In both football and investing, picking the best players doesn’t always make for the optimal team; the secret to success is how players’ skills complement each other.

Ahead of the UEFA Euro 2024 football championship, which kicks off on Friday, fund selectors have put themselves in the shoes of football managers to come up with a winning portfolio that strikes the right balance between defensive and offensive plays and has the best chances of coming out on top.

Defenders

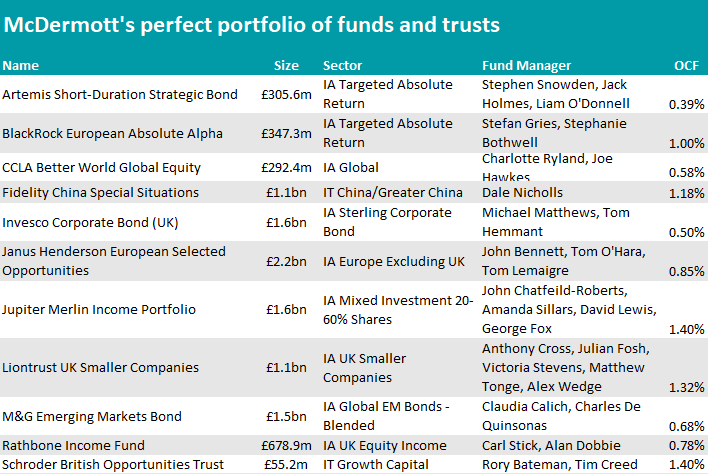

Starting with the goalie, it’s all about capital preservation. The Artemis Short-Duration Strategic Bond fund should be able to pull the best saves, according to FundCalibre managing director Darius McDermott.

The fund adapts to changing market conditions by adjusting its allocation to government bonds, investment-grade and high-yield. The focus on bonds with five years or less to maturity “should make it less volatile than the wider bond market”, said McDermott, who also appreciated manager Stephen Snowden’s use of derivatives and futures to reduce risk and manage duration.

The fund has produced a positive return in four of the past five calendar years and also offers an “attractive” distribution yield of 5.21%.

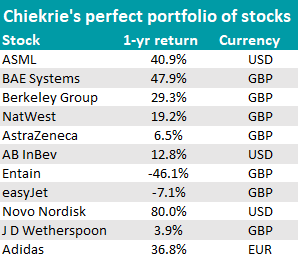

Moving to stocks, Hargreaves Lansdown equity analyst Aarin Chiekrie said that “like the best goalkeeper in the world, it’s hard to see any opponent getting past” ASML, as the Dutch semiconductor company “has a monopoly on the most advanced type of lithography machines used to make the chips that power your phones, computers and even cars”.

As defenders, McDermott chose his back four with some bite.

First up is BlackRock European Absolute Alpha, a long/short pan-European equity fund with a focus on capital preservation and low levels of volatility, but which also managed to almost double the return of the average IA Targeted Absolute Return peer over the past five years, as the table below shows.

Performance of fund against sector over 5yrs

Source: FE Analytics

It is flanked by two bond funds, M&G Emerging Markets Bond and Invesco Corporate Bond, and aided by the Jupiter Merlin Income Portfolio, a “stalwart in the multi-asset sector” designed to provide “an immediate and growing income” as well as the potential for capital growth.

Chiekrie called four players to the pitch: defence company BAE Systems, which is “almost guaranteed to give you a solid performance”; building company Berkeley Group, which “sits on solid ground, despite the current shaky housing market”; NatWest, which convinced him for its new chief executive officer, strong balance sheet and a prospective 5.6% dividend yield; and AstraZeneca, which is seeking to debut 20 new medicines to help fuel growth by 2030.

Midfielders

Midfield is where matches are won and lost, according to McDermott, who turned to Rathbone Income, Janus Henderson European Selected Opportunities and CCLA Better World Global Equity for “goals, flair and bravery”.

The Rathbone strategy has “one of the best – if not the best – track records among open-ended funds for paying dividends,” he said.

“Manager Carl Stick is somewhat of a contrarian investor, so the fund may lag behind while his peers catch up with the news,” but all of its 30 to 50 holdings are chosen for their high quality and visibility of earnings.

The Janus Henderson portfolio is a jack-of-all-trades, mixing mega and large blue-chip holdings with some mid-caps to achieve additional sources of alpha.

