HgCapital Trust has made a name for itself in the private equity space through its investments in ‘boring’ software and business services companies.

However, this specialism has enabled it to join a select group of 32 investment trusts that could have made an investor an ISA millionaire. To achieve this, one would have had to invest their full annual ISA allowance in the trust every year since 1999.

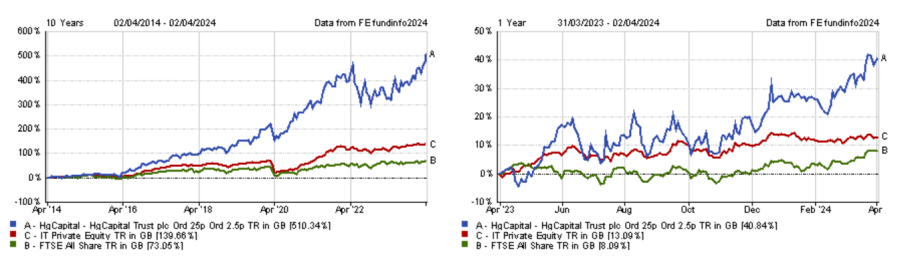

It has also been one of the best performing investment trusts in the IT Private Equity sector over the past decade, ranking second after 3i Group.

Furthermore, HgCapital showed resilience last year in a challenging market environment, as its share price grew 26.3%, making it the third best-performing portfolio in the sector in 2023.

Performance of investment trust over 10yrs and 1yr vs sector and benchmark

Source: FE Analytics

Below, Jim Strang, chairman of HgCapital Trust, tells Trustnet about its latest acquisitions and exits, explains what the implications of higher levels of inflation and interest rates mean for private equities and reveals what the biggest misconceptions about the asset class are.

What is your investment process?

HgCapital* is tasked with finding privately held assets in software and technology-enabled business services, which fit within specific clusters of activities. Those are significantly based around things like tax, accounting and [enterprise resource planning] ERP software.

Then, we look to grow the businesses we acquire to scale, to monetise them over multiple years and to return the capital back to the structure.

We're really boring. We do a few big clusters in software and business services and that's it. Rather than looking at everything under the sun where you have to build an experience curve every time you do something, which is kind of a lottery, we narrow the focus. There's way more private businesses than public ones and software is such a rapidly growing sub-sector that there's no shortage of things to do.

How different are you from your peers?

You’ve got two big archetypes in the sector. One is the fund of funds structure. What they're doing is choosing how many different people they want to eat the cooking from and they then build a portfolio accordingly.

The other type of archetype is ‘direct’, which is where a single manager follows a single strategy, so you effectively have just one kind of cooking. We’re a single-manager strategy.

What are your typical exit strategies?

Initial public offerings (IPOs) for private equity deals in Europe, the Middle East and Africa are quite rare, it's a much bigger part of the exit structure in the US. Most of the time, our holdings are sold to another private equity owner or a strategic buyer.

The other thing is that we tend to own our assets for quite a long time. Because of what we're doing and how we're buying them, they tend to have very long-term compounding of return, multiple decades in some cases.

The typical private equity holding period is six years, but we can hold assets for a lot longer than that if they continue to compound up. In this case, they move between underlying investment structures, but they stay inside the company.

What have been your latest acquisitions and exits?

A good example of a recent exit is Azets, which provides accounting services. The reason I picked it is because it was harder than we thought to deliver the outcome we wanted.

Although we've extracted all our initial investment as well as a small profit, we burnt a lot of time on that. Actually, one of the operating partners at HgCapital went in as the chief executive of Azets for 18 months to run it and turn it around.

GTreasury, a treasury management software, is one of our latest acquisitions. We love tax and accounting as a sector because it's effectively an enabler for businesses. They need those services. For instance, if you're a chief financial officer, you need to have treasury, tax, accounting, payroll, etc in your toolkit. GTreasury is an acquisition into that theme.

What are the implications of higher inflation and interest rates on private equity?

The industry doesn't stop working in a higher interest rate environment, it adjusts itself to it. The only thing that's tricky is the adjustment, but as long as you know where you're heading then you can just operate accordingly.

I think what you'll probably see is some adjustments in pricing for assets. The deal-making activity will have to slightly recalibrate to whatever the prevailing levels of rates are.

In the case of our businesses, they are pretty resilient because companies need them. As long as a company is trading, it needs tax and accounting software and it needs to reduce the costs of its operations to cope with the uncertainties it faces in its own business. Our holdings are not cyclical.

The other point is when good private equity firms buy businesses, they tend to go for leadership assets not for the player number 15 in the market. In any period of uncertainty where businesses are put under pressure, the weaker businesses have the greater problems first and the stronger ones typically benefit. As a result, they tend to come out stronger than they went in.

A thing I would be more worried about is that there’s quite a lot of capital in the market. The private equity market is recovering and needs to keep recovering to soak up this capacity that's been created. That's something I will watch out at the industry level.

What’s the biggest misconception about private equities?

That we fire everybody. You cannot make money in a private equity deal by shrinking the business, you make money by growing it.

For example, Visma, which is a big investment in our portfolio, has 10,000 more employees that it did at the start. Many of them are shareholders in Visma and are therefore incentivised by the value that's created. That's a real multiplier effect if you create that.

The other one is about how you grow the business. It is not done by financial chicanery, it’s done through having a model that you can implement over and over again that allows you to drive the upside to the business.

*HgCapital Trust is an investor in FE fundinfo.