Only five funds managed by ‘veteran’ managers – those who have been at the helm since 2004 or earlier – have made top-quartile returns over the past three years across the IA Mixed Investment 40-85% Shares, IA Mixed Investment 20-60% Shares, IA Mixed Investment 0-35% Shares, and IA Flexible Investment sectors, data from Trustnet has revealed.

Among those five funds, three are from the Jupiter fund house and are managed by industry veteran and FE fundinfo Alpha Manager John Chatfeild-Roberts as well as Amanda Sillars, David Lewis and George Fox.

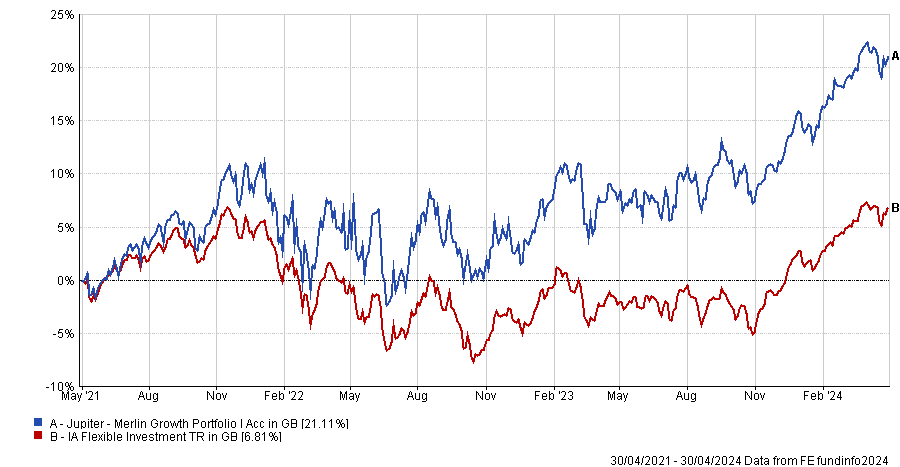

One of them is Jupiter Merlin Growth Portfolio, which is the only fund in the IA Flexible Investment sector that has matched our criteria. Chatfeild-Roberts was appointed manager of this fund in April 1997.

Over the past three years (to last month end), the fund has returned 21.1%, guaranteeing it a place in the sector’s top quartile.

Like the other Jupiter funds managed by Chatfeild-Roberts in our list, Jupiter Merlin Growth Portfolio uses a fund of funds approach, meaning that it invests in other funds, including both in-house Jupiter funds as well as funds from external providers.

Performance of fund over 3yrs vs sector

Source: FE Analytics

Analysts at Square Mile said: “The investment process starts with an analysis of the macroeconomic environment, which helps them formulate their investment strategy.

“By having an informed view on the broader economy and the market cycle, the team believe they are better placed to identify key turning points and thus make changes to the portfolio in a more timely manner.

“The team then focus on fund selection and seek strategies that are likely to benefit in the prevailing macroeconomic and market backdrop.”

The portfolio typically has 10 to 20 holdings, with Jupiter Global Value Equity, Jupiter UK Special Situations, WS Morant Wright Japan, Findlay Park American and IFSL Evenlode Global Equity currently the five largest positions in the fund.

The fund’s longer term performance has also been commendable, as it sits in the top quartile over five and 10 years.

