It may have flown under many investors’ radars, but the best-performing investment trust so far this year specialises in private space tech businesses.

Since the beginning of the year, Seraphim Space has surged by 94.8%, nearly 40 percentage points ahead of the runner-up, Foresight Sustainable Forestry Company.

While Seraphim Space’s performance in 2024 has been stellar, it follows two consecutive challenging years, with the investment trust’s share price falling 64% in 2022 and 23.9% in 2023.

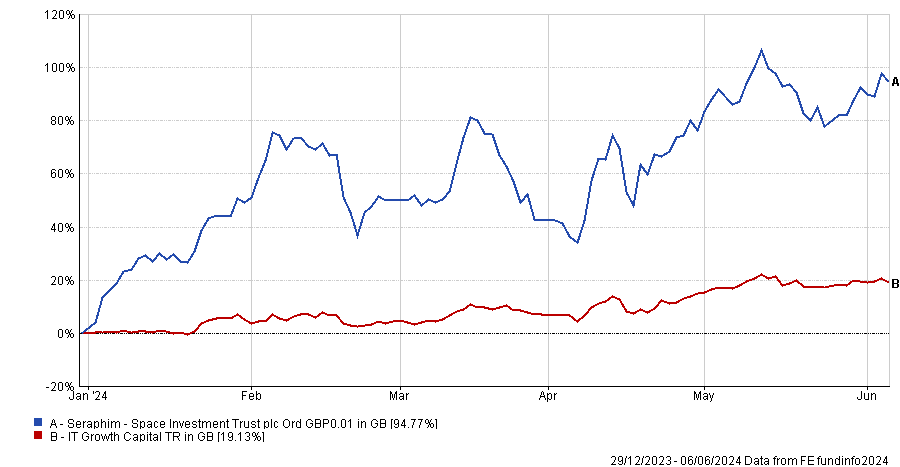

Performance of investment trusts YTD vs sector

Source: FE Analytics

Therefore, this outperformance is more of a recovery, as investors are warming up to riskier assets.

Rob Morgan, chief investment analyst at Charles Stanley, said: ”The NAV [net asset value] has remained much more stable, illustrating that sentiment around the perceived value of the underlying assets, which are all private companies, has varied markedly over this time and accounts for most of the change in the share price.

“One of the main factors affecting the trust, as well as many others in the growth capital sector, is rising interest rates. This makes the cost of funding higher, as well as depressing the value attributed to future income streams. This double whammy has affected a lot of pre-profit company shares in both public and private markets.”

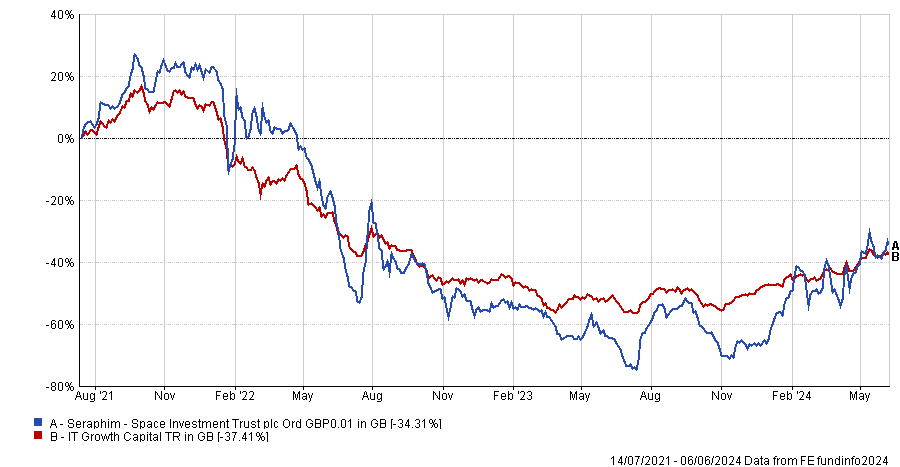

As a result, the investment trust is still down 34.3% since its launch and had even lost three-quarters of its IPO price by summer last year.

