Smaller funds can afford to be more nimble and take advantage of market volatility in a way that is hard to replicate for their larger, and therefore more rigid, peers, but a big drawback is they tend to cost more.

With less money under management firms typically hike up the cost to make the portfolio profitable, while larger funds can drop their prices thanks to economies of scale.

For instance, Nick Wood, head of fund research at Quilter Cheviot, considers funds with less than £100m in assets under management (AUM) to be sub-scale.

He said funds with less than £100m in assets are “too small” for institutional investors to consider as they typically do not want to own such a large percentage of any one fund, which puts a block on these funds growing and gaining enough assets to begin lowering prices.

And this is borne out in the numbers. The average fund in the IA Global sector (including passives) charges about 0.8% in ongoing charges. For ‘sub-scale’ funds, this rises to 1%.

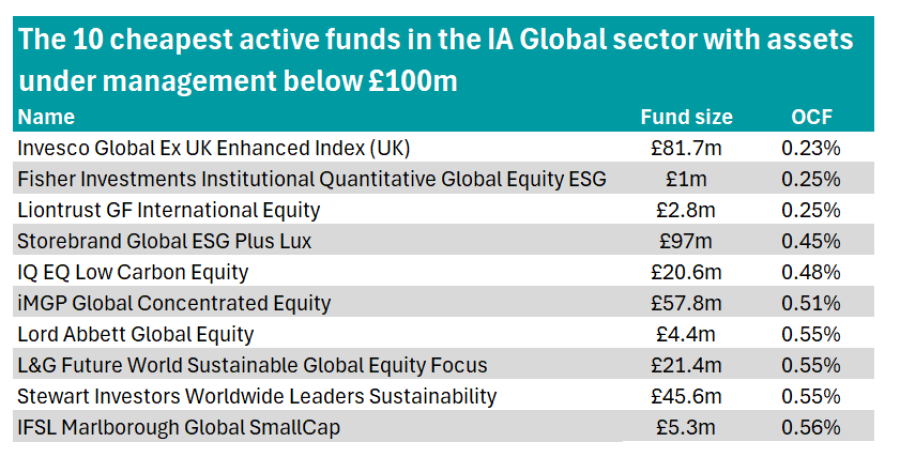

However, there are exceptions to the rule. As such, below, Trustnet highlights the 10 cheapest active funds in the IA Global sector with less than £100m in AUM.

Source: FE Analytics

With a size of £91.4m and an ongoing charge figure (OCF) of 0.23%, Invesco Global Ex UK Enhanced Index (UK) is the cheapest ‘sub-scale’ fund in the IA Global sector.

The fund has been managed by Georg Elsäesser since 2021 and Michael Rosentritt since 2023 and is based on a systematic factor-based investment process focusing on momentum, quality and value.

Relative risk is managed using an analytical tool that recommends trades to enhance portfolio exposure to selected stocks within established risk and return parameters.

The managers also limit risk at the country, sector and industry levels when building the portfolio. For instance, the fund is slightly underweight technology and the US relative to its benchmark, but marginally overweight financials and Japan.

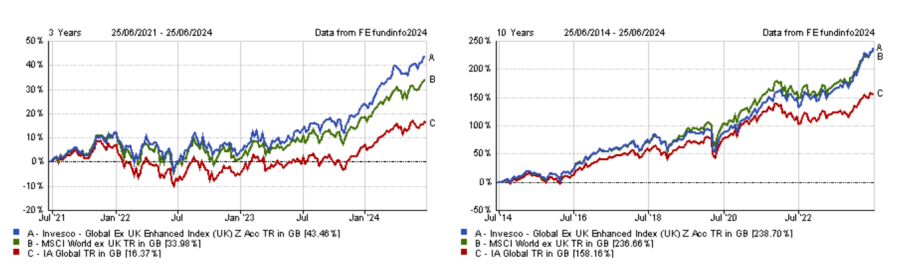

Performance of fund over 3yrs and 10yrs vs sector and benchmark

Source: FE Analytics

The fund has outperformed both the IA Global sector and the MSCI World over one, three, five and 10 years.

