People keep talking about when the UK market is going to turn, but very few realise it probably already has. There have been signs particularly in the small-cap arena, as the asset class has silently climbed up the 2024 performance table and leapfrogged to the very top earlier this month.

Jonathan Brown and Robin West, managers of the £146m Invesco Perpetual UK Smaller Companies trust, have been patiently watching this trend since the autumn of last year, when they started to crank up the gearing on the trust from 0%, where it has been since 2011, all the way to the current 5%.

Their decision to take up more debt and increase the exposure to the market was based on a combination of favourable conditions measured through multiple lenses, including valuations, momentum and earnings momentum, economic outlook and geopolitics.

“Valuations had looked attractive for a long time and we felt inflation was about to peak. Then, we started to see the beginnings of takeover activity, so we put on 1% to 2% and waited to see how the market would fare,” West said.

“Our confidence has increased since then and we’re now geared between 5% and 6%.”

The pickup in market momentum over the past quarter has been a reason for the increase in optimism, but the most convincing parameter for the managers was valuations.

“We looked at the valuations of smaller companies in the past 30 years. When they traded on similarly low multiples as they do today, the average return was 19% over the next 12 months and 36% over the next two years,” West continued.

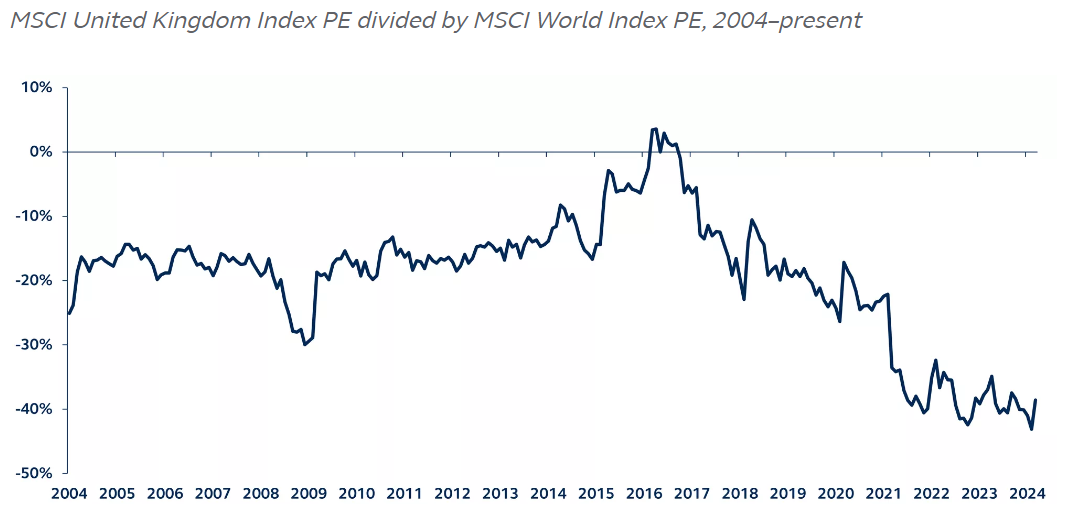

On top of that, the UK is one of the biggest underweights globally and is “definitely on sale” at the moment, with the MSCI UK index more than 30% cheaper than the MSCI World index, as the chart below illustrates.

UK price/earnings relative to the world

Source: Factset, MSCI, Principal Asset Management. Data as of December 31, 2023.

This value is not only clear to the managers but also to private equity and corporates, which have been snapping up bargain after bargain in the UK. It is also apparent to other investors too, they noted.

“At the end of March 2024 for the first time in the past two years, the institutional trading system at Merrill Lynch went from showing the UK as a net sell to having net buyers,” West said.

“That's a reason why we think the discount that the UK is trading at will close, and that was one of the key factors behind our decision to introduce gearing.”

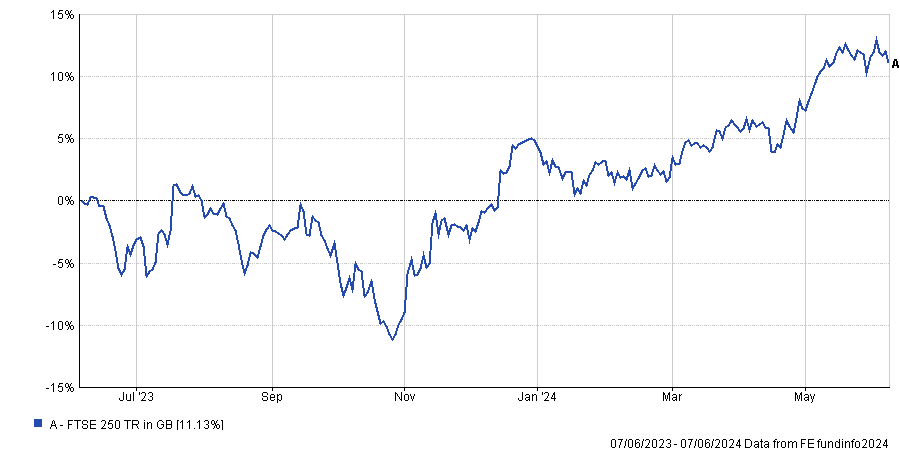

To those that aren’t convinced the market has already turned, Brown suggested looking at the performance of the FTSE 250 index.

Performance of index over 1yr

Source: FE Analytics

It bottomed at the end of October last year, but has recovered over 25% since then.

“It's not a question of when the market is going to turn, it's already turned thanks to better sentiment about inflation and interest rates, the cheapness of the UK and takeover bids, whose cash gets reinvested back into the market as well,” he said.

“With the economic situation further improving and the future interest rate cuts, we can see a push even further. That's not well understood by investors. After a period of being in the doldrums, the market has had a very strong six or seven months, and for where valuations are, it's got a very long way to run still.”