Equities have thrived over the past 15 years, especially US and high quality European stocks, as they have benefited from a prolonged period of low interest rates. After a blip in 2022, the equity market bounced back in 2023, recovering some of the losses from the previous year.

Yet, Charlotte Yonge, assistant fund manager of Personal Assets Trust, warned that the equity market is not factoring in a recession.

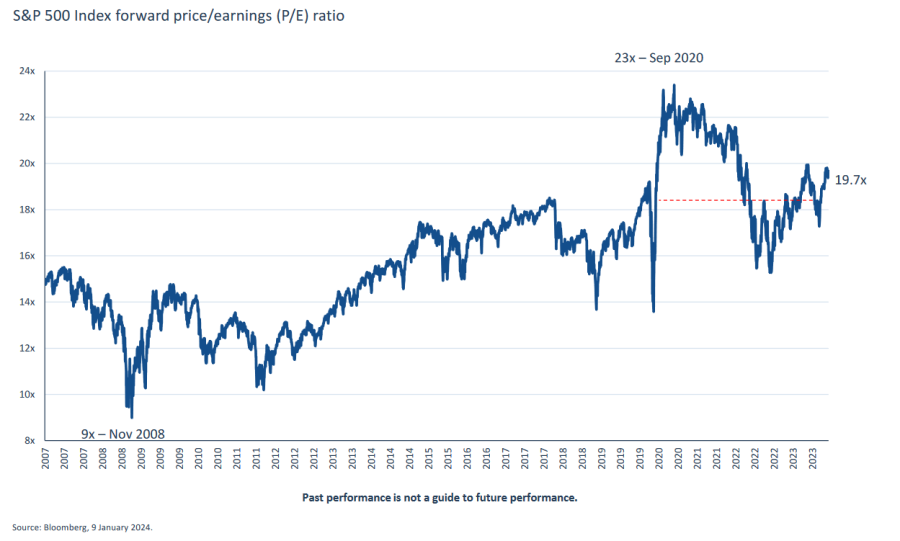

She said: “We're in a very different environment now, so we have concerns not only about this valuation level, but also on the earnings that underpin it.

“Earnings for the S&P 500 are forecasted to grow over 9% this year and over 11% next year. We find that concerning, because we think a recession is the most likely outcome from this rate hiking cycle. Those figures show that the market is not factoring in anything like a recession or even a sort of moderate slowdown.”

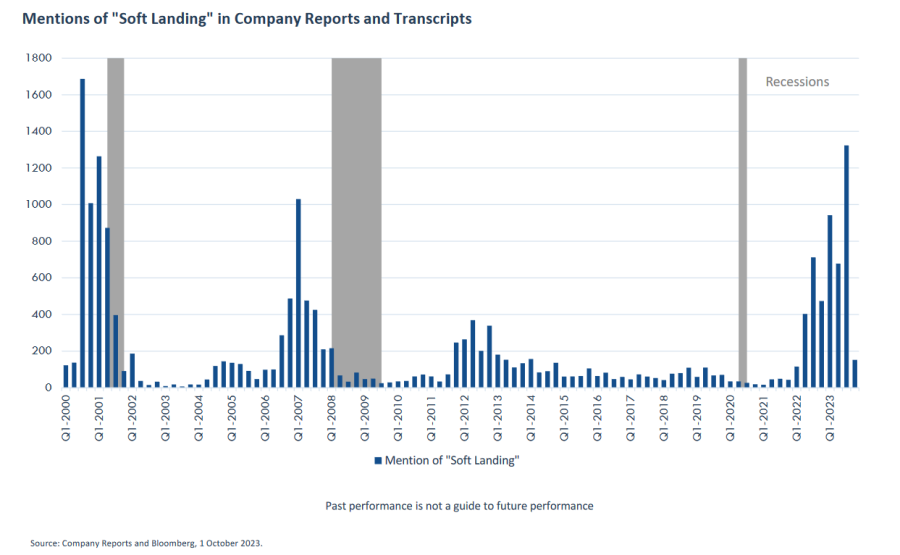

A reason why Yonge believes the market is wrong to have written off a recession and expecting instead a soft landing is because there tends to be a lag between the last rate hike in the cycle and the beginning of a recession. Therefore, the impact of the recent hiking cycle may not have fully played out yet.

She said: “In 1989, we had 16 months between the last rate hike and the start of a recession. In 2000, the last rate hike was in March 2000 and the recession began in January 2001. The global financial crisis of 2008 started one and a half years after the last hike in June 2006.