Next up is the £3.4m Liontrust GF International Equity fund, which has an OCF of 0.25%. A distinctive feature of this fund is that it excludes the US from its investment universe and seeks opportunities in Japan, the emerging markets, and Europe.

While the fund lacks exposure to US tech heavyweights, it still maintains a significant allocation to the information technology sector through companies such as Taiwan Semiconductor Manufacturing Company, Keyence, and Mercadolibre.

However, consumer discretionary remains the largest sector weight in the portfolio, including holdings such as China’s Trip.com and India’s MakeMyTrip.

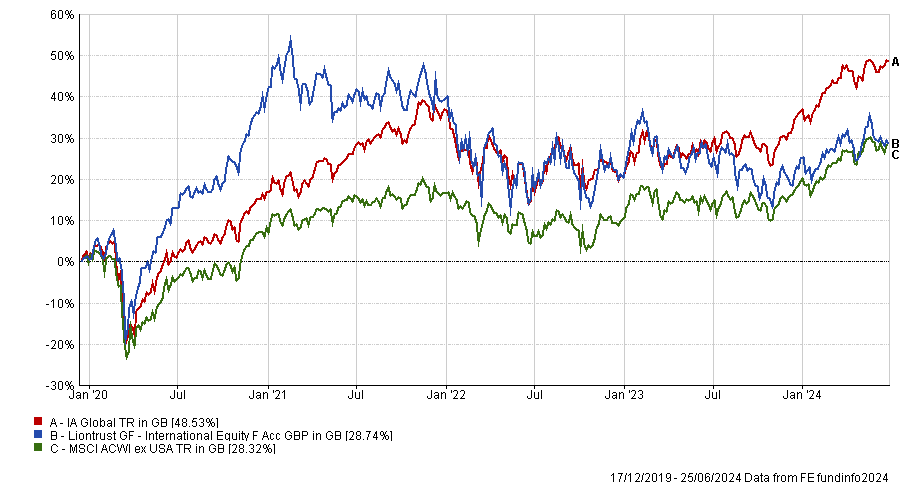

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

Since its launch, Liontrust GF International Equity has slightly outperformed its benchmark but has significantly lagged behind its peer group, primarily because its mandate restricts investments in the narrow cohort of US tech stocks that have driven the market in recent years.

Another fund among the 10 cheapest global funds with less than £100m in AUM is IQ EQ Low Carbon Equity managed by Des Flood. The fund invests in businesses considered leaders in addressing climate change within their respective sectors, with companies such as Microsoft, Quanta Services and Siemens among its top 10 holdings.

It also excludes companies that profit from the exploration, extraction or burning of fossil fuels.

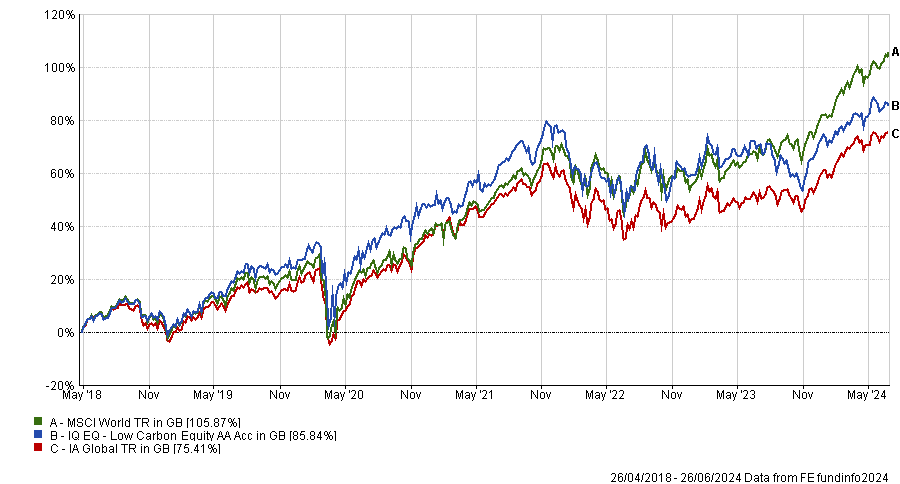

IQ EQ Low Carbon Equity was launched in 2018 and sits in the third quartile of the IA Global sector over five years. However, it has demonstrated lower levels of downside risk over the same period, as indicated by its maximum drawdown score of -14.3%, ranking 49th out of 405 in the IA Global sector. In comparison, the benchmark's maximum drawdown over the same period was -15.7%.

