Ashoka WhiteOak Emerging Markets was one of just two investment trusts to go public last year amidst a period of drought in new listings for the London Stock Exchange.

This new fund aims to replicate the success of its stablemate Ashoka India Equity by applying the same investment philosophy to the broader emerging markets universe.

The £35m investment trust made the headlines again recently as it is looking to absorb its much larger peer, Asia Dragon Trust, to grow its assets under management and get onto the radar of a wider investor base.

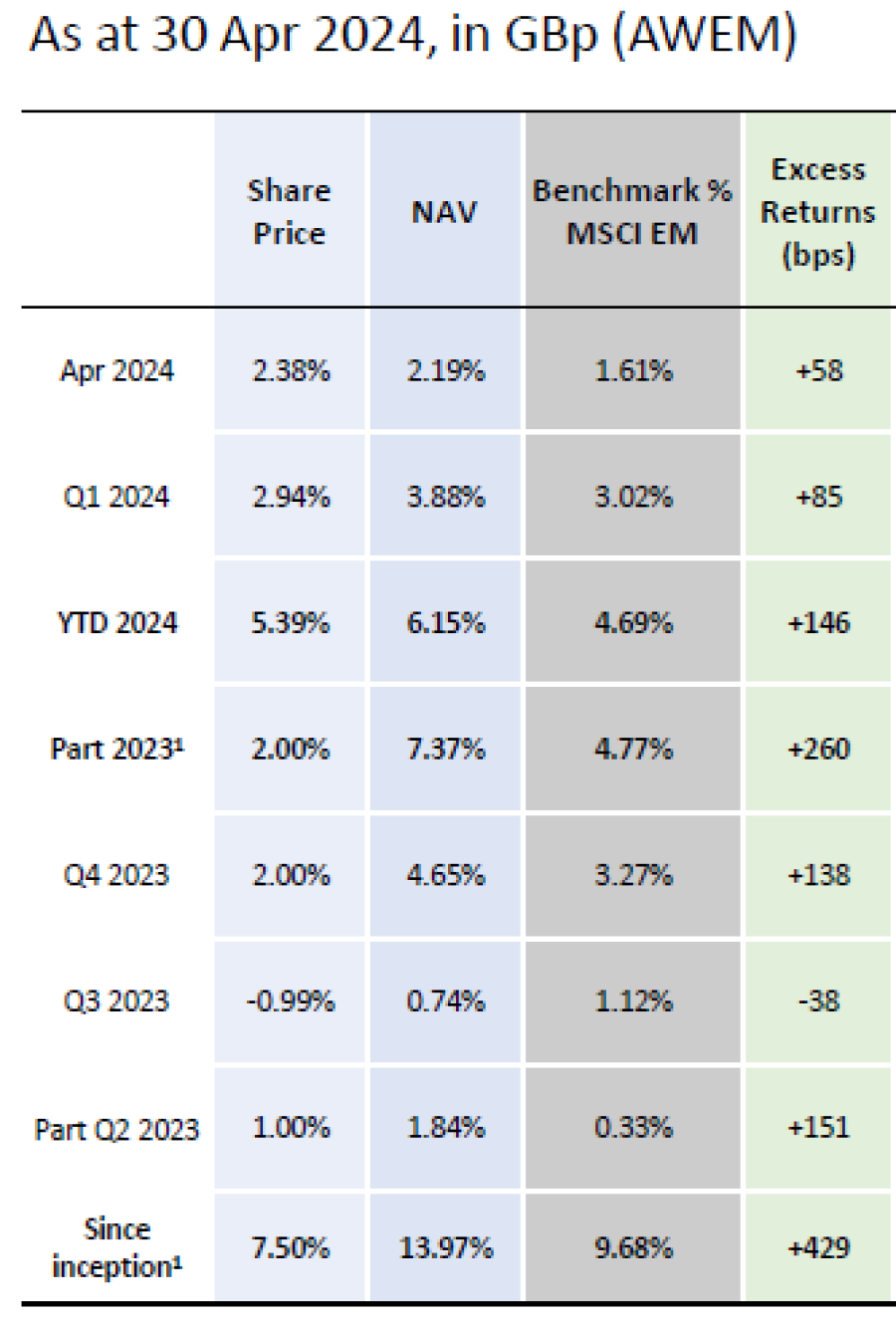

Performance of fund

Source: WhiteOak Capital Management

Below, the founder of WhiteOak Capital Management, Prashant Khemka explains his strategy, how the investment trust structure enables him to generate higher alpha and why managers who don’t outperform their benchmarks should not charge fees.

