Polar Capital and Fidelity International offer the most reliable actively-managed thematic funds. Their technology, healthcare and financial services strategies performed consistently well during the past decade, data from FE Analytics showed.

Funds run by Polar Capital and Fidelity topped the tables by outperforming the most common benchmarks in the Investment Association Healthcare and IA Financials and Financial Innovation sectors since 2014.

A noteworthy exception was technology, where passives took the lead.

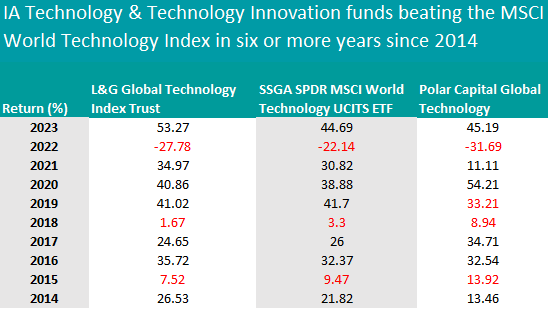

Amongst the 32 funds in the IA Technology & Technology Innovation sector, only 13 vehicles have a 10-year long history and were therefore part of this study.

Only two funds managed to beat the MSCI World Technology Index (the most common benchmark for the peer group) in seven of the past 10 years – the L&G Global Technology Index Trust and the SSGA SPDR MSCI World Technology UCITS ETF.

Both are passive vehicles, which benefitted from the Magnificent Seven’s relentless growth last year.

This burgeoning of just a few companies, particularly in the past year, left active managers who scan the market for underappreciated opportunities behind.

With £2.8bn of assets under management, the L&G Global Technology Index Trust is a popular option for investors. It tracks the FTSE World Technology Index and returned 53.27% last year, charging a mere 0.32%.

Marginally cheaper, with an ongoing charges figure (OCF) of 0.3%, and significantly smaller (£497.4m), the SSGA SPDR MSCI World Technology UCITS ETF tracks the MSCI World Information Technology Index Capped 35/20 instead. It stood behind our reference benchmark in 2022, 2018 and 2015, as the table below shows.

Source: Trustnet. The red highlight represents underperformance against the reference benchmark.

In the active space, the most consistent strategy was the $6.6bn Polar Capital Global Technology fund, co-managed by Ben Rogoff, Nick Evans, Fatima Iu and Xuesong Zhao, who were highlighted by Square Mile analysts for their skill at “identifying changing industry trends and the companies that are poised to benefit as a result”.

“A plus for the fund is the experience of the managers, who have witnessed first-hand a plethora of seemingly promising businesses that have fallen by the wayside, alongside the gains that can be generated through companies that succeed in sustaining the growth of their business,” they said.

“We believe this is an attractive fund for long-term investors who are looking for exposure to rapidly growing technology companies.”

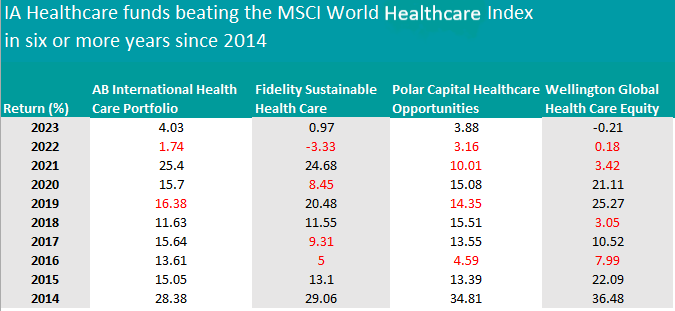

Moving on to the IA Healthcare sector, where only seven of 22 funds qualified for this study, the £3.1bn AB International Health Care Portfolio stood out with eight years of outperformance against the MSCI World Healthcare index in the past decade.

The fund is managed by John H. Fogarty and Vinay Thapar, who focus on companies that are expected to attract healthcare spending through the introduction of new treatments and therapies or by offering customers cost reduction opportunities.

Their top holdings are Eli Lilly (8.1%) and Novo Nordisk (7.5%), which are among the most successful pharmaceutical companies of the recent past and contributed to the fund’s performance in an otherwise difficult period for healthcare funds.

The portfolio is concentrated in 43 names and the top 10 holdings constitute 55% of its assets.

Source: Trustnet. The red highlight represents underperformance against the reference benchmark.

Fidelity Sustainable Health Care, Polar Capital Healthcare Opportunities and Wellington Global Health Care Equity also stood out having outperformed the benchmark in six of the past 10 years.

The Fidelity and Wellington funds are similar – both invest almost exclusively in healthcare and they have a correlation of 87% – whereas Polar Capital Healthcare Opportunities is more diversified across sectors, with biotechnology and medical making up 47% of the portfolio, healthcare 25.2%, medical products 11.8% and pharmaceuticals 15.72%.

All three funds have more than £1bn in assets.

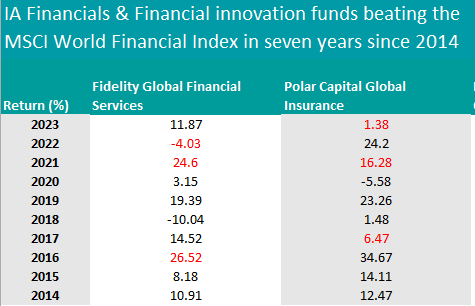

We conclude with the IA Financials & Financials Innovation sector. Here, eight funds out of 14 had a 10-year track record and the largest of them were also the most consistent.

Fidelity Global Financial Services (£1bn) and Polar Capital Global Insurance (£2.2bn) had seven strong years. Fidelity’s fund slipped up in 2022, 2021 and 2016, while Polar Capital struggled in 2023, 2021 and 2017, as the table below shows.

Source: Trustnet. The red highlight represents underperformance against the reference benchmark.

The Polar Capital fund is managed by Dominic Evans and Nick Martin, who are the chief reason why Square Mile analysts favour the vehicle. They also like the “sensible” strategy that emphasises well-managed and proven insurance companies that have high returns on equity and good underwriting records.

“Martin has built a deep pool of company knowledge and is well informed as to the intricacies of investing in this sleepy sub sector of markets that is not widely covered, is perceived as complex and includes plenty of companies of variable quality,” they said.

“Evans’ promotion to fund manager in March 2022 was a natural progression for both him and the fund. We believe that the managers of this fund should be able to achieve their objectives over the long term.”

With exposure to distributors, healthcare, insurance and transport, Polar Capital Global Insurance is quite different to Fidelity Global Financial Services, which almost exclusively focuses on financials and combines a bottom-up fundamentals approach with top-down macroeconomic views. The two are only 57% correlated.

This article is part of an ongoing series on consistency. Find the previous instalments here: Emerging Markets, IA Global, Europe, IA UK Equity, IA UK Equity Income, UK Small Caps, UK bonds, cautious funds, balanced funds, adventurous funds.