It is rare for managers to want their market to fall, but Kristy Fong, investment director at abrdn New India Investment Trust, is an exception to the rule.

While Indian equities have delivered very strong performance over the past year, valuations may now be overstretched. As a result, she warned that the market may be heading toward a correction. But more than this, she is actively hoping for it to happen.

She said: “We are concerned and wouldn't be surprised if there's a pullback in India. It might be sharper in the small- and mid-cap space, because that's where the rally has been stronger.

“I've been hoping for a correction for the past six months. Given where valuations are, a lot of the earnings growth and returns expectations are already in the price. It's hard to see what will drive a further rerating from here. If the market doesn't correct, it would make it very hard for us to invest at these multiples.”

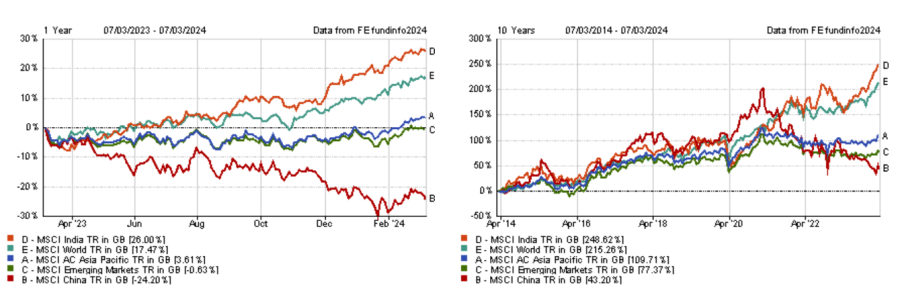

Performance of indices over 1yr and 10yrs

Source: FE Analytics

This is also the view of Catherine Yeung, investment director of Fidelity Asian Values, an investment trust taking contrarian positions in undervalued businesses.

The trust’s mandate allows it to invest across the Asia-Pacific region and it is close to its lowest relative exposure to Indian equities (versus the index) since Nitin Bajaj stepped in as manager in 2015.

Yeung said: “There are many expectations that India will become the ‘giant of the region’ when it comes to GDP growth. This expectation is likely to see valuations remain relatively high as more investors take a position in India given its growing profile.

“We expect more volatility in India going forward but such pullback should be positive for the long-term health of the market.”

Fong agrees that a correction in India would be beneficial for the market. As the interest for India is growing among investors, she believes a cheaper market would be more enticing.

However, Ayush Abhijeet, adviser to the Ashoka India Equity Investment Trust, finds India’s multiple to be broadly in line with its 10-year average and does not take a view on whether a correction is around the corner.

He said: “Indian equity markets continue to be under-researched and hence inefficient. The most exciting part about the Indian markets is the potential to generate outsized alpha; thus, the opportunity cost of market timing is also very high.”

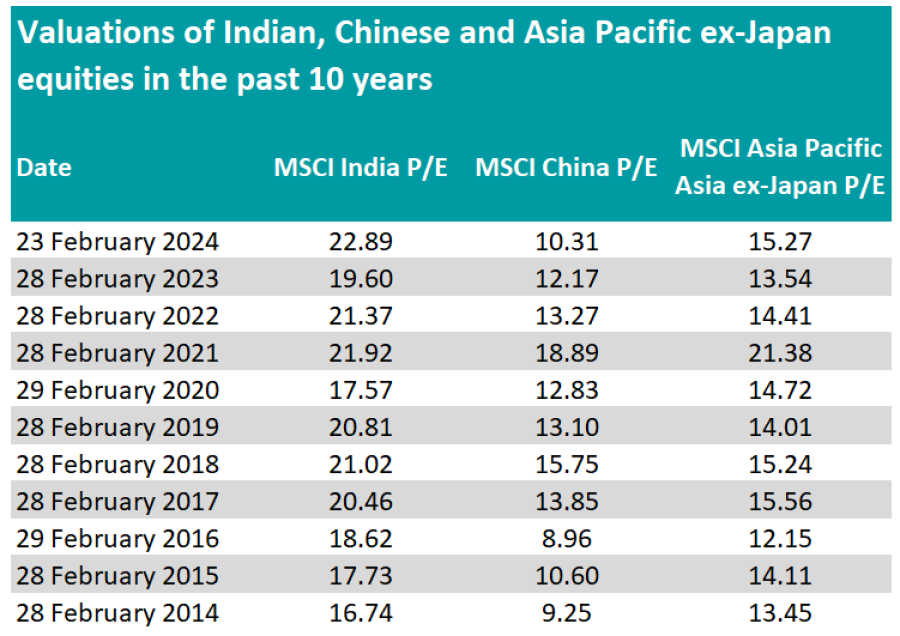

While Indian equities are trading on high multiples and may look overvalued to some, Chinese equities have collapsed dramatically in recent years and look cheaper than ever in comparison. Therefore, a risk is that investors may sell India to buy China.

Source: Bloomberg, 23 February 24

Fong said: “I wouldn't be surprised if foreign investors rotate back into China. Valuations in China are very cheap and expectations very low, so it would take very little to surprise.”

This is something Bajaj has already done, as Fidelity Asian Values’ exposure to Chinese equities is close to the highest it has been under his tenure.

Yeung said: “As the world’s second largest economy, and with the continuation of accommodative policy support (it has been targeted and tweaked stimulus versus what we have seen in the past), we strongly believe both the earnings and multiples of our Chinese holdings will rerate and recover from recent levels.”

Yet, Abhijeet is not too worried about what foreign investors will choose, as Indian savers are pouring more and more money into their stock market.

He explained: “ Financialisation of household savings is a long-term trend and is likely to be boosted by increasing per capita incomes, a young population, rising digital penetration and easier access to financial products.

“Rising retail participation in equity markets has been a key feature of the Indian markets in recent years, and domestic inflows have acted as a strong counter-balance to the volatile foreign institutional investors’ flows.”

While Fong is worried over the short term, she believes India has a more compelling story over the long term.

She explained: “India doesn’t have the structural problems China has. The property market is doing well and is driven by real demand for owned homes. It has had its crises in the past, but it has gone through reforms and is much better operated today.

“The country has also gone through its own series of domestic crises and learnt its lessons. The fiscal position is a lot stronger than before, the currency much more stable and the banking system more robust.”

Fong is also pleased to see the manufacturing sector in India picking up, as it will add a layer of growth and diversify the Indian economy, which has historically been reliant on consumption and services.

Fong said: “India still needs to make sure there's enough jobs for everyone. With a young and growing population, India has a demographic advantage, but this can be a drag if there is not enough job creation.”

Abhijeet agreed that India has a “compelling” investment case, adding that it has an attractive macro-environment compared to not only China but most markets in the world.

He concluded: “Globally, we are in an environment characterised by unfavourable inflation dynamics, persistently high geo-political risks and higher climate costs. In contrast, India’s macroeconomic conditions are relatively healthier and a broad-based recovery in corporate earnings is underway.”