory is still towards lower inflation. “The direction of inflation is clear but as ever one-month statistics can and will surprise,” he said.

Another expert with a more optimistic view was Melanie Baker, senior economist at Royal London Asset Management. She argued the data was “not as bad as it looks”.

“Just as for the November data, when the downside surprise in inflation wasn’t as good as it looks, today’s upside surprise for the December data isn’t as bad as it looks – at least in terms of what it implies for underlying inflation trends,” she said.

However, she added that it will “probably take a while, and quite a bit more evidence, for the Monetary Policy Committee (MPC) to feel convinced that inflation is going to sustainably return to 2%”, suggesting the first rate cut would be in the second half of this year.

Others were more concerned. AJ Bell head of financial analysis Danni Hewson said although the move higher was “tiny”, she added that “psychologically it’s a mountain”.

Many would have hoped for an easing to the cost-of-living crisis, but the latest figures will be a particular disappointment, especially as the situation in the Red Sea is yet to be factored into the data.

“People know prices are still rising, you can’t do your weekly shop without accepting that, but the moment at the checkout when the cashier tots up the damage had begun to feel a little less overwhelming,” she said.