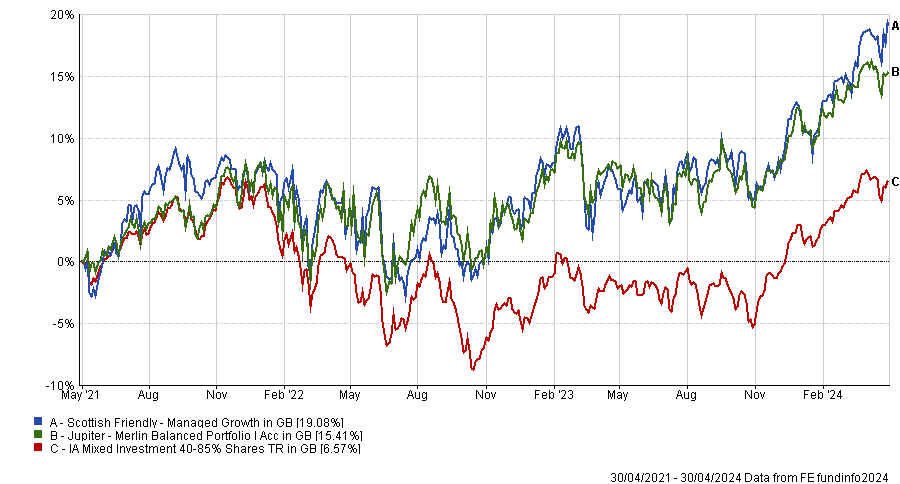

Jupiter Merlin Balanced Portfolio has achieved the same feat in the IA Mixed Investment 40-85% Shares sector. Chatfeild-Roberts took responsibility for this fund later in his career, as he was appointed manager in October 2002.

It is led by the same team as Jupiter Merlin Growth Portfolio and follows a similar investment process. A significant difference is that Jupiter Merlin Balanced Portfolio has a 10% allocation to fixed income and holds more alternative assets, whereas Jupiter Merlin Growth Portfolio is almost a pure equity play.

Performance of funds over 3yrs vs sector

Source: FE Analytics

Unlike in the IA Flexible Investment sector, Chatfeild-Roberts is not the only veteran manager to have shined over the past three years, as Colin McLean – who has been at the helm of Scottish Friendly Managed Growth since June 2004 – is also on a hot streak over the past three years.

In contrast to Jupiter Merlin Balanced Portfolio, Scottish Friendly Managed Growth does not use a fund of funds approach and directly holds a range of assets. It is currently predominantly invested in equities, although fixed income accounts for 10% of the portfolio.

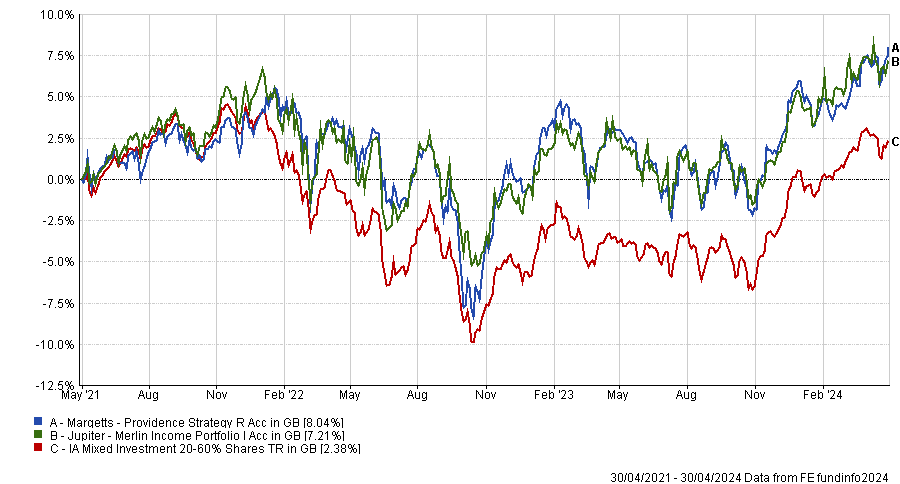

In the IA Mixed Investment 20-60% Shares Jupiter Merlin Income Portfolio also made it to the list, again with the same management team and investment approach, but with an even higher allocation to fixed income and alternative assets, accounting for roughly 30% and 9% of the portfolio respectively.

Performance of funds over 3yrs vs sector

Source: FE Analytics

Toby Ricketts, who has managed Margetts Providence Strategy since January 2001, is the other veteran manager in the sector to have made top-quartile returns over three years.

The fund also follows a fund of funds approach, as a minimum of 70% of the portfolio must be invested in collective investment schemes, providing an exposure to shares ranging from 30% to 60%.

Moreover, at least half of the portfolio must be invested in assets which are denominated in Pound Sterling or hedged back to this currency.

Equities currently account for 56% of the portfolio, bonds make up 40%, and the remainder is held in cash.