The fixed income space has proven to be a difficult area for long-serving managers to excel in recent years.

Indeed, only two ‘veteran’ managers – those who have been at the helm since 2004 or earlier – have made top-quartile returns over the past three years across the IA Sterling Strategic Bond, IA Sterling Corporate Bond and IA Sterling High Yield sectors, according to data from Trustnet.

One of those two experienced managers who have stood the test of time is FE fundinfo Richard Woolnough, who has been at helm of M&G Strategic Corporate Bond since February 2004.

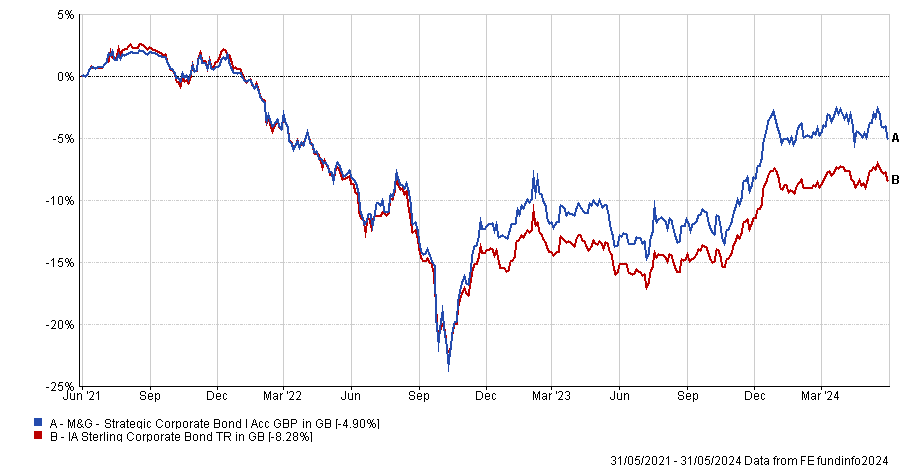

The fund – which Woolnough has been co-managing with Ben Lord since 2021 – has fallen 4.9% over the past three years (to the end of May). Nonetheless, it still ranks 23rd out of 90 in the IA Sterling Corporate Bond sector over that period.

Performance of fund over 3yrs (to last month end) vs sector

Source: FE Analytics

Long-term performance has also been commendable, as the fund sits in the sector’s top quartile over 10 and five years.

Although the M&G Strategic Corporate Bond fund belongs to the IA Sterling Corporate Bond sector, its mandate allows Woolnough and Lord to invest up to 20% in government bonds. Additionally, high-yield bonds should not account for more than 20% of the portfolio.

Analysts at FE Investments said: “The investment process begins by agreeing on a view of the global economic environment and how this will affect inflation and interest rates, particularly in the UK. This helps the managers define the appropriate risk level to employ in the fund and identify sectors and asset classes offering most value.

“Credit analysts at M&G study issuing companies across the UK, Europe and the US in order to identify pockets of value, and the portfolio managers combine these recommendations with their macroeconomic views to finalise portfolio positioning.”

They also noted that, historically, the fund has outperformed peers when credit markets rallied, as was the case in 2017 or the second half of 2020, but lagged during sell-offs, such as in 2018 and March 2020.

The other top-performing fixed income fund manager is Eric Holt of Royal London Sterling Extra Yield Bond in the IA Sterling Strategic Bond sector.

Holt has run the five-crown rated fund since April 2003 and was joined by Rachid Semaoune in 2019. Together, they aim to achieve a gross redemption yield of 1.25 times the gross redemption yield of the FTSE Actuaries British Government 15 Year index.

Performance of fund over 3yrs (to last month end) vs sector and benchmark

Chart

Source: FE Analytics

According to the fund’s latest factsheet, unrated bonds and bonds rated BB or below account for 32% and 42.6% of the portfolio, respectively. This suggests a higher exposure to issuers with poorer credit quality, but also higher compensation due to the associated default risk.

In terms of maturity, half of the bonds in the fund are due to mature within 0 to five years, while 31.6% of the securities have a maturity of more than 15 years.

Over the past three years (to the end of May), the strategic bond fund has returned 12.4%, ranking fourth out of 80 in its sector.

Longer term performance has been even stronger, as Royal London Sterling Extra Yield has been the top-performing fund in the IA Sterling Strategic Bond sector, roughly 16 percentage points ahead of runner-up AXA Framlington Managed Income.

Finally, no veteran manager met our requirements in the IA Sterling High Yield sector.