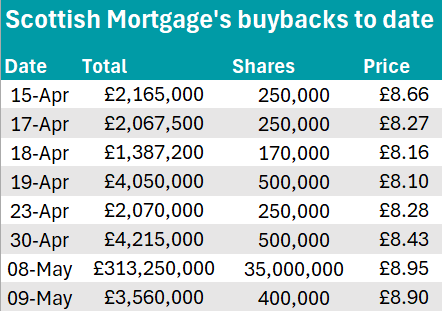

The Scottish Mortgage investment trust went on a shopping spree this week, buying £311m worth of its own shares in just one day – the largest buyback since its two-year budget of at least £1bn was announced in March.

Paying £8.95 per share, the company bought back 35 million shares on Wednesday, following up with a more modest £3.5m purchase on Thursday. Prior to this, the average purchase had only been worth approximately £2.8m per transaction.

The scale of this move means that 94.1% of the trust’s buybacks so far were carried out on this day, taking Scottish Mortgage approximately one-third of the way in its announced buyback programme.

Source: Trustnet, HMRC

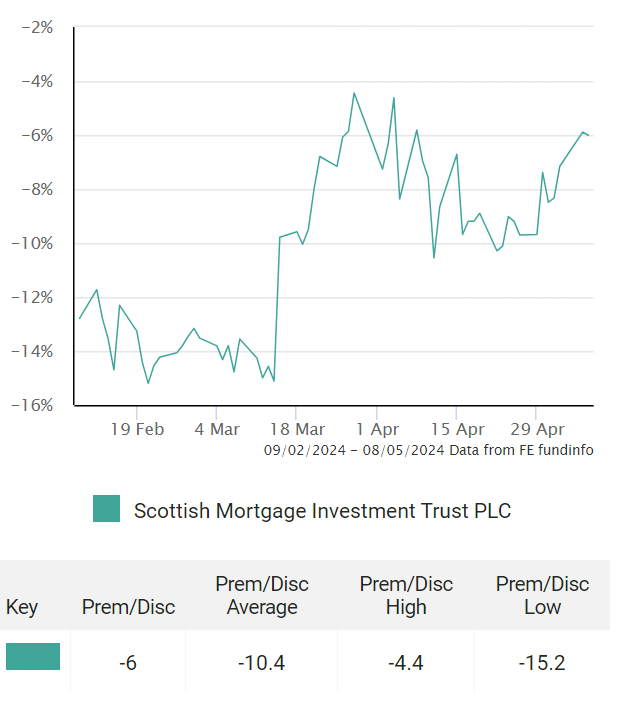

The goal of this scheme is to narrow the trust’s discount, which was north of 14% in mid-March. Although the efficacy of buybacks has been brought into question by some, results seems to have arrived for the Baillie Gifford flagship trust, which is now trading at a 6% discount.

Scottish Mortgage’s discount

Source: Trustnet

Scottish Mortgage commercial director Stewart Heggie said the board and managers of the trust remain “resolutely committed” to facilitating trading around net asset value (NAV) and maximising returns for shareholders.

“Since the announcement of the buyback programme, the discount has narrowed by around 10 percentage points, which has contributed towards a share price return of 45% over the past year,” he concluded.