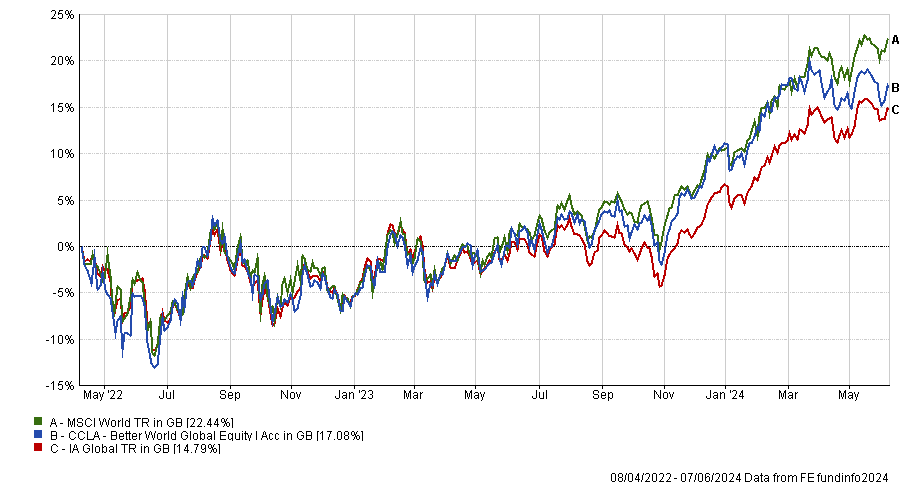

Rising star CCLA Better World Global Equity was launched in 2022 but has proved “very successful since then”, as the chart below illustrates.

Performance of fund against sector and index since launch

Source: FE Analytics

Over in the stocks tournament, Chiekrie put his faith in Belgian drinks company AB InBev, which owns fan-favourite beers such as Budweiser, Corona and Stella Artois.

“Like a midfield maestro dictating the tempo of the game and spraying passes out to all teammates, the group’s diverse portfolio of drinks brands means it has something for everyone this summer,” he said.

The analyst also chose UK-listed Entain, which owns betting houses such as Ladbrokes and Coral.

“It’s been under plenty of pressure from regulators and overall performance has been underwhelming recently, but still, you wouldn’t bet against them turning their form around and making a positive contribution.”

Finally, easyJet looks well-placed with a portfolio of slots at some of Europe’s most valuable airports. It is trading at a cheap valuation despite increased passenger numbers, so there’s scope for this airline to become a fan favourite in the near future, Chiekrie said.

Attackers

For high-octane performance, McDermott has been warming up Fidelity China Special Situations.

Having fallen over 40% since February 2021, the re-rating of China’s equity market has been “indiscriminate”, which has created “plenty of valuation opportunities”.

“With a bias towards smaller and medium-sized companies, this trust is not for the faint-hearted, but manager Dale Nicholls has consistently outperformed his peers and the trust is on an attractive 10% discount,” he said.

For his final two choices, McDermott stuck with recovery plays, this time in the UK.

Liontrust UK Smaller Companies and Schroder British Opportunities Trust should benefit from the recovery of smaller companies, which, coupled with attractive valuations and an increasing number of mergers and acquisitions, could be a compelling opportunity from here.

Source: FE Analytics

“Backed by a market-leading team, the Liontrust fund has a very clearly-defined investment process based on intangible strengths. Every stock in the portfolio must have intellectual property, a strong distribution network or recurring revenues,” the fund selector said.

Investing in both public and private businesses, Schroder British Opportunities targets ‘high growth’ and ‘mispriced-growth’ companies.

“Although performance has held up well relative to its peers sentiment has been hit hard, with the trust at a near 35% discount.”

Performance of trust against sector over 5yrs

Source: FE Analytics

Completing the stock squad are strikers J D Wetherspoon and Adidas.

According to Chiekrie, Wetherspoons’ low-value proposition means that “it's well-placed to block out the noise of an unsettled economy and just focus on its own game”, having already scored a like-for-like sales rise of 5.2% last quarter.

On the way home from the match, fans are more likely to pick up an original shirt from Adidas, after host country Germany announced fines of up to £4,000 for supporters caught wearing fake shirts.

“After a challenging 2023, which saw revenue and profits wide of the post, Adidas could be poised to score impressive growth this year,” the analyst concluded.

Source: Google Finance