The global equity market has been powered higher by surging US stocks but research by Trustnet shows a handful of UK funds are outperforming them over the past three years.

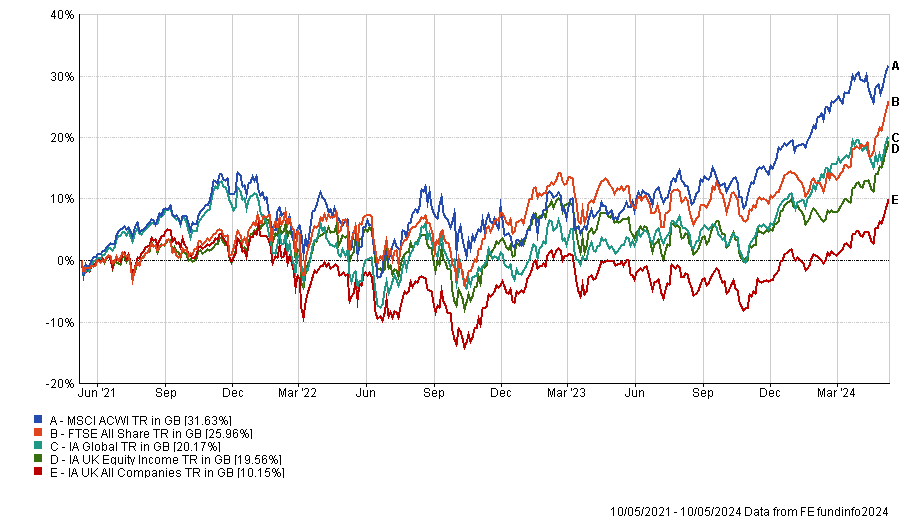

UK equities have been out of favour among investors for an extended period and, as the chart below shows, the FTSE All Share has underperformed the MSCI AC World index over the past three years (although this has started to narrow more recently).

For active managers, beating global equities – with its high weighting to the efficient US market – is no mean feat. The average fund in the IA Global sector is more than 10 percentage points behind the MSCI AC World (its most common benchmark) while the IA UK Equity Income and IA UK All Companies sectors are also nowhere near the index.

Performance of sectors and indices over 3yrs

Source: FE Analytics

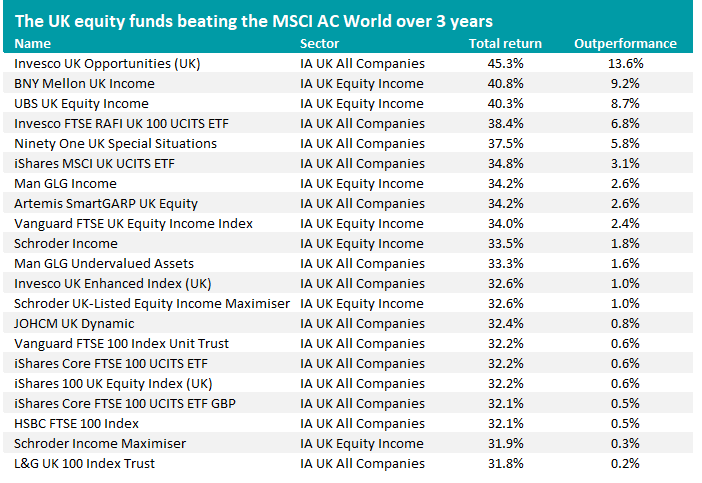

However, there are some funds in the two main UK equity sectors that have made a higher return than the global stock market over this period: FE Analytics shows that 21 out of the 300 funds with a sufficient track record – or 7% – have done this.

Martin Walker and Bethany Shard’s Invesco UK Opportunities fund has made the highest three-year return, posting a gain of 45.3% and beating the MSCI AC World index by 13.6 percentage points in the process.

The £1.3bn fund has a value approach with Walker and Shard looking for companies with attractive earnings potential that isn’t recognised by the rest of the market. This tends to lead them to UK large-caps with strong international businesses; among the fund’s top holdings are the likes of Shell, BP, AstraZeneca, Unilever and Imperial Brands.

In their latest update, the managers said: “Despite the caution engendered by macro views, we remain optimistic at the medium- to long-term outlook for UK equities – particularly on a relative basis – as the value factor increases in importance. We expect an increased focus on cash generation in UK equities and the low starting point for valuation will combine to overcome inertia in relative performance.

“We believe that over the next 10 years, in an environment of higher interest rates and higher inflation than we have experienced since the global financial crisis, value as a factor will be more important. An environment that is different calls for equity exposure that is different. And sector exposures in the UK are very different to other global equity markets. The FTSE All Share index offers low correlation to US markets, but still has scale, breadth and depth of companies.”

Signs of these can be seen in the below table, which shows the 21 IA UK All Companies and IA UK Equity Income funds that have made a higher return than the MSCI AC World over the past three years.

Source: FE Analytics. Total return in sterling between 10 May 2021 and 10 May 2024

Many of the funds in the above table take a value approach to investing with Man GLG Income, BNY Mellon UK Income, Man GLG Undervalued Assets, Schroder Income, JOHCM UK Dynamic, Ninety One UK Special Situations and UBS UK Equity Income being among them.

Although value investing has continued to underperform growth in 2024 – the MSCI AC World Growth index is up 11.8% while MSCI AC World Value gained 8.9% – the UK stock market has been catching up with its international peers.

The FTSE 100 has reached a record high, as investors overcome the aversion that has been in place since 2016 and take another look at UK stocks – and UK value is outperforming UK growth.

The recent outperformance of the UK is apparent when we look at the number of funds outperforming the MSCI AC World index since the start of the year: 69, or 22% of the 311 with a long enough track record.

This compares with just one fund beating global equities on a five-year view (Artemis UK Select).

Matt Britzman, equity analyst at Hargreaves Lansdown, said: “Investors are finally starting to look at UK businesses and see reasons to be optimistic. The Bank of England held rates steady earlier in the week but hinted at rate cuts to come. Meanwhile, economic growth came in better than expected, but crucially not too much better to drive up fears it could cause inflation to spike. This comes on the cusp of major UK banks reporting over the past couple of weeks and there was a huge array of optimism from management teams around the outlook for the UK.

“Many will look at this run and assume it has no legs, UK investors have been beaten down too many times in the past. UK bulls will argue it’s been long overdue, with the market suffering from a hefty valuation discount to global peers for some time.”