The UK was one of the world’s best performing stock markets for the past three months, beating US and global equities hands down. One quarter does not atone for a decade’s underperformance but it does shine the spotlight on the UK’s nascent recovery, attractive valuations and wealth of high-quality, dividend-paying companies.

A handful of global equity income managers are well placed to profit from the UK’s turnaround, with more than a fifth of their portfolios in domestic equities.

Although income funds often favour UK and European stocks because they tend to pay higher dividends than US-listed companies, a 20% allocation is still a large bet, particularly compared with the MSCI World and the MSCI World Quality Dividend index, which have just 4% and 6% respectively in Britain.

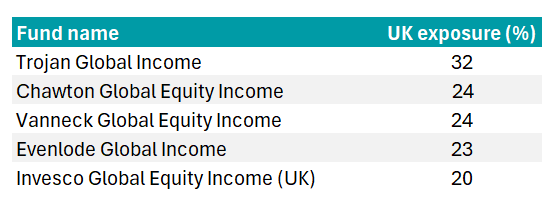

Global equity income funds with more than 20% in the UK

Source: FE Analytics, funds’ factsheets

Why are these funds overweight the UK?

Several of the funds’ managers said they were overweight the UK for stock-specific reasons, at a time when many high-quality UK companies are cheap.

Stephen Anness, head of global equities at Invesco, said: “We have been able to find several businesses at attractive valuations in the region. Part of this is linked to the UK now being such a small part of the overall index that it does get less attention from a lot of global managers and therefore you can find some really interesting opportunities and hidden gems.”

James Harries, senior fund manager of the Troy Global Income strategy, added that despite the UK being "deeply out of favour", it has "a number of global companies that offer a compelling combination of quality and long-term income growth".

Michael Crawford, chief investment officer at Chawton Global Investors, said he looks for quality companies delivering a high return on invested capital, where capital allocation drives shareholder value, and these qualities are more evident in the UK and Europe.

As a result, the WS Chawton Global Equity Income fund has had a significant overweight to the UK since inception in April 2019. Next and Bloomsbury are its largest two holdings.

The UK stock market isn’t the British economy

The high UK allocation is a bit of a misnomer, Anness pointed out, because so many UK-listed companies are global businesses earning more of their revenues abroad.

For example, the Invesco Global Equity Income fund’s biggest position is 3i, a private equity investment trust that earns 97% of its revenues outside the UK and has a large holding in Action, Europe’s fastest-growing non-food discount retailer.

“We see this as nothing less than one of the best businesses on the continent – hidden within a financial company. Action currently has more than 2,300 stores across Europe and plans to open 400 a year by 2026. We estimate it could take almost 20 years to saturate Europe alone so there is a very long runway for growth,” Anness said.

Invesco’s next two largest UK holdings, Rolls Royce and Coca-Cola Europacific Partners, are “multinational companies where the UK is very small component of overall revenue, they just happen to be UK listed,” he said.

Evenlode also looks at its geographical exposure through the lens of where revenues are generated, said investment analyst Rob Strachan.

Evenlode Global Income currently has 23% in UK-listed stocks, near the top of its historical range. Its UK exposure has varied between 16% and 24% since inception in 2017, but revenues from the UK have always remained below 5%.

“We are well positioned in certain high-quality, multinational, UK-listed businesses that look relatively good value compared to our wider investable universe, such as Unilever, RELX and Diageo,” Strachan explained.

“The largest position in the fund is currently Unilever, reflecting its globally diversified portfolio of brand intangible assets, distribution advantages and attractive relative valuation.”

Unilever also features within the top 10 holdings of Trojan Global Income and VT Vanneck Global Equity Income, which have almost a third (32%) and a quarter (24%) of their portfolios in the UK, respectively.

In addition, Troy holds British American Tobacco, RELX and Reckitt Benckiser, while Vanneck owns Rio Tinto and Hargreaves Lansdown. The investment platform’s share price has soared in the past couple of months after it received bids from a consortium of private equity firms led by CVC Capital Partners.

Stock selection can override asset allocation

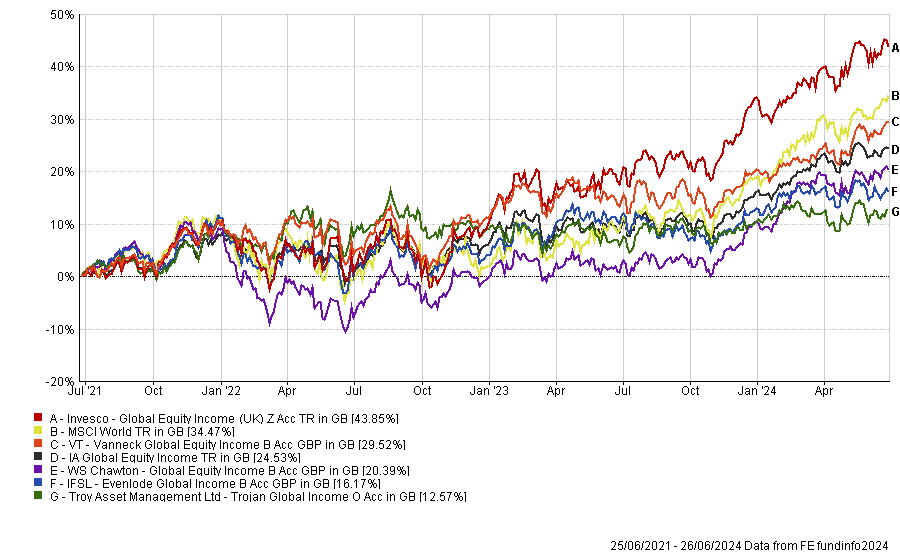

A large UK weighting has been a drag on performance given the relative gap between the UK and US stock markets for the past decade. However, some of the funds have made up a lot of that ground through stock selection and Invesco Global Equity Income stands out as a top performer.

Performance of funds vs sector and MSCI World over 3yrs

Source: FE Analytics

Stock selection within the UK has helped the fund. Invesco owns Rolls Royce, which soared 198% in the 12 months to 26 June 2024, while 3i delivered total returns of 70.7%.

Global equity income funds in general were at a relative disadvantage last year when the Magnificent Seven contributed more than 50% of the MSCI World index’s returns, Anness pointed out.

“When seven out of over 1000 companies make up more than half of the total return of a major index, being benchmark agnostic (or underweight them) can be extremely painful. On top of that, the bedrock of our philosophy is a focus on cash flows, dividend-paying companies and a strict focus on valuation. Given that only three of the Magnificent Seven pay a dividend we tend to be underweight these companies… and yet we still beat the market.”

Top contributors last year included Broadcom, chemicals company Celanese, BE Semiconductor Industries (Besi) and private equity manager Kohlberg Kravis Roberts (KKR), in addition to Rolls Royce and 3i.

“I suspect few would have guessed that in the year of artificial intelligence, Rolls Royce would have outperformed Nvidia, or that a lesser-known chemicals company, Celanese, could outperform Apple,” Anness pointed out.