Could you explain your investment strategy?

A crucial prerequisite to generate sustainable, peer group-leading performance over many years and market cycles is to have a robust investment culture. Everyone in our team is driven by a single-minded objective: to generate the highest return compared to anyone else in the peer group. We don’t have a top-quartile or top-decile mindset, but a sportsman-like mindset: we’re aiming for the gold medal.

We follow a stock selection-based approach, underpinned by the belief that outsized performance is generated by investing in great businesses trading at attractive valuations. We use an analytical framework, which also serves as a valuation framework, called ‘OpcoFinco’.

From a risk management perspective, an end objective is to maximise alpha while also minimising the volatility of that alpha.

What is the OpcoFinco framework?

To generate cash flow sustainably in the future, a company needs returns on incremental capital to be higher than the cost of capital.

When you find businesses that possess these attributes, you must value them logically and invest only if there is a substantial upside to fair value.

The OpcoFinco framework enables you to analyse a company through the prism of return on incremental capital and then to quantify the value of return on incremental capital.

Unlike many people, we don't use the price-to-earnings ratio at all. We think it's very misleading because it is distorted.

Could you explain your fee structure?

We have a 0% fixed management fee structure. We charge a performance fee on a three-year cumulative alpha basis, which means we only get paid if we outperform. The alignment of interest is strong because we can't just sit on our laurels and expect to get paid.

There are too many investment trusts out there that have never generated alpha, but are charging fees on an ongoing basis. There's very little accountability and I'm quite surprised to find that the accountability level is not as high as I would have expected in a developed market like the UK.

The 0% management fee combined with the annual redemption facility and performance of the trust should keep the discount very tight. In the case of Ashoka India Equity, we've generally been trading at a small premium versus a 15% to 20% discount for most of our peers.

Why did you choose the investment trust structure?

Emerging markets are inefficient segments of the global equity market and we have an overweight to small and mid-cap (‘smid’) companies because it’s an even more inefficient part of emerging markets. Being overweight smids doesn’t mean you are going to outperform but a good management team can generate higher alpha in that space.

Because it's closed-ended, the investment trust structure enables us not to worry as much about liquidity. Hence, we can allocate more capital in small-cap companies, which may not be appropriate from a liquidity management perspective in an open-ended vehicle.

It also allows investments in pre-IPO opportunities. It’s not possible to explore those opportunities in open-ended vehicles.

What has been the best-performing stock in the portfolio since launch?

The best performer has been Doms Industries, which is an Indian stationery and art material manufacturer. It produces things such as pencils, erasers and mathematical instruments. Basically, things students would use in school.

When I grew up, Doms wasn't around. We used all kinds of pencils that weren't necessarily branded. But now when I go back to India, I see that all the kids in the family are using Doms products.

Fila Group from Italy is an investor in Doms Industries and owns a good amount of its shares.

What about the worst-performing stock?

It has been Budweiser Brewing Company APAC, which is listed in Hong Kong. The Chinese market has been under tremendous pressure and most of our Chinese names are down 11% to 44%.

Following the reopening of China after Covid, it was expected that the demand for beer consumption would substantially normalise and get back to its earlier growth path, but like many other segments of the Chinese economy, consumption has been fairly tepid.

That is why Budweiser has derated.

The portfolio is underweight China relative to the benchmark. How do you approach this market?

We never form top-down views such as ‘China is in deep trouble, so we will underweight this market.’

However, the portfolio is overweight the most democratic countries and underweight the least democratic countries. We believe authoritarian regimes have lower alpha potential. Similarly, we are underweight state-owned enterprises and overweight private companies.

Now, if you reassign some of the companies in the portfolio that are exposed to China like South Africa’s Naspers (which has a sizeable stake in Tencent) as well as some off-benchmark names, our allocation to China is more or less in line with the benchmark.

How do you select your off-benchmark positions?

Most of them have three attributes: they derive the majority of their value from emerging markets, are high alpha opportunities and mitigate some factor risks in the portfolio.

For example, if you take France’s LVMH, 60% of its growth was driven by China alone in the 10 years prior to the Covid crisis and we estimate that a majority of its profits still come from emerging markets. It mitigates the underweight risk in China.

Similarly, Netherland’s ASML derives the majority of its value from emerging markets, has high alpha potential and mitigates the underweight risk in Taiwan.

What do you do outside of fund management?

I like to spend time with my family. I have three kids and we have a fund management competition going on between them. They have their own portfolios and try to outperform each other. It’s good fun to see the industry within the family as well.