Janus Henderson Strategic Bond and Jupiter Strategic Bond are the largest funds in the IA Sterling Strategic Bond sector, suggesting significant demand from investors.

Both funds are managed by experienced and respected teams. For instance, FE fundinfo Alpha Manager Ariel Bezalel has been at the helm of the Jupiter fund since 2008. Meanwhile, Janus Henderson Strategic Bond has been managed by John Pattullo since 1999 and Jenna Barnard since 2006, although Pattullo will retire in March 2025.

Paul Angell, head of investment research at AJ Bell, said the funds approach duration in a similar way.

“Both funds are genuinely dynamic in their duration positioning, which is surprisingly rare when compared to most funds in the IA Sterling Strategic Bond sector.

“An appetite for duration risk was particularly evident during the years of low interest rates through the tail-end of the 2010s, when the managers of both funds were willing to buck wider consensus and take sizeable duration positions as part of a 'lower for longer' interest rate trade,” he explained.

“The funds have been similarly positioned in their duration positioning in recent years with both now operating near a maximum long, given their managers' concerns with economic growth and expectations around falling inflation.”

Trustnet asked experts about the differences between the funds, their personal preferences, and whether they would suggest any other strategic bond funds besides those two.

How do they differ?

Eduardo Sánchez, associate research director of fixed income, alternatives and multi-asset at Square Mile Investment Consulting and Research, highlighted Jupiter’s barbell approach, combining high-quality credits with highyield bonds.

In comparison, Janus Henderson Strategic Bond has reduced its position in high-yield credits. While this is a sign of prudence, it has caused the fund to underperform compared to Jupiter.

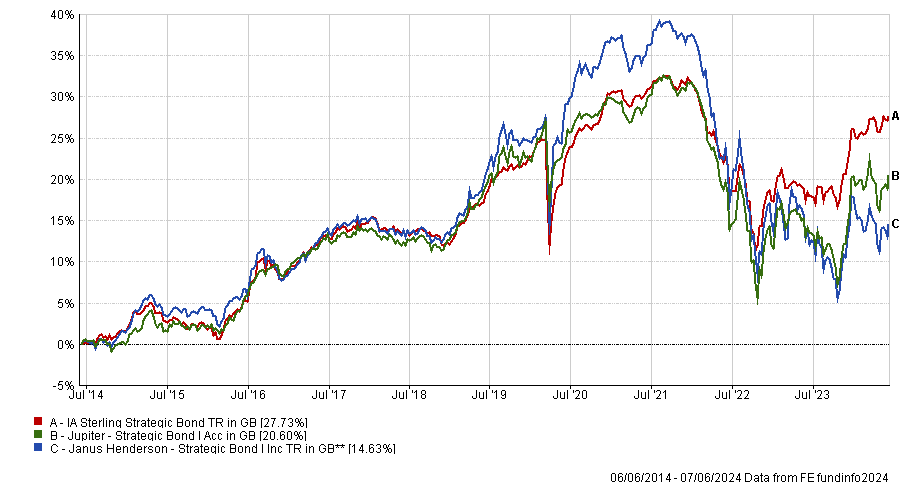

Performance of funds over 3yrs

Source: FE Analytics

Angell said: “Janus Henderson typically invests in what it sees as lower beta, defensive credits in sectors such as telecoms, software and healthcare, whereas the Jupiter team typically has a broader and more active approach to allocating across sectors, depending on where the managers see the best opportunities through time.”

In addition, Jupiter Strategic Bond allocates to emerging market debt, while the Janus Henderson fund avoids this part of the market.

Janus Henderson Strategic Bond has two-thirds of its portfolio invested in AAA to A-rated bonds, which is more than twice the allocation of the Jupiter fund.

Which fund do experts prefer?

While considering both funds to be “solid” options, Sánchez prefers Janus Henderson Strategic Bond. He highlighted the experience of the portfolio managers and their top-down macro expertise.

Yet, he also warned that they can “get stuck to their views”.

“When these go against market moves, the strategy can experience sustained periods of underperformance given their willingness and patience to allow their thesis to play out,” Sánchez said.

