Some of the world’s best companies are willingly giving up profits today to build up their brands for the future. Evenlode Investment Management describes this hard-to-quantify investment in future growth as ‘foregone revenue’.

For instance, Netflix has always promised its customers they can cancel at any time, rather than locking them into contracts and levying cancellation fees.

James Knoedler, co-manager of the £340m Evenlode Global Equity fund, said this policy might have been painful financially for Netflix early on, but it is “part of the brand” and was “a smart decision in the long term”.

“It is the price of creating an intangible asset,” he explained.

Another example of foregone revenue is Airbnb, which Evenlode bought in January 2024. Airbnb spends 5-10% of its revenue compensating customers who have had a bad stay, offering discounts and giving its hosts and guests other incentives.

Airbnb could reduce this cost but it is a valuable part of the company’s ethos and helps to attract new users, said FE fundinfo Alpha Manager Chris Elliott, who co-manages Evenlode Global Equity alongside Knoedler.

Airbnb provides pricing guidelines for its hosts with much cheaper rates than hotels to create long-term loyalty amongst its customers. It also benefits from a two-sided network effect; the more guests it attracts, the more valuable the platform becomes for hosts, and if more hosts join, guests have a wider choice. Two-sided networks are “very hard to displace”, Knoedler said.

Forgone revenue is often overlooked or underappreciated because it is difficult to incorporate into accounting models. For example, it is hard to assign a number to Netflix’s promise that customers can cancel at any time or to Airbnb’s customer service.

Another example of costs that are hard to categorise is Alphabet’s $5bn-$6bn annual spending on “other bets” such as “robot dogs”, Knoedler continued. Alphabet is the fund’s second largest position after Mastercard yet he described some of the firm’s projects as “science fiction stuff.”

For fund managers, the “secret sauce” lies in figuring out whether companies that give up income or accrue costs today will be rewarded in the future. “There’s no point forgoing profitability if you don’t have an end state that is highly profitable,” Elliott pointed out.

Evenlode has built a forward-looking valuation model, which assesses how much money a company is likely to make during its whole lifetime, then looks at the price at which investors can currently buy the company and those future earnings.

This is a markedly different approach to price-to-earnings ratios based on short-term earnings forecasts, which are used by many investors.

Evenlode’s model assumes competitive advantages will be eroded over time and rewards companies that constantly reinvest to maintain their edge. It gives companies credit for investments, including forgone revenue, that will enhance long-term profitability.

“We segment the cash flows into good calories and bad calories,” Knoedler explained. Good calories include investments in customer service or research and development. Bad calories are synonymous with wasting money, although it is often hard to tell which investments in areas such as marketing will be profitable and which will not.

To that end, Evenlode prefers investing in stable companies with good management, healthy top-line growth and pricing power, so they are not under pressure to slash costs or to nickel and dime. “We’re not going to try to perform an appendectomy on the goose that lays the golden egg,” Knoedler said.

Evenlode itself has forgone revenue by soft closing its flagship £3.4bn Evenlode Income fund. Knoedler said that Evenlode will always soft close its funds well ahead of any capacity constraints in recognition that, if funds grow too large, “it’s only good for the shareholders in the firm, which is a classic problem in fund management”.

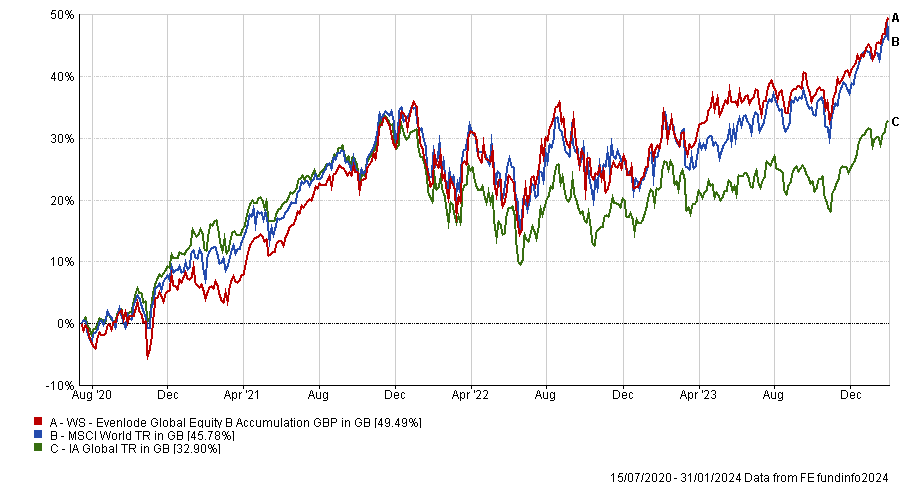

The Evenlode Global Equity fund, meanwhile, has beaten its benchmark and sector since inception three years ago, as the chart below shows, and is top quartile over one and three years.

Performance of fund vs benchmark and sector since inception

Source: FE Analytics