Performance of investment trusts since launch vs sector

Source: FE Analytics

Winterflood Securities believes that Seraphim Space’s sell-off has been overdone and added the investment trust to its recommendation list at the beginning of this year.

Shavar Halberstadt, equity research analyst at Winterflood, said: “Our thesis at the start of year was relatively straightforward: Seraphim Space benefits from structural tailwinds in the shape of rising spending on defence and climate monitoring solutions.

“It had been de-rated to a level that we viewed as preposterous, with a share price essentially implying that all but its top two holdings were worthless. This despite tangible progress at the company level, with multiple holdings awarded large government contracts and partnering with established aerospace and defence players, indicating a stickiness of revenue that often eludes early-stage companies.

“Furthermore, additional details on profitability of large holdings were expected and delivered in March, and the fund would be a general beneficiary of rate cuts and IPO green shoots. Substantively all of these dynamics played out as expected over the year to date, and the market concluded, rightly in our view, that Seraphim Space had been woefully oversold.”

Charlotte Cuthbertson, co-manager of MIGO Opportunities Trust, who holds shares in Seraphim Space in her own investment trust, added that half of the portfolio companies are either profitable or nearing profitability.

Can Seraphim Space soar even higher?

Although some shareholders might prefer to cash out after such a strong surge, Winterflood assessed in March that Seraphim Space had more room to run. This was based on guidance on profitability, discount metrics, and portfolio company fundraising and operational progress.

Halberstadt said: “Listed portfolio company AST SpaceMobile is up +250% over the last month, following a $100m partnership with Verizon; portfolio company Voyager Space saw Mitsubishi join its ‘Starlab’ effort to build the next International Space Station; funding rounds for ICEYE and Xona were oversubscribed; while Tomorrow.io was awarded a $10m DoD contract, amongst other developments. Thus, we believe Seraphim Space continues to be well positioned.”

Yet Darius McDermott, managing director of Chelsea Financial Services and FundCalibre, does not expect to see returns of that magnitude going forward, as the “easiest money” has probably already been made. However, he noted that as the trust is still trading at a discount of around 30%, there is still potential for further narrowing over the longer term.

Should you get on board?

Although space-related technology is an exciting area and represents a new frontier of growth potential, Morgan emphasised the high-risk profile of Seraphim Space.

Therefore, he recommended that investors adopt a very long-term horizon with Seraphim Space and size it appropriately in a portfolio.

“This holding should very much be a satellite position at the very fringes of an investor’s universe (no puns intended!) It’s esoteric nature, concentration in both theme and number of stocks makes it more akin to holding an individual share than a diversified fund. That said, it could be an interesting long-term investment and it captures the imagination – something to get kids who are interested in space also interested in investing perhaps.”

James Carthew, head of investment companies at QuotedData, agreed and added that the trust is a unique proposition, even among space funds.

He said: "The few other space funds that investors can access tend to be more exposed to big aerospace and defence stocks that have a side-line in space, whereas Seraphim is more focused on unlisted companies that would be impossible for most investors to access any other way. It is a diversifier, therefore, but it has been volatile and that may continue."

Due to the risky nature of the investment trust, McDermott called on investors to do a lot of research on the trust’s underlying holdings if they are considering buying it.

He stressed that space tends to be highly capital intensive and difficult to make returns from.

“This trust is highly concentrated and much of its performance will depend heavily on its largest positions in ICEYE, D-Orbit and All.SPACE,” he said.

“The environment has become much tougher for earlier stage businesses in the higher interest rate environment. The trust is also quite small and illiquid. Given it is mostly invested in private companies, the NAV is highly uncertain.”

Finally, Cuthbertson said she would look to top up her position if the share price weakens from here.

She concluded: “Seraphim Space gives investors exposure to fast-growing companies in the space sector. Space is becoming increasingly important due to its growing impact on critical industries such as communication and defence. Its exposure to defence is particularly pertinent in the current geopolitical environment where defence budgets are increasing worldwide.”