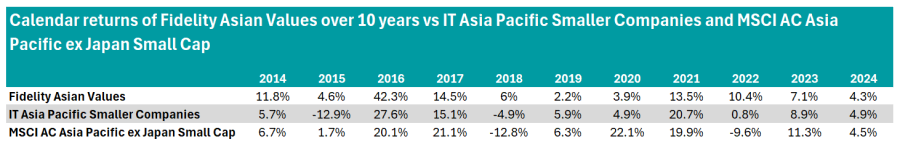

Anyone who has invested in the same fund for a decade has almost inevitably experienced a year or more of negative returns.

However, this is a feeling from which investors in Fidelity Asian Values are immune. Indeed, it is the only investment trust whose share price has not fallen into the red in any calendar year since 2014, according to research by Trustnet.

This ability to sidestep downturns owes much to the investment philosophy of FE fundinfo Alpha Manager Nitin Bajaj, who has been in charge of the Asian small-cap investment trust since 2015.

Catherine Yeung, investment director of Fidelity Asian Values, explained that Bajaj’s method is about understanding and buying good companies that can withstand market downturns and emerge stronger when the cycle shifts.

Another key ingredient has been staying away from momentum growth rallies. For instance, Bajaj avoided Chinese stocks such as Meituan and Alibaba in 2021, as they were trading on sky-high price-to-earnings ratios, even if that meant temporarily underperforming the benchmark.

Source: FE Analytics

Yeung recalled: “Our underlying stocks were actually delivering on earnings, increased market share, etc., but because everyone was in love with those Chinese high growth names, ours were out of favour from a relative perspective.

“To be really frank, Bajaj often gets more stressed when his names are doing well very quickly, because he then takes profit and has to find new opportunities.

“For example, when China came out of lockdown at the beginning of 2023, the portfolio was so exposed to the reopening theme that we had a huge outperformance. So Bajaj trimmed very quickly and rotated into other areas, because he's mindful of not being part of consensus trading and strictly adheres to his target prices.”

Performance of investment trust over 5yrs and 10yrs vs sector and benchmark

Source: FE Analytics

This contrarian approach has enabled Fidelity Asian Values to be the third best performing investment trust across the IT Asia Pacific, IT Asian Pacific Equity Income and IT Asia Pacific Smaller Companies sector over 10 years, behind Baillie Gifford’s Pacific Horizon and Schroder Asian Total Return.

It has also done better than its sector peers abrdn Asia Focus and Scottish Oriental Smaller Companies in that period while being less volatile.

However, the picture is different over five years, as both abrdn Asia Focus and Scottish Oriental Smaller Companies have outperformed Fidelity Asian Values, which has also lagged the MSCI AC Asia Pacific ex Japan Small Cap index.

Yeung explained that this relative underperformance was partly due to the underweight positions in Taiwanese and Korean equities, as the two markets soared on the back of the excitement around artificial intelligence (AI).

Yeung said: “Anything related to AI, whether it's in Korea or Taiwan, has just gone soaring. It's absolute bubble territory.”

Performance of indices over 1yr

Source: FE Analytics

Another factor was the early decision to overweight China. In May 2023, Bajaj raised his overweight position to China and Hong Kong from about 28% to 39% and added gearing. However, Chinese equities continued to dip until turning a corner in February of this year.

The current weighting to China (30%) and Hong Kong (9%) is the highest the investment trust has ever allocated to those markets, although Bajaj has a self-imposed limit of 35% for any single country.

Yeung said: “For a meaningful recovery to happen in China, we need to see earnings stabilise. We're probably at the trough now.

“Apart from earnings, there's a very interesting dynamic taking place in China. Both state-owned enterprises and private companies are rewarding minority shareholders.

“Japan also played an influential role in those changes, as the reforms enacted by the Tokyo Stock Exchange have attracted investors back into that market.”

She also highlighted that the Korean market is trying to emulate the reforms undertaken in Japan as well via its Value-Up programme, with the aim of putting an end to the ‘Korea discount’.

Bajaj also has high conviction in Indonesia, which is the third largest country allocation after China and India.The Southeast Asian archipelago accounts for 15.5% of the portfolio, with most of the names being either banks or consumer companies

“Indonesia offers the best mix of growth, quality and valuation. It has very similar dynamics to India, but it's trading at a lot more attractive valuations,” Yeung explained.

“The policy dynamics in Indonesia has been very effective. The country has been very good at implementing pro-business policies.

“It has commodities, a good demography and it is benefiting from the China plus one strategy like Thailand and Vietnam.”

While the investment team at Fidelity Asian Values has found some attractive stocks elsewhere in Southeast Asia, the breadth of opportunities is not as large as in Indonesia, while liquidity is frequently an issue.

When it comes to Indian equities, Bajaj is cautious due to the high valuations they command and prefers China at the moment.

“What's interesting when it comes to India versus China is that the consumption story in China has been underpinned by a recovery in the low price goods. People want value for money, even though households are well off, so the low-end part of the pricing curve has picked up enormously or had a recovery,” Yeung said.

“In India, it's the other way around. We often look at two-wheeler sales as an indicator for consumption, and it's not doing very well. In other words, the rural consumers in India aren't spending. What's lifting up this consumption theme is, in fact, middle class or higher middle class spending. It's not a broad base consumption recovery.”

Yet over the long term, Yeung expects India to replace China as the “GDP giant” of the region.