Chinese equities have recently staged a comeback after three consecutive calendar years of significant negative returns, linked to regulatory crackdowns, a crisis in the property sector and questioning around the country’s growth trajectory.

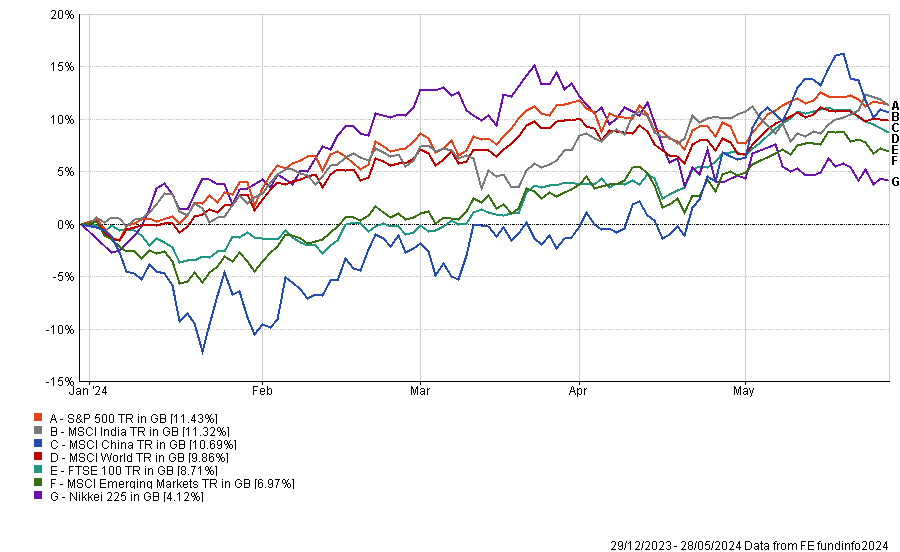

Since the beginning of the year, the MSCI China index has outperformed the MSCI World and MSCI Emerging Markets, although it has lagged the S&P 500 and its emerging markets rival, MSCI India.

George Efstathopoulos, multi-asset portfolio manager at Fidelity International, attributed China’s rebound to a combination of factors.

“The ‘national team' [state-backed financial companies] has stepped up their involvement in markets after the capitulation earlier in the year,” he said.

“The growth outlook appears to have improved – GDP growth recently surprised to the upside, leading many analysts to raise year-end growth estimates and causing some foreign investors to cover underweight positions. Policy support has also increased recently, with the ailing property sector the latest recipient.

“Meanwhile, Chinese companies have carried out more buybacks recently and earnings beats are being rewarded in this earnings season, which hasn't been the case in the last few years, a further indication that the capitulation period is over.”

Performance of indices year-to-date

Source: FE Analytics

The question for investors now is whether this rebound is sustainable or merely a dead cat bounce.

Sandy Pei, deputy manager of the Federated Hermes Asia ex-Japan Equity fund, argued that the bounce has been “very modest” so far and that absolute and relative valuations remain attractive. She believes that investors in China have huge upside potential if Chinese equities re-rate to “normal” multiples.

David Townsend, managing director of Value Partners’ business in Europe, the Middle East and Africa, is also bullish on China and argues it is in the early stages of a U-shaped recovery.

He said: “From a fundamental perspective, we maintain our investment thesis that the stock market has reached an inflection point, supported by the recent strong market performance.

“We anticipate the start of a longer-term market upturn, supported by strong fundamentals such as healthy corporate balance sheets and large household deposits, which could sustain China’s long-term growth story.”

“From a technical perspective, it also looks like the market rally could continue for some time, especially given the very light / underweight positions for many investors in China. It does look as though some capital is starting to come back to the market to reduce the underweight exposure of many long-only investors.”

Yet, others believe it is still too early to tell whether Chinese equities are back on track.

For instance, Efstathopoulos stressed that earnings will need to deliver for the bounce to prove sustainable and this will require an improvement in the currently fragile consumer sentiment in China.

Rob Brewis, co-manager of the Aubrey Global Emerging Markets Opportunities fund, also warned that the property market is still in the doldrums, monetary growth subdued and deflation remains predominant. He also believes that geopolitics and trade frictions are going to increase ahead of the US election, while a trade war between China and Europe seems to have started.

For example, ministers of Germany, France and Italy called for a common front against China’s expanding export power last week during a G7 meeting. Moreover, the European Union is investigating a range of Chinese products, including electric vehicles, to assess whether they are receiving unfair subsidies from the Chinese government or being sold below cost.

Another risk highlighted by Pei is an unexpected reversal of the monetary policy stance, which is currently centred around monetary easing, consumption stimulus and being capital friendly.

Therefore, Townsend stressed that investors will need to keep an eye on the ‘Third Plenum’ in July 2024.

He explained: “In addition to further supportive measures for the property market, the structural reform agendas – traditionally a focal point of the ‘Third Plenum’ – are worth watching as they may be necessary in navigating both cyclical headwinds and demographic challenges.

“A key risk could be that if the communication disappoints the market, in the sense that investors begin to feel that the government is starting to turn its attention to focussing on things other than the economy, there may be something of a pull back.”

Nonetheless, GQG Partners’ investment team believes that things are unlikely to get meaningfully worse from here for China.

“There is a bevy of earnings coming out of some of the largest weights in the benchmark and in our view, earnings remain like gravity and it will be individual company execution rather than macro noise that will ultimately drive the attractiveness of select Chinese equities,” GQG analysts concluded.

Nonetheless, the GQG Partners Emerging Markets Equity fund is structurally underweight Chinese equities due to their lack of durable earnings growth, heightened geopolitical risk and better opportunities elsewhere.