Investors withdrew more than £250m apiece from defensive funds such as Ruffer Total Return, Vanguard LifeStrategy 40% Equity, Troy Trojan and Baillie Gifford Managed during the first quarter of 2024 in favour of more equity-heavy portfolios.

At the other end of the spectrum, the most popular multi-asset fund by far was Vanguard LifeStrategy 80% Equity, which netted £378m during the first quarter, data from FE Analytics revealed.

It grew its assets from £10bn to £11bn during the quarter, with investment performance adding almost twice as much as inflows. The fund has benefitted in recent months from its relatively high equity allocation versus its sector during a bull market, as the chart below shows.

Performance of fund vs sector over 1yr

Source: FE Analytics

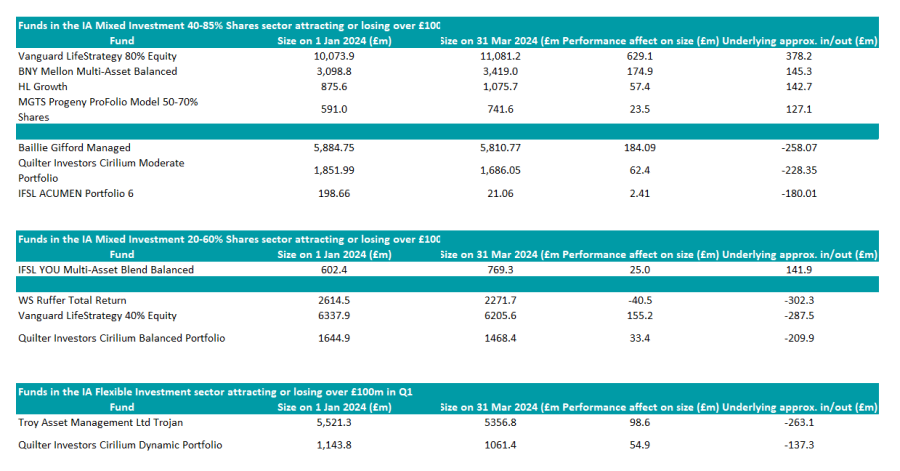

In this series, Trustnet scrutinised fund flows data for the IA Flexible Investment sector and the three IA Mixed Investment sectors to uncover which funds gained or lost more than £100m. No funds in the IA Mixed Investment 0-35% Shares sector had such large flows but a list of the most and least popular funds in the other sectors is below.

Multi-asset funds attracting or losing more than £100m in Q1 2024

Source: FE Analytics

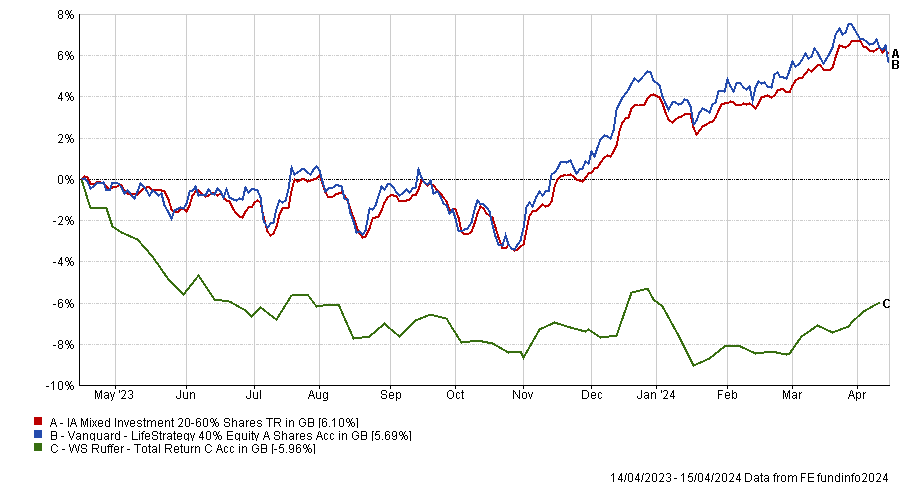

Several large funds run by well-known managers suffered outflows this year. Investors pulled £302m out of the £2.3bn Ruffer Total Return fund, which lost an additional £40m through poor performance, making it the only strategy with negative returns on the list above.

