The availability of semiconductors has been a primary force in markets over the past few years and so far, just a handful of companies have been able to benefit from this trend.

While Nvidia is the clear winner on the global stage, the European semiconductor darling has been ASML – a company that has an 8.2% weighting in the Comgest Growth Europe ex UK fund, co-managed by James Hanford.

Comgest’s investment process requires managers to challenge each other on their positions and Hanford takes pride in being able to play devil’s advocate for ASML’s position as the fund’s top holding.

While he remains confident in the company’s strong competitive advantage, he is having to defend it against a new technology application from Japan.

As time goes by, new competitors are bound to disrupt some of the certainties in the chips space and one company with a good chance of doing precisely that is the Japanese optical, imaging and industrial product maker, Canon.

“Canon has been quite vocal about a technology called nano imprint. Currently, it is used to make CDs through a stamp, but Canon is looking into applying it for semiconductor-making as well,” the manager explained.

“The company has a whole research department engaged in this. I've spoken to a lot of people in Japan and Taiwan about these efforts in nano imprint and for now I'm not concerned about Canon from a competitive standpoint against ASML. But we’re keeping an eye open and always pushing ourselves to find where we could be wrong.”

Performance of stock over 1yr

Source: Google Finance

While Canon might be onto something that may come to fruition in the long term, the biggest threat to ASML’s investment case today doesn’t stem from Japan, but from China.

In January and April 2024, the US asked its allies to stop selling high-end semiconductors to China, which has hit ASML.

“The revenue of the semiconductor industry as a percentage of global GDP has only been going up in the past 50 years and is now at 0.7%. As human beings, we want better, including better electronics, which require chips, so demand isn’t a problem,” Hanford noted.

“The key problem is that it’s an extremely geo-sensitive industry. Overall, this is a good thing for ASML, because it's creating excess demand, but in the short term, restrictions by the US on what ASML could ship to China is definitely the main risk.”

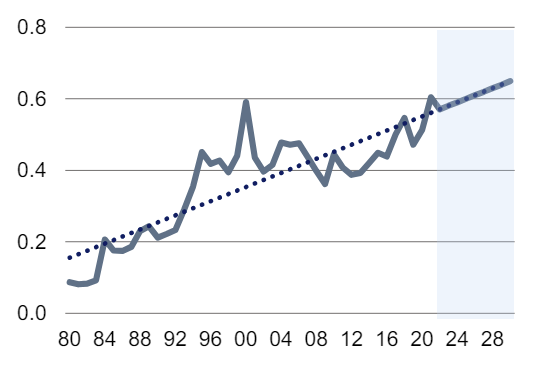

Semiconductors sales relative to global nominal GDP (in % of GDP)

Source: Deutsche Bank Research, IMF, WSTS.

Comgest Growth Europe ex UK has been co-managed by FE fundinfo Alpha Managers Alistair Wittet and Franz Weis since 2014, joined by Hanford in 2023.

Square Mile Research analysts rate the fund for its distinct bias to quality growth companies and its managers’ stock selection skills.

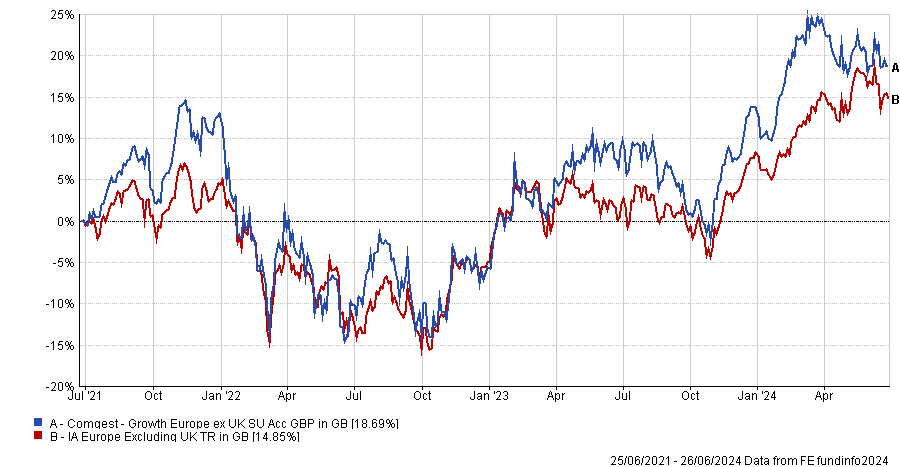

Performance of fund against sector and index over 1yr

Source: FE Analytics

“The team's edge is their company analysis, and, as such, we would expect longterm returns to be primarily driven by stock contribution, although sector and country allocation can also have an influence at times,” they said.

“The performance can be highly variable and we would anticipate this fund to do well when the growth style is in favour, as well as when investors are focusing on company fundamentals. More broadly, we believe this is a solid longterm offering for investors seeking exposure to some of the region's leading companies.”