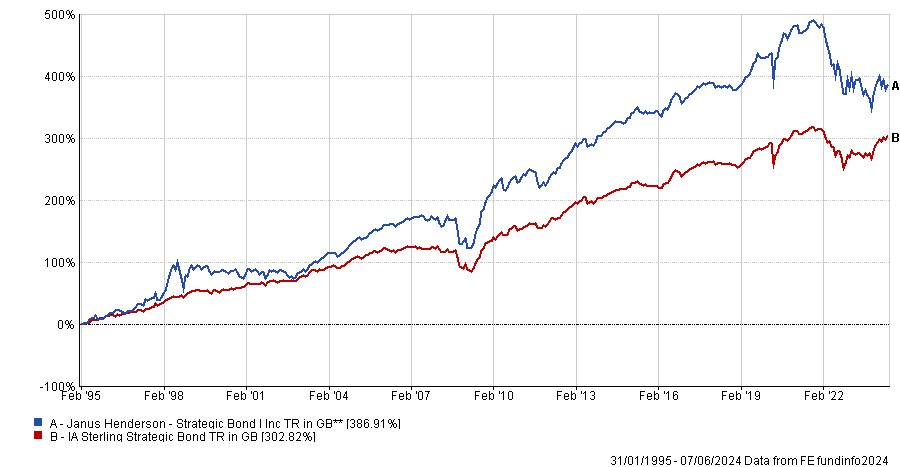

Performance of fund since launch vs sector

Source: FE Analytics

Jason Hollands, managing director at Bestinvest, also opted for the Janus Henderson fund. He emphasised the depth of resources available to the managers, including the ability to leverage a team of 20 credit analysts based in London and Denver.

He added: “The key Janus Henderson strengths in my view are the flexible approach and strong risk management mindset, which has helped the fund perform well across different market conditions.”

Yet, Sam Benstead, fixed income lead at interactive investor, favours Jupiter Strategic Bond, stressing the strong absolute and risk-adjusted returns since inception.

Performance of fund since launch vs sector

Source: FE Analytics

He said: “Bezalel has been happy to own fewer UK government bonds to achieve this, and currently has debt from the US, Brazil, New Zealand and Australia in his top 10. Around a quarter of his fund is in sterling-denominated bonds compared with 37% for Janus Henderson.

“Both funds have a similar duration and amount invested in government bonds, but Jupiter has a higher yield because it owns more lower-rated bonds. Janus Henderson has 90% in investment-grade bonds and Jupiter has only around 40%.

“Investors looking for higher yields are better served by Jupiter, but the downside is that the bonds could perform worse if there is a recession and doubts over the credit worthiness of companies.”

Are there better alternatives?

While Janus Henderson Strategic Bond and Jupiter Strategic Bond are the largest funds in the IA Sterling Strategic Bond sector, it is worth noting that they have both lagged behind their peer group over the past 10 years.

As a result, investors may prefer to bet on a strategic bond fund with a lower profile but a more appealing recent track record.

Both Hollands and Angell pointed to TwentyFour Dynamic Bond and Invesco Tactical Bond, which are both best ideas funds with flexible mandates.

