Investors have sold down tech stocks over the past month as concerns continue to grow that the trade is becoming too crowded, the latest Bank of America Global Fund Manager Survey reveals.

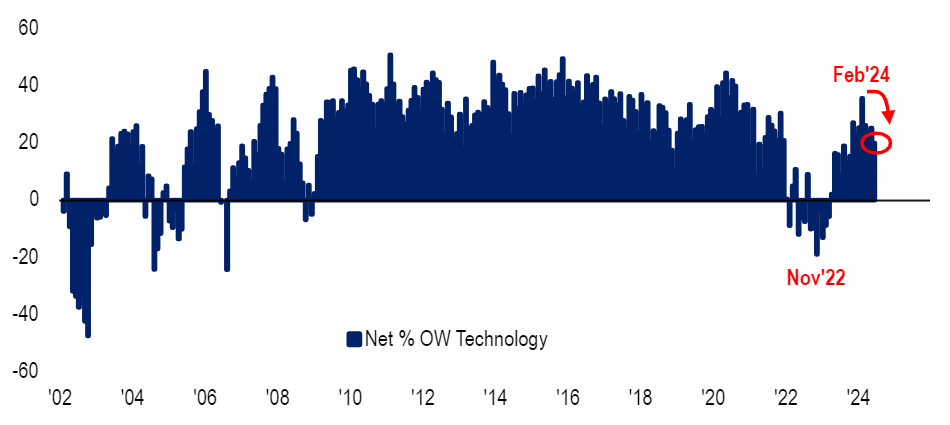

The closely watched survey polled 206 fund managers running a collective $640bn between 7 and 13 June 2024 and found that their allocation to tech stocks currently stands at a net 20% overweight, which is its lowest since October 2023.

This allocation is down from the recent high of a net 36% overweight in February 2024 and is now below the long-term average of a net 22% overweight.

Net % overweight to tech stocks

Source: Bank of America Global Fund Manager Survey, Jun 2024

Tech stocks have been one of the strongest parts of the market over 2024 so far. FE Analytics shows the MSCI ACWI Information Technology and Communication Services index is up 27% this year, compared with an 11.6% gain for the MSCI AC World index. Tech has driven most of the gains in the wider index as the second-placed industry (financials) is up just 8.5%.

Of course, tech has been leading the market for some time. Aside from a sell-off when interest rates started to rise, tech stocks were consistently at the top of the performance tables thanks to ultra-low interest rates powering growth stocks, the Covid lockdown sending demand for their products soaring and, more recently, the rise of artificial intelligence.

However, the Bank of America Global Fund Manager Survey shows asset allocators are all too aware that this part of the market has potentially attracted too much attention. Being long the Magnificent Seven (Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms and Tesla) has been most crowded trade for 15 consecutive months.

What fund managers consider to be the most crowded trade

Source: Bank of America Global Fund Manager Survey, Jun 2024

Some 69% of fund managers said the most crowded trade is being long the Magnificent Seven – a big jump on last month’s reading.

Analysts at Bank of America added: “There have only been a handful of times when a single trade was more crowded in Fund Manager Survey history… 71% for long US tech in Oct 2020, 80% for long US tech in September 2020, 74% for long US tech in July 2020, 72% for long US growth stocks in June 2020 and 72% for long US dollar in February 2015.”

A reduction in the tech overweight, however, does not indicate that fund managers are becoming more bearish overall. Indeed, the survey found the opposite – fund managers are growing increasingly bullish.

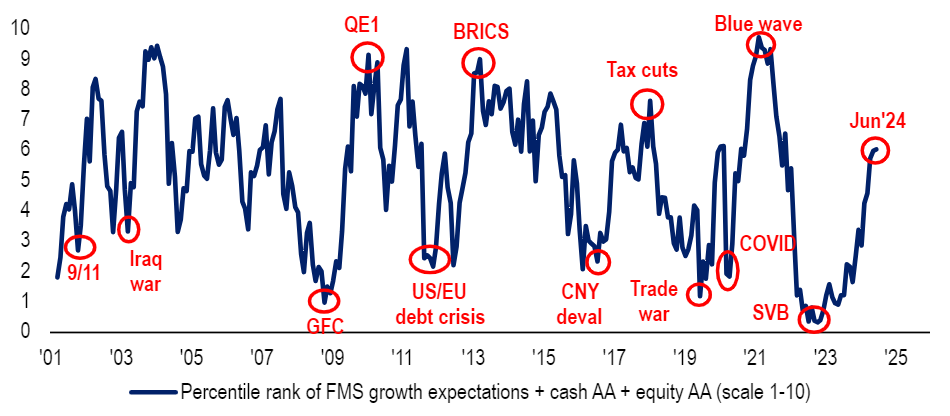

Bank of America’s fund manager sentiment indicator, which is based on investors’ cash levels, equity allocations and economic growth expectations, is currently at its highest since November 2021.

BofA Global FMS sentiment indicator

Source: Bank of America Global Fund Manager Survey, Jun 2024

Global fund managers’ average cash allocation stands at 4% (its lowest level since June 2021) while a net 39% of investors are overweight equities.

Their growth expectations are less optimistic, with a net 6% of managers thinking the economy will be weaker in 12 months’ time, although this is an improvement on last month (when a net 9% expected a weaker economy).

Some 62% of fund managers think the most likely scenario for the global economy over the next 12 months is ‘below-trend growth and above-trend inflation’.

Alternatively, ‘above-trend growth and above-trend inflation’ is forecast by 17%, while 11% expect ‘below-trend growth and below-trend inflation’ and 6% forecast ‘above-trend growth and below-trend inflation’.