“If we take the average of all of these and assume we had the last rate hike in July 2023, then it might take until the end of this year before we see a recession. Every recession looks like a soft landing at first. We've seen it in the past in prior cycles.”

The robust health of the labour market has also misled the equity market in believing in the soft landing narrative, according to Yonge, as unemployment figures are also a lagging indicator.

She said: “It tends to be the last cost companies address because it's the most time consuming and most expensive.”

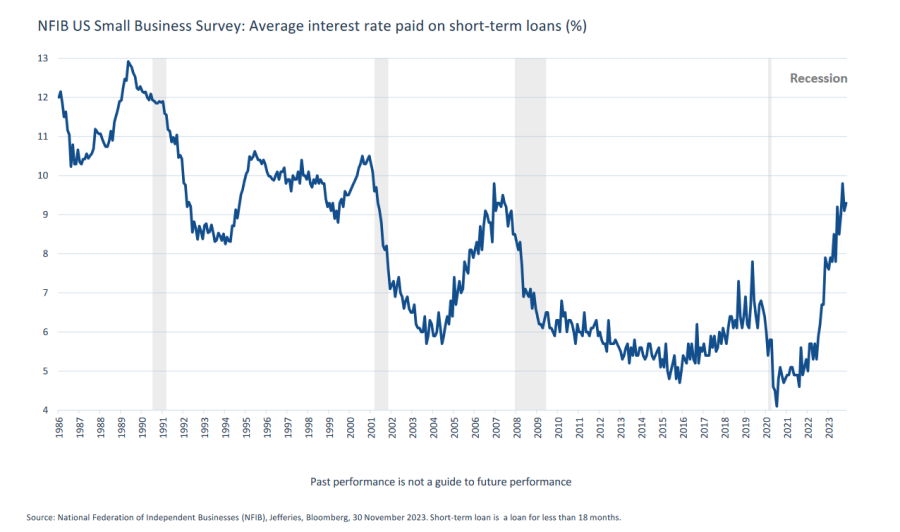

Yet, recent weaknesses in small businesses may show that the labour market is deteriorating, as smaller companies respond faster to changes in interest rates.

Yonge said: “Small businesses rely on bank loans rather than capital markets for their financing. Those loans are typically 12 to 18 months in duration and that is actually starting to hurt now. The cost on these loans has gone from 4% during Covid to over 9% today.

“This is significant from an economy perspective, but also from a stock market perspective, because small businesses employ 75% of the US population.”

Inflation will remain structurally higher

Another reason why Yonge is wary of equities is because she believes inflation and interest rates will stay higher than in the previous decade.

She said: “There are two ways to lose in equity markets. Even if our recession forecast is wrong, we think rates will probably stay higher and that's not going to be good for valuations.”

There are several reasons why Yonge thinks inflation will remain structurally higher in the years to come. If an economic downturn pans out, she expects it to trigger a fiscal response from the government, which will set in motion an inflationary environment in the following years.

She said: “The response that supported consumers during the Covid-19 recession is likely to be repeated. It will not be in the exact same form, but similar in the spirit of redistribution of wealth.”

The Personal Assets Trust manager also observed labour’s bargaining power is increasing, with the discontent that policymakers have tended to provide more support to the owners of capital during crisis. This was the case after the financial crisis in 2008 for example.

She added: “Quantitative easing was the way policymakers dealt with the global financial crisis, but that created a huge amount of inequality.”

There are also drivers in motion supporting structurally higher inflation, which do not involve a recession, such as the reversal of globalisation. Yonge said that reshoring efforts involve spending vast sums, which is conducive to a more inflationary environment. The fight against climate change and the decarbonisation process will also be costly.

While Yonge is bearish on equities, she is bullish on bonds, as the fixed-income market has started to price in higher interest rates.

She said: “They are trading at more attractive levels than you've seen in the past 15 years. You're getting a real yield in the US of over 2% today. What that means is that if you hold those bonds for 10 years, you'll get 2% plus whatever inflation turns out to be. So, if inflation is 5%, that's a 7% annualised government-back return. It's pretty attractive on a risk-adjusted basis.

Yonge also likes gold for its protective nature. In fact, gold bullion accounts for 10.7% of Personal Assets Trust’s portfolio.

She concluded: “Gold is an insurance against monetary instability and it also tends to do well when markets are more volatile.”