Multi-asset funds are something of a one-stop shop for investors, offering exposure to a broad range of asset classes, which usually serves to reduce volatility. However, it has been a challenging half a decade for multi-asset investors, with the Covid pandemic, rising interest rates, rampant inflation, elections and war all creating significant volatility in the equity and bond markets during this time.

Nevertheless, several multi-asset funds have managed to strike a delicate balance between risk and reward. As part of our ongoing series, Trustnet examines the strategies that made the best risk-adjusted returns over the past five years, looking at those with top-decile Sharpe ratios and performances. Below we examine the funds in the various IA Mixed Investment and IA Flexible Investment sectors.

The IA Mixed Investment 0-35% Shares sector has been excluded due to minimal distinctions between the constituent's Sharpe ratios.

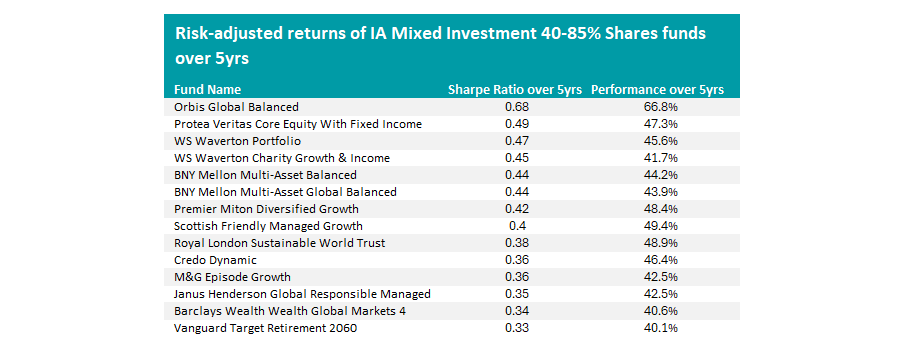

For investors in the IA Mixed Investment 40-85% Shares sector, the £444m Orbis Global Balanced strategy, led by FE Fundinfo Alpha Manager Alec Cutler, stood out.

Risk-adjusted returns of IA Mixed Investment 40-85% funds over 5yrs

Source: FE Analytics, total returns in Sterling, Data to 30 Sep 2024

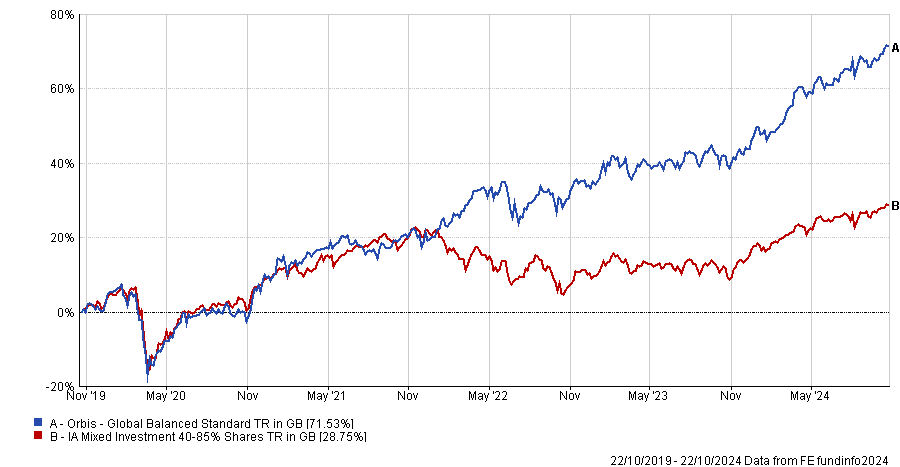

Over five years, the portfolio was up by 66.8%, a best-in-class result, which it paired with a sixth-decile volatility of 10.7%. This combination of risks and rewards led to a five-year Sharpe ratio of 0.68, the best in the sector. This was better than its nearest competitor, Protea Veritas Core Equity With Fixed Income, by 0.19.

Performance of fund vs sector over 5yrs

Source: FE Analytics

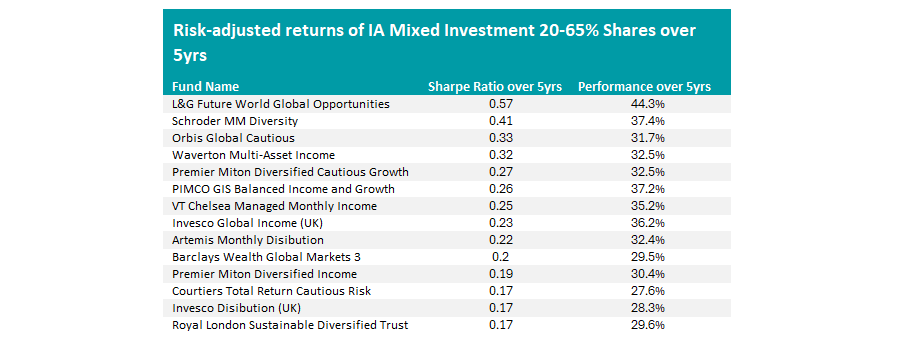

Turning to the IA Mixed Investment 20-65% Shares sector, a more cautious strategy differentiated itself.

