Active investing is all about stock selection and outperforming indices in order to give investors extra returns that they can’t get through passive funds.

By outperforming their benchmarks, managers can show that their decisions have benefitted the fund, keeping investors happy and justifying their higher fees.

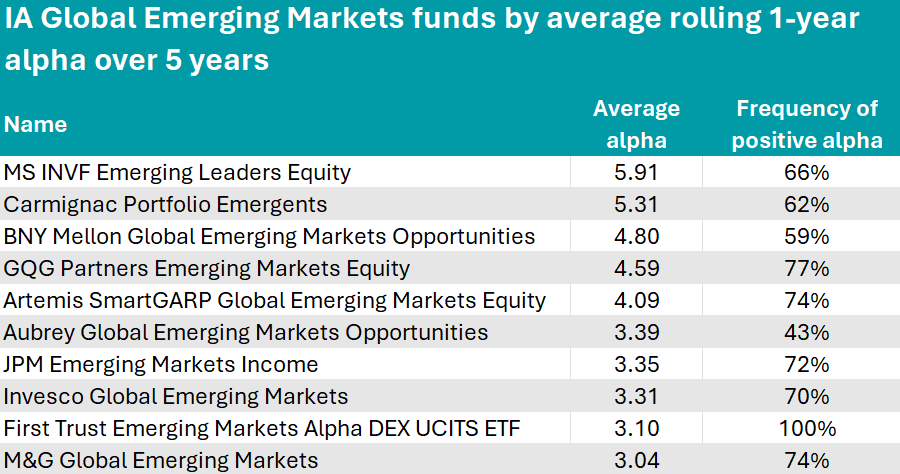

In this series, Trustnet is looking at funds’ outperformance, as measured by alpha, over the past 61 year-long periods measured every month from 2018 to 2023.

Today, we analyse the IA Global Emerging Markets sector, where the Morgan Stanley Investment Management’s MS INVF Emerging Leaders Equity fund had the highest alpha score.

The $955.6m fund follows a benchmark-agnostic investment process whereby the manager Vishal Gupta focuses on companies that are poised to benefit from future growth themes.

His top three stocks are Brazil-based digital banking firm Nu Holdings (8.3%), Argentinian online marketplace MercadoLibre (7.4%) and Taiwan Semiconductor Manufacturing Company (7%).

Over the past five years, the fund outperformed its benchmark, the MSCI Emerging Markets index, by an average of 5.9% per annum.

Source: FinXL

The second-best fund was Carmignac Portfolio Emergents, with an average alpha of 5.31.

It is co-managed by Xavier Hovasse and Haiyan Li-Labbé, who combine a fundamental top-down approach with bottom-up analysis. The fund’s main country exposure is China (27.9%), followed by South Korea (18.4%) and India (14.4%). The top holding is Samsung (9.9%).

In third position, BNY Mellon Global Emerging Markets Opportunities concluded the podium with an average alpha of 4.8. It is managed by Liliana Castillo Dearth, although she joined Newton Investment Management in October 2023 – the fund’s track record prior to that was built by former managers Paul Birchenough and Ian Smith.

Other notable strategies in the list included the value-focused Artemis SmartGARP Global Emerging Markets Equity fund (average alpha: 4.09), which is recommended by FE Investments analysts as a core emerging-market fund. Its investment process “goes beyond deep value and distressed stocks to include a wider variety of factors”, they said.

The Aubrey Global Emerging Markets Opportunities fund (average alpha: 3.39) has a “strong consumer focus and growth-bias”, FE analysts said, making it a good fund for secondary exposure

Finally, the five FE fundinfo Crown-rated JPM Emerging Markets Income (average alpha: 3.35) also deserves a mention.

“In tough environments such as 2020, where many companies looked to cut their dividend payments, this fund’s ability to focus on capital appreciation provided it with resilience and the capacity to maintain total return generation in downward markets,” FE analysts said.

“Unlike traditional income funds, this fund takes a more flexible approach, in that capital appreciation is as equally important as income generation. The fund is best suited as a core emerging market exposure, with defensive characteristics for those seeking a source of income.”

There was only one fund in the whole emerging markets sector that consistently delivered a positive alpha throughout the past five years – the First Trust Emerging Markets AlphaDEX UCITS ETF.

With just £15.3m of assets under management (AUM), this overlooked exchange-traded fund (ETF) has beaten the benchmark it is tracking, the Nasdaq AlphaDEX EM index, with an average outperformance of 3.1% – higher than many active managers in the sector.

For this, it only charged 0.80%, in a sector where the average ongoing charges figure (OCF) is approximately 0.95%. Its main exposures are to China (18.1%), Turkey (15.3%) and Taiwan (11.63%).

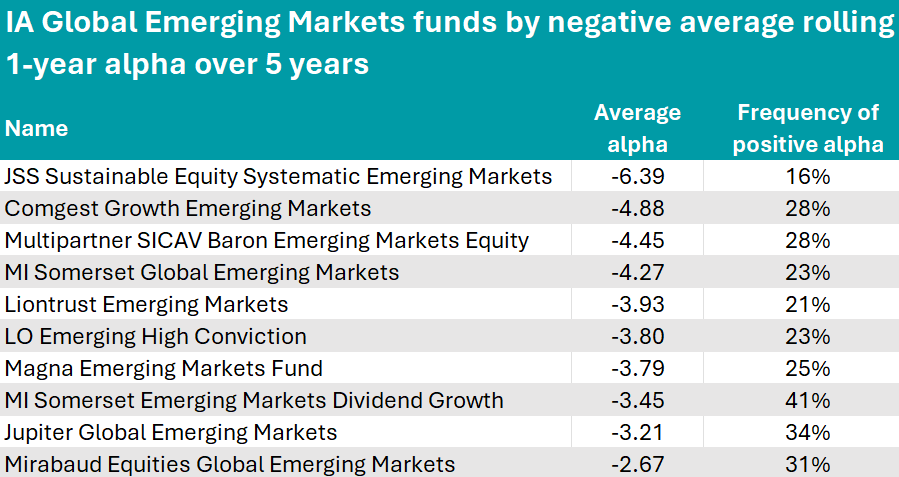

At the bottom of the table were funds with negative alpha, whose managers’ active decisions detracted from performance rather than contributed to it.

Source: FinXL

The most negative scores were those of JSS Sustainable Equity Systematic Emerging Markets (-6.39), Comgest Growth Emerging Markets (-4.88) and Multipartner SICAV Baron Emerging Markets Equity (-4.45).

Sectors previously in this series: UK Equity Income, UK All Companies, Global, Global Equity Income, Sterling bonds, smaller companies, global bonds, cautious funds, balanced and adventurous funds, European funds, Asia funds.