Ruffer has been betting on the yen’s recovery and has a bearish view of equity markets. Its derivative positions, which are focused on credit default swaps and on protecting against equity market downside risk, have “dragged” on performance, Ruffer said in its March 2024 factsheet.

Vanguard LifeStrategy 40% Equity was hit by similar outflows of £287.5m, despite its performance sitting around the sector average.

Performance of funds vs sector over 1yr

Source: FE Analytics

Investors also pulled £263m from Troy Asset Management’s £5.4bn Trojan fund, which is known for its conservative stance and emphasis on capital preservation.

The fund only has 28% in equities, which have rallied strongly in the past five months or so, leaving the Trojan fund far behind its average peer in the IA Flexible Investment sector, as the chart below shows.

Performance of fund vs sector over 1yr

Source: FE Analytics

The Trojan fund has a large bond allocation with 36% in US Treasury inflation-protected securities, 13% in short-dated gilts, 8% in short-dated US Treasuries and 3% in index-linked gilts.

Besides bonds, its largest holdings are iShares Physical Gold and Invesco Physical Gold, which together account for 11.7% of the portfolio. In March 2024, the gold price surged to new highs in all major currencies as geopolitical risk remained elevated, bolstering the Trojan fund, which has held gold for many years for diversification and portfolio insurance.

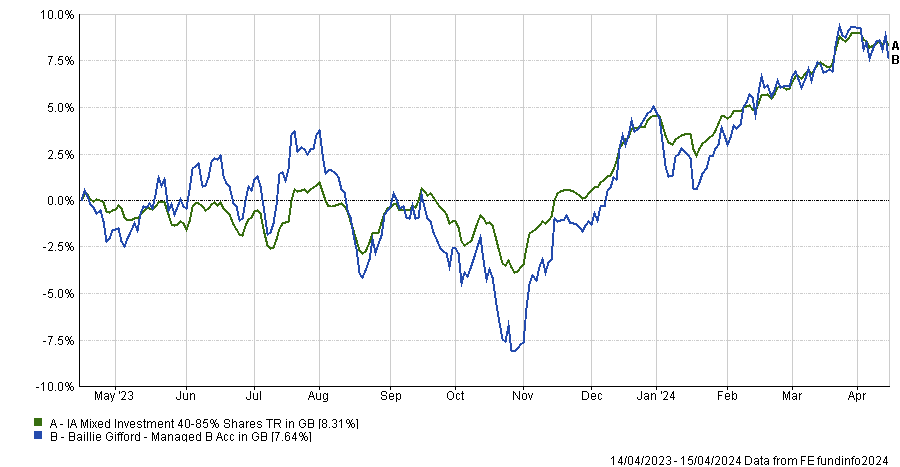

Meanwhile, Baillie Gifford Managed had the fourth-largest outflows amongst all multi-asset funds. A core growth portfolio with an emphasis on bottom-up stock picking, the fund’s top 10 holdings include Amazon, Nvidia, Meta, Taiwan Semiconductor Corp. and ASML.

Performance of fund vs sector over 1yr

Source: FE Analytics

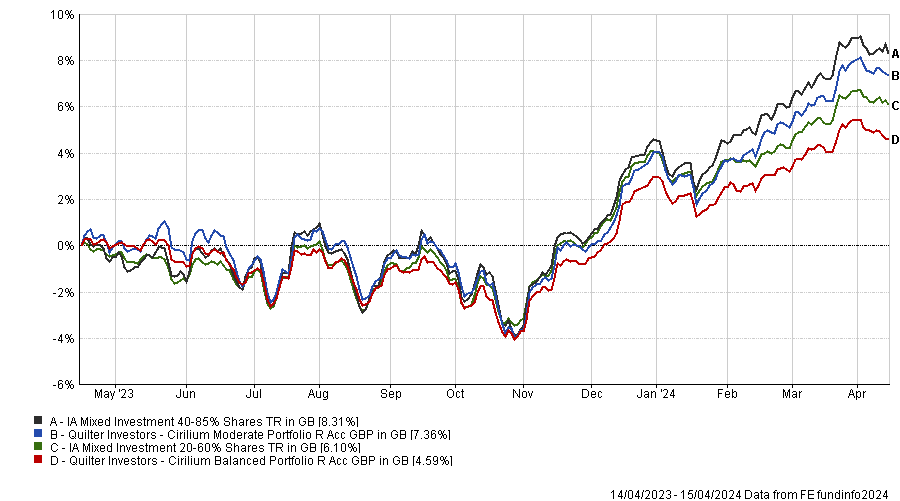

Three of Quilter Investors’ multi-manager Cirilium portfolios – the moderate, balanced and dynamic iterations – lost more than £100m each in outflows.