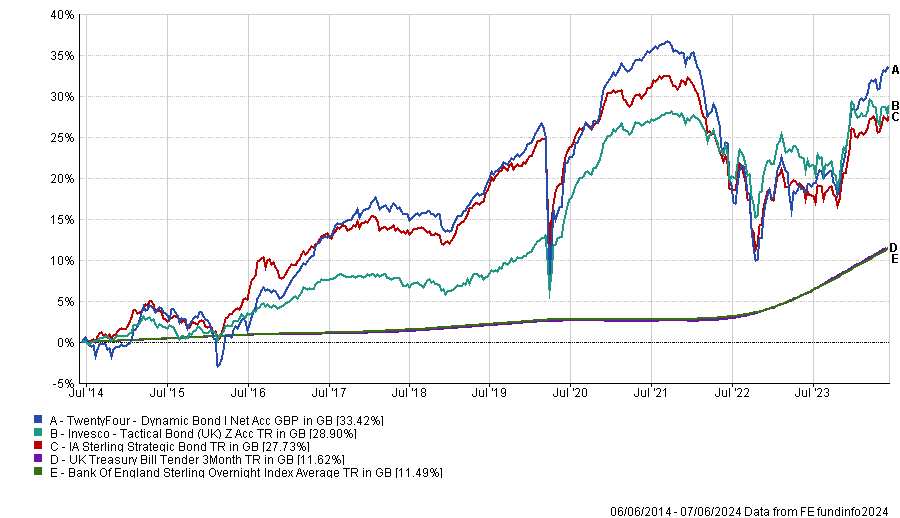

Performance of funds over 10yrs vs sector and benchmarks

Source: FE Analytics

Angell said: “The managers of the TwentyFour fund have made the most of its dynamic asset allocation, as well as its holdings in high-yielding collateralized loan obligations, whilst the Invesco fund positioned well into the rising interest rate environment.”

As for Sánchez, Waverton Sterling Bond and Aegon Strategic Bond are his preferred choices alongside Janus Henderson Strategic Bond.

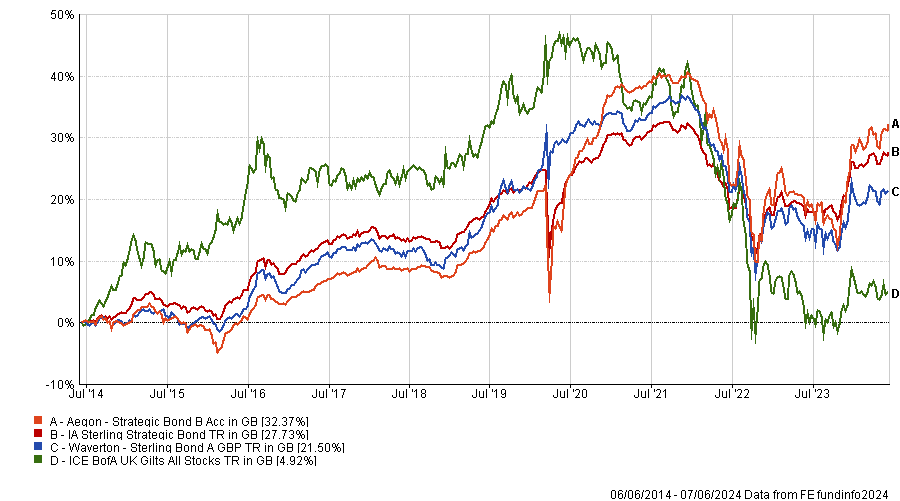

Performance of funds over 10yrs vs sector and benchmark

Source: FE Analytics

The Waverton fund, managed by James Carter and Jeff Keen, aims to offer investors a blend of income and capital growth with low correlation to equities and high-yield debt.

Sánchez said: “We believe this to be an attractive feature making the fund a core fixed income offering, providing diversification benefits in risk off periods.

“However, the fund is also flexible enough to manage credit exposure actively, including high yield credit and emerging markets debt, to deliver income.

“In addition, we like the managers’ high conviction approach which emphasises a high-quality portfolio, with a minimum 80% exposure to investment grade rated bonds and a self-imposed minimum interest rate risk exposure of at least five years.”

The Aegon Strategic Bond fund is an active, unconstrained strategic bond strategy consisting of a dynamic blend of global fixed income instruments, constructed to maximise risk-adjusted total returns through the market cycle. It is co-managed by Colin Finlayson and Alexander Pelteshki.

Sánchez added: “The process relies on six areas of alpha generation: asset allocation, credit risk, duration, yield curve, stock selection and sector selection. The managers blend top-down views with bottom-up security selection, with alpha coming from the different factors in different ways depending on the market environment, seeking to exploit long term and short-term market opportunities and inefficiencies.

“This combines to make the fund a compelling option for investors seeking a blend of income and capital growth through a dynamically managed portfolio of fixed income assets.”