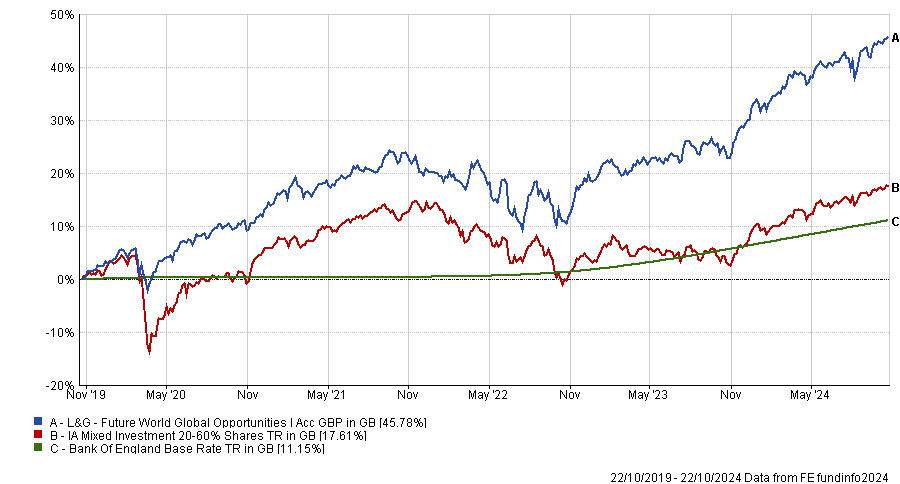

With second-decile five-year volatility of 7.3%, the L&G Future World Global Opportunities fund was one of the least risky strategies in the peer group. Launching in 2018 under the leadership of Alpha Manager Colin Reedie, the fund rose 46.2% over the past half a decade.

Risk-adjusted returns of IA Mixed Investment 20-65% funds over 5yrs

Source: FE Analytics, total returns in Sterling, Data to 30 Sep 2024

High returns and comparatively low risk meant the portfolio achieved a Sharpe ratio of 0.57 over five years – the best in the peer group by 0.16.

Despite lacking a 10-year record, the fund has consistently performed well in the shorter term, ranking within the top 10 strategies of the Mixed Investment 20-65% sector over the past three years and one year.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

Additionally, the portfolio also protected investors’ money during this period better than many of its competitors. With a maximum drawdown of just 11.9%, it was the third-best portfolio in the sector at minimising losses over the past half a decade.

Finally, in the IA Flexible Investment sector, the more gung-ho strategies generally thrived, with the Premier Miton Diversified Dynamic Growth fund ranking as the best in the sector for risk-adjusted returns.

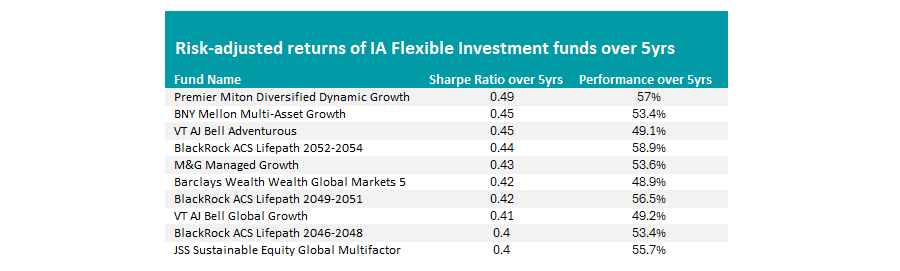

Risk-adjusted returns of IA Flexible Investment funds over 5yrs

Source: FE Analytics, total returns in Sterling, Data to 30 Sep 2024

Over the past five years, the fund, which launched in 2019 under chief investment officer Neil Birrell, has made 57%, a top 10 result within the 119-strong IA Flexible Investment peer group.

It has paired this with a seventh decile volatility of 12.2%, making it slightly more aggressive than the average fund in the Flexible Investment sector. Combined, the fund’s Sharpe ratio of 0.49 was the best result in the sector.

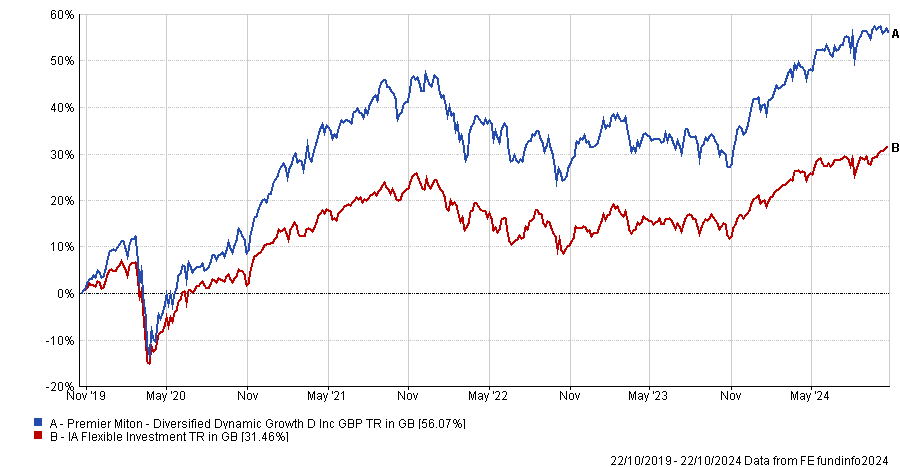

Moreover, it has replicated this strong performance in the near term, with the fund climbing by 22% over the past year, another first-decile result. While it did fall to the second quartile over the past three years, its performance of 11% still outpaced the sector average of 7.7%.

Performance of fund vs sector over 5yrs

Source: FE Analytics

Its impressive results have been attributed to its experienced management team, with analysts at Square Mile describing the investment team as “key to the strategies’ success”.

Lead manager Neil Birrell was described as particularly influential, due to his long history in fund management and ability to “position the portfolio to benefit from the prevailing economic environment”, allowing it to thrive even in more challenging circumstances.

Previously in this series, we have looked at the IA North America, IA Global and the IA UK All Companies sectors.