Investors would have been considerably better off choosing investment trusts over their open-ended siblings, according to new research from Wealth Club, which compared returns from 80 fund/trust pairs over the past decade.

Three-quarters (75%) of investment trusts delivered higher returns than their sister open-ended funds over 10 years on an underlying net asset value (NAV) basis, outperforming by an average of 5.3 percentage points.

Source: Wealth Club

The data is less conclusive on a total return basis, given that investment companies’ share prices have not, on the whole, kept up with their net asset values, resulting in pervasive discounts. Indeed, at present investment trusts sit on an unusually wide discount compared with their long-term history.

Over the long term, however, share price volatility accounts for a diminishing proportion of total returns, so although investment trusts’ share price returns have lagged their open-ended siblings over five years, they have outperformed over 10 years, as the chart below shows.

Source: Wealth Club

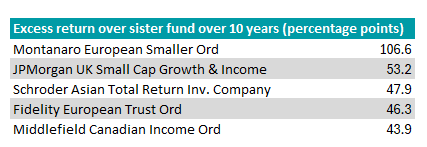

Five trusts in particular stand out for trouncing their open-ended siblings, outperforming by an average of 59.6 percentage points on an NAV basis.

Source: Wealth Club

The Montanaro European Smaller Companies trust is managed by George Cooke and Stefan Fischerfeier. The pair also managed the Montanaro European Smaller Companies fund until 31 March 2024, when Cooke stepped down from that particular strategy, although Fischerfeier continues to run it.

The trust has a £264m market capitalisation and its discount has widened by 3.2% over 10 years.

Performance of Montanaro European Smaller Companies fund vs trust over 10yrs on a total return basis

Source: FE Analytics

The JPMorgan UK Small Cap Growth & Income trust was recently formed through the merger of JPMorgan UK Smaller Companies and JPMorgan Mid Cap. Georgina Brittain and Katen Patel managed both trusts previously and now run the new entity.

For this study, Wealth Club compared the track records of the JPMorgan UK Smaller Companies trust with the open-ended fund of the same name.

Performance of JPMorgan UK Smaller Companies fund vs trust over 10yrs

Source: FE Analytics

In third place, the Schroder Asian Total Return trust and fund are both managed by Robin Parbrook, who was recently named FE fundinfo Alpha Manager of the Year, and King Fuei Lee.

Their best ideas portfolio of 40-50 stocks is complemented by derivatives to provide an element of capital preservation.

Performance of Schroder Asian Total Return fund vs trust over 10yrs

Source: FE Analytics

Nicholas Hyett, investment manager at Wealth Club, said investment trusts tend to outperform for three reasons: “gearing, reduced liquidity concerns and the opportunity to buy back their own shares”.

“Investment trusts let you invest in things like private equity and infrastructure, that are otherwise the preserve of institutions and the mega wealthy,” he explained.

“Not having to worry about meeting investor redemption requests at short notice means that investors can take positions in small illiquid companies they might otherwise avoid. A wider opportunity set, together with the ability to harvest the premium that is usually associated with illiquid stocks, has the potential to boost returns over the long term.”