Legendary investor Warren Buffett famously said that his favourite holding period is forever.

Some of the best-known fund managers, including Nick Train, Terry Smith and Stonehage Fleming’s Gerrit Smit, buy stocks with the intention of holding them for the very long term and make minimal changes to their portfolios. Many fund managers invest with at least a five-year view.

The rationale behind buy-and-hold investing is that, although it may not always be smooth sailing, the best companies will eventually prevail due to their strong fundamentals.

Yet FE fundinfo Alpha Manager Brian Kersmanc, a portfolio manager at GQG Partners, does not believe this is the optimal way to invest.

“We embrace turnover in our portfolios and think of it in terms of optimisation,” he said.

“At the beginning of a game, the manager of a sports team puts the players on the field that they believe are going to execute well over the course of the next several quarters.

“However, conditions evolve during the game, so maybe they will need to change who they have on the field.”

Kersmanc cited several turning points during the past five years that would have been difficult, if not impossible, to predict, such as the Covid pandemic, the war in Ukraine, the rapid deterioration in trade relations between the US and China, as well as the return of inflation.

He said: “Let's face it, there's no way I could have foreseen those events, so why should we act in a way where we absolutely want to set a five-year view that we’re going to anchor and never change? Our portfolio moves as much as the information flow changes.”

As a result, the investment team at GQG Partners is comfortable making bold moves to identify better opportunities or ensure capital preservation.

“If we see a risk percolating on the horizon, we will trim positions very aggressively,” Kersmanc added. “If the risk doesn't come to fruition, we're more than happy to get back in.”

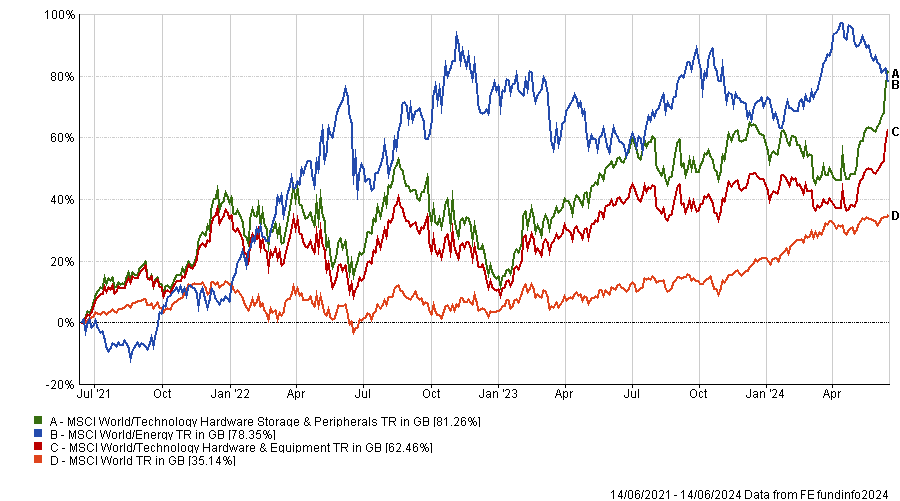

For instance, GQG Partners rotated out of technology in late 2021 and moved into energy across its portfolios, a decision that proved to be rewarding.

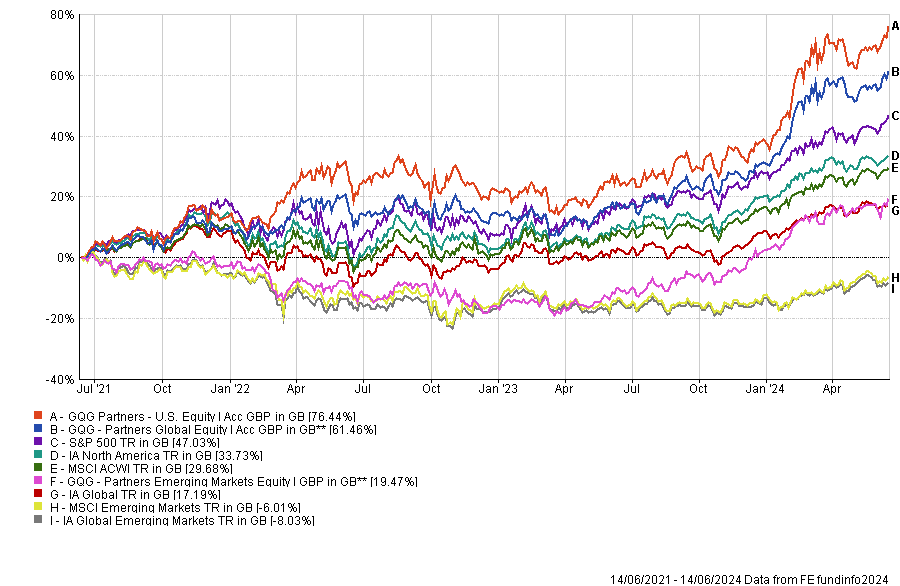

As a result, the GQG Partners Global Equity, GQG Partners U.S. Equity and GQG Partners Emerging Markets Equity are comfortably ahead of their respective sectors and benchmarks over three years.

Performance of funds over 3yrs vs sectors and benchmarks

Source: FE Analytics

Kersmanc said: “We made a pretty big call that the quality of a lot of energy companies was improving pretty substantially and they were underappreciated at that point in time.

“In fact, we noticed back in 2019 through our screening process that energy companies’ balance sheets, cash flow generation and return on capital have been getting a lot better. The rate of change has really picked up. They are exhibiting higher quality characteristics.

“By the way, these are businesses that were once considered exceptionally high quality.”

Performance of indices over 3yrs

Source: FE Analytics

An example he cited is the US oil company ExxonMobil, which years ago was considered a blue chip stock that everyone held in their pension funds.

“Perception is changing over time, the views on what quality is can ebb and flow,” Kersmanc added. “For example, software companies were considered to have cyclical capital structures 10 years ago.”

Performance of stock over 3yrs vs index

Source: FE Analytics

Last year, GQG Partners reengaged with tech companies because their cycle had rolled over.

Yet, in spite of the recent artificial intelligence (AI) frenzy, Kersmanc focuses on where he sees returns now rather than on jam tomorrow.

“Of all areas where AI has the potential to be helpful, one where we're seeing real returns right now is the digital advertising space. That's where the earnings are,” he said.

“What AI is doing is giving customers better search results and the content that's being delivered to them is causing the eyeballs to be stickier on the platforms. That has value. The companies are getting better at identifying what users want to see in terms of advertisements.

“For the rest of it, we'll see like how valuable it turns out to be over time.”

GQG Partners recently won the FE Fundinfo Alpha Manager of the Year award for emerging market equities.