Infrastructure was once seen as a must-have alternative for investors who were suffering through the era of low interest rates in the 2010s, but has fallen by the wayside more recently.

This culminated in a disastrous 2023, when the asset class dropped as central banks hiked rates to deal with rampant inflation.

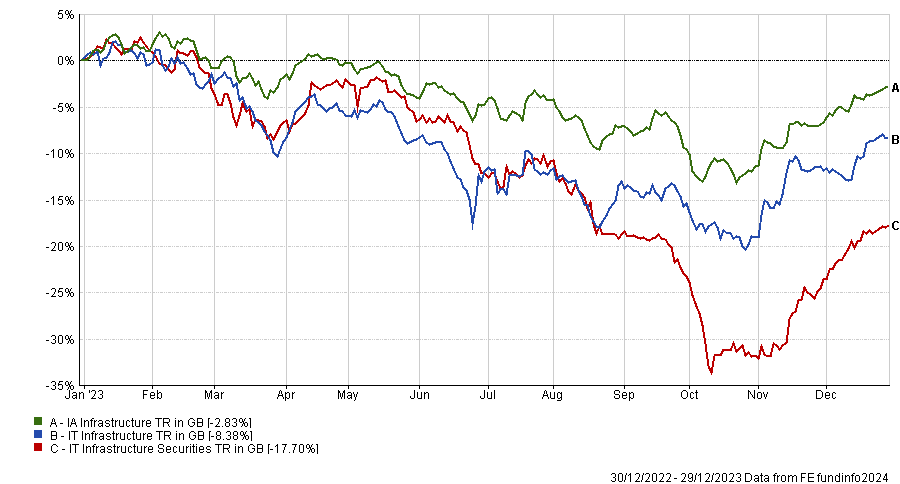

Indeed, looking at the main infrastructure sectors in both the Association of Investment Companies (AIC) and Investment Association (IA) universes, all made a loss last year, ranging from 2.8% (IA infrastructure) to 17.7% (IT Infrastructure Securities).

Performance of sectors in 2023

Source: FE Analytics

Returns have continued to underwhelm in 2024, with the IT Infrastructure the best of the trio, up 0.6%, while IA Infrastructure is down 1.1% and IT Infrastructure Securities has dropped 0.9%.

Thuy Quynh Dang, portfolio manager on the global listed infrastructure team at Cohen & Steers, said the main issue for the asset class has been the macroeconomic picture.

“While global economic growth continued to slow, it was generally stronger than expected over the course of 2023. This, combined with falling inflation, lessened the appeal of infrastructure’s defensive qualities,” she said.

Several factors were involved but perhaps the main one was the yields available to investors from other assets. Over the past decade, bonds have yielded very little with rates nailed to the floor, but now investors can make 5% or more from cash and low-risk government bonds – yields that were previously only achievable through alternatives such as infrastructure.

“In 2023, for the first time in years, interest rates rose to levels that made fixed income investments a viable alternative to higher-yielding equities,” she said.

Additionally, inflation caused companies’ costs to rise, while elevated rates and higher borrowing costs hurt sectors that tend to have more debt, such as utilities, she added.

Yet the impact of rate rises is now priced in, according to Dang. Even if rates remain higher for longer, she said markets expect a 7.8% total return from the infrastructure sector, with some areas such as renewable energy infrastructure in particular potentially making even more.

Jeremy Anagnos, portfolio manager of Nordea’s Global Listed Infrastructure strategy, was even more bullish, suggesting the asset class could “eclipse” the 8-10% returns it made over the past decade.

Infrastructure has historically performed well during periods of above-average inflation and high interest rates, he noted, highlighting the performance between 2000 and 2007, when the yield from 10-year US treasuries ranged from 3.8%-5.1% and infrastructure delivered a double-digit annualised return.

As such, “with low debt refinancing needs and healthy balance sheets, we think infrastructure can perform well if US risk-free rates remain in the 4%-5% range,” said Anagnos.

If this is reversed and rates start to fall – as is still expected at some point either this year or in early 2025 – the returns from infrastructure could be even stronger.

“Performance during the rate reversal trade over November and December, a period in which infrastructure delivered a 14% return, is a good indication of what investors could expect under such a soft-landing scenario. During this period, infrastructure kept pace with equities and nearly doubled the returns of fixed income,” said Anagnos.

Lastly, infrastructure should do well in a scenario where there is more market uncertainty (either through central banks wavering on rates or from geopolitical risks). After all, it has “saved investors about 30% of the downside in a negative market”, he noted.

Shannon Saccocia, chief investment officer of private wealth at Neuberger Berman, added that companies should do well regardless of the interest rate environment, as there remains a need for these assets.

Infrastructure is a broad term that includes bridges, roads, tunnels, power grids, hospitals, schools, data centres and ports, among numerous other areas.

“Whatever the great economic and investment themes of the next generation turn out to be, and however complex their nuances, without infrastructure they are not going to happen,” she said.