The £1bn Cirilium Dynamic Portfolio outperformed the IA Flexible Investment sector over the year to 15 April 2024, returning 9.6% versus 8.6% for the sector average, but its larger moderate and balanced stablemates trailed their respective sectors.

Performance of fund vs sector over 1yr

Source: FE Analytics

The Cirilium range is in relatively new hands, having been led since December 2022 by Ian Jensen-Humphreys and Sacha Chorley, who replaced Paul Craig and Hinesh Patel.

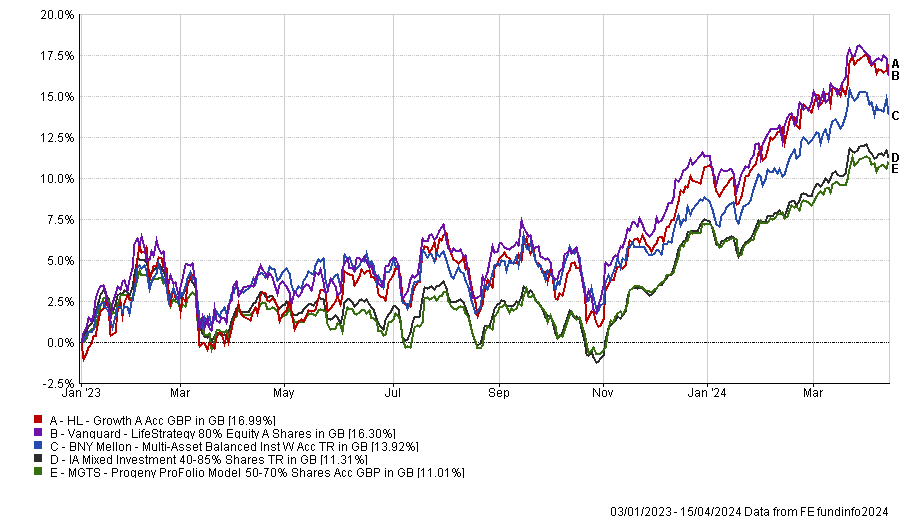

Four funds in the IA Mixed Investment 40-85% Shares sector received more than £100m in inflows apiece. In addition to the popular Vanguard LifeStrategy 80% Equity fund, investors also backed BNY Mellon Multi-Asset Balanced, Hargreaves Lansdown’s HL Growth fund and MGTS Progeny ProFolio Model 50-70% Shares.

The £1bn HL Growth fund is the strongest performer in this group with top-quartile returns, as the chart below shows.

Launched in December 2021, HL Growth allocates to a range of passive strategies, most of which are run by Legal & General Investment Management. Its largest holding is a 33% allocation to the L&G Future World ESG Developed Index fund and it also has 14.5% in L&G Future World ESG North American Index and 13% in L&G Future World ESG Emerging Markets Index.

Performance of funds vs sector over 1yr

Source: FE Analytics

BNY Mellon Multi-Asset Balanced is managed by FE fundinfo Alpha Manager Bevin Shah alongside Paul Flood and Simon Nichols. It has top-quartile performance over three and five years and a FE fundinfo Crown Rating of five (the highest score based on alpha, volatility and consistent outperformance). Its largest holdings are Microsoft, RELX and Shell.

ISFL YOU Multi-Asset Blend Balanced was another winner, taking in £142m from investors during the first quarter. The £769m fund has achieved top-quartile performance over three years and second-quartile returns over the 12 months ending 15 April 2024. It was established in 2019 and is part of YOU Asset Management’s range of model portfolios and funds.