There is a lot of anticipation for smaller companies to recover after some painful years. However, investors should be aware that many large funds have commercial reasons to avoid the sector altogether, leaving returns on the table.

That’s where David Walton, manager of the IFSL Marlborough European Special Situations fund, who this year entered the FE fundinfo Alpha Manager Hall of Fame, steps in.

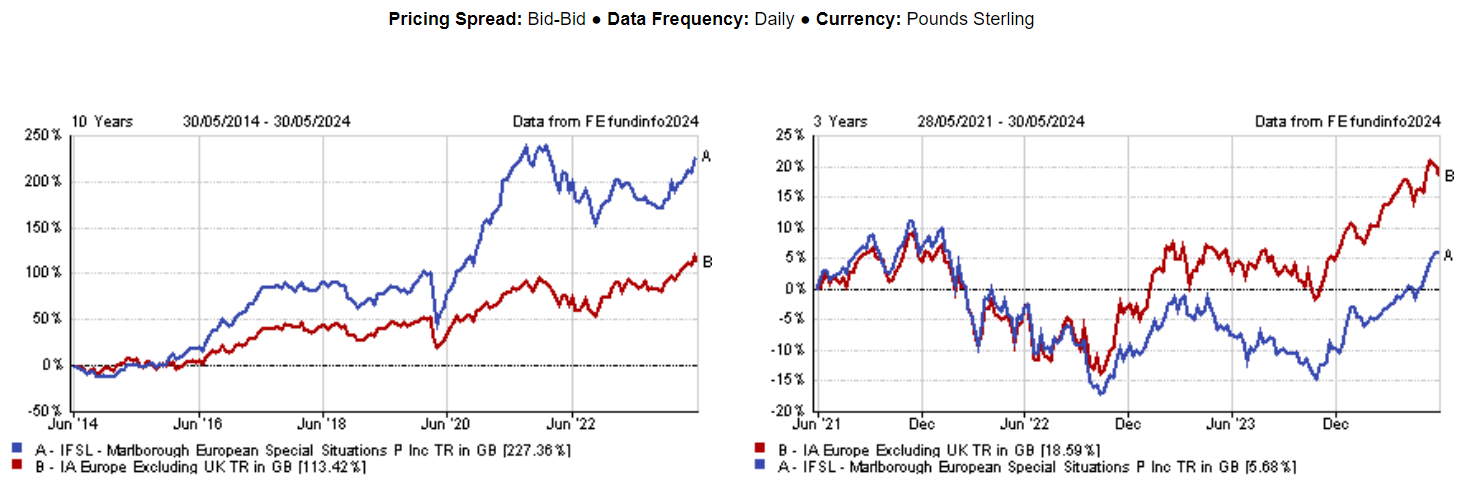

With £270.3m of assets under management, the fund is the right size to take advantage of many overlooked opportunities and has been the first performer over the past 10 years against the then 99-strong IA Europe Excluding UK sector, maintaining a first-quartile ranking over five years too.

Below, he explains why big funds are creating an investment “anomaly”, why European smaller companies are a better investment than UK and global ones, and why investing when the sky is cloudy leads to better outcomes than when it’s clear.

Can you summarise your investment process?

We invest in companies that are growing their profits at an above-average rate, have a good management team and whose shares are attractively valued, trading at price that’s not reflecting the company’s future growth potential.

We're not looking for loss-making or marginally profitable companies with a relatively unproven business model that promise to expand and earn huge profits. We are also not looking for companies in sectors that are appealing for investors at that time and focus instead those that are not on most investors’ radars, perhaps because they are small or somewhat obscure.

What type of companies does this correspond to?

We choose to look particularly at the small and micro-cap end of the market, where you can find the greatest under-valuations. Most managers of large funds won't look at companies below the £250m threshold because micro-caps don’t move the needle for them. It’s a perfectly rational, commercial reason, but it does create a market anomaly.

The size of this fund is such that we're able to take advantage of that anomaly and today, around 20% of the fund is in micro-caps.

Why should investors pick your fund?

If an investor is prepared to invest for at least five years, there is the potential to make good returns with this fund.

We're not in control of if and when share prices go up, so ours is a buy-and-hold strategy – it does take time for some of these companies to develop and grow. The fund can go through a number of years of fairly mediocre performance, but over a longer period, if we’re able to be patient with the holdings, we can get the benefits.

Why did the fund drop to the fourth quartile over three years?

The fund had strong gains in 2020 and 2021, when there was a boom in Europe, fuelled by Covid-era subsidies. With hindsight, we were too slow to take profits on number of Covid winners, for example, the Finnish sauna equipment maker Harvia. We were selling it on the way up and on the way down making good money on it, but we didn't take the chance to sell enough of it higher up.

There were a few other examples like that, which cost us on the way down in 2022.

Performance of fund against sector over 10 and 3yrs

Source: FE Analytics

Why are European small-caps a better investment than global or UK ones?

In Europe, you are investing in a market which is still somewhat underdeveloped compared to the UK and the US in terms of the equity culture. The size of the stock markets, compared to GDP, is also clearly lower in Europe.

On top of that, there are certainly headwinds which are affecting small companies now, but sometimes investing when the sky is a little bit cloudy can be better than when the sky is completely clear blue.

The war in Europe – obviously a human tragedy – is impacting the valuations of European equities, particularly the ones focused on domestic European economies. Most of these are smaller companies, which have got less diversification by geography compared to large-caps.

What stock was the best contributor to performance recently?

The fund’s biggest holding currently is Sarantis, a sort of Greek Unilever selling basic household goods. Its share price has gone up from €6.5 to €11 over the past 18 months, partly because of its aggressive growth plan.

It has expanded from Greece into the Balkans and Southeast Europe as bigger groups such as Procter and Gamble have retrenched from peripheral countries. Serrantis’ model is to acquire sales force in new countries and bring their products to the newly acquired retail customers, paired with some organic growth too.

We bought into it for the first time in 2016, a time when Greece was seen as a no-go zone for some investors. But the company itself had a good buying story behind it and we still hold it today.

What didn’t work as well instead?

A French company called Bilendi has been struggling but should be posed for recovery. It runs online research panels collecting data by asking any sort of questions to paid volunteers and then selling that data onto other companies who write market research.

The company did well for a period of time until last year, when its sales growth started to suffer, more than halving the share price. Today it’s at €17.9, down from €20.5 at end of December 2022.

We've held it because it didn't have any financial difficulties, it’s simply experiencing a headwind to its growth. One of its competitors however has recently become overly indebted because of a private equity buyout, so it might be an opportunity to gain some market share back.

What do you do outside of fund management?

I have a very full family life. I have four children so I'm often supporting their activities. Or I’d be hill walking with friends or family.