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

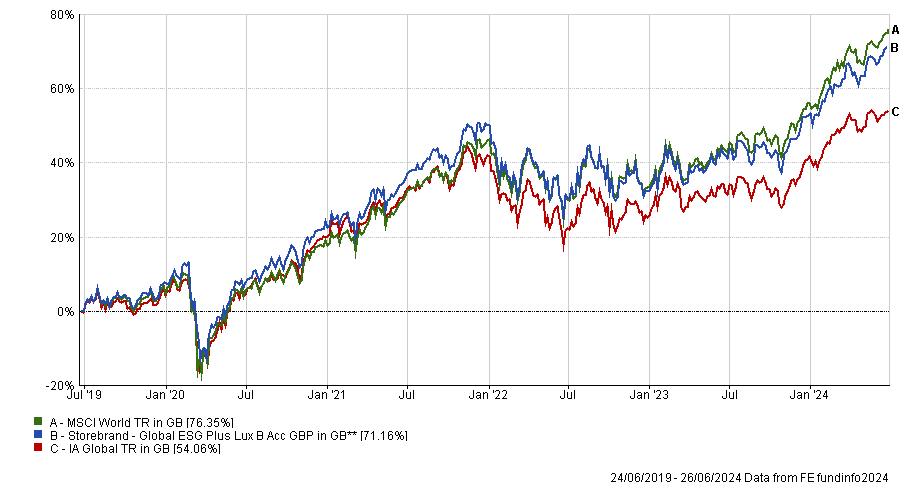

Storebrand Global ESG Plus Lux, managed by Henrik Wold Nilsen, also follows a fossil-fuel-free investment approach, but takes additional environmental, sustainable and governance (ESG) criteria and sustainability factors into consideration.

Investee companies must have a high Storebrand sustainability rating and be aligned to the UN’s sustainability goals. Moreover, the fund invests up to 10% of its assets in businesses related to clean energy, energy efficiency, recycling and low-carbon transport.

Performance of fund over 3yrs and 10yrs vs sector and benchmark

Source: FE Analytics

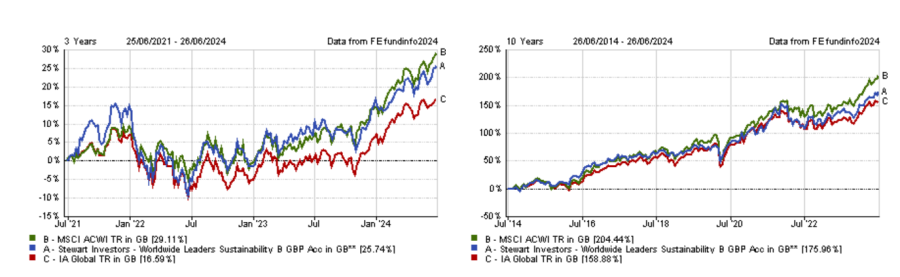

Up next, the £45.6m Stewart Investors Worldwide Leaders Sustainability fund charges investors 0.55% – one of the higher figures on the list but still far below the average IA Global fund’s costs.

Managed by FE fundinfo Alpha Manager David Gait and Sashi Reddy, the fund invests in large- and mid-caps across both developed and emerging markets. For instance, India holds the second-largest country weighting in the fund after the US, with Indian company Mahindra & Mahindra as its top holding.

Gait and Reddy aim to invest in high-quality companies positioned to both contribute to – and benefit from – sustainable development. They assess businesses on three metrics: quality of management, quality of the company and quality of the company’s finances. The fund sits in the second quartile of the IA Global sector over 10 and five years, as the below chart shows.

Performance of fund over 3yrs and 10yrs vs sector and benchmark

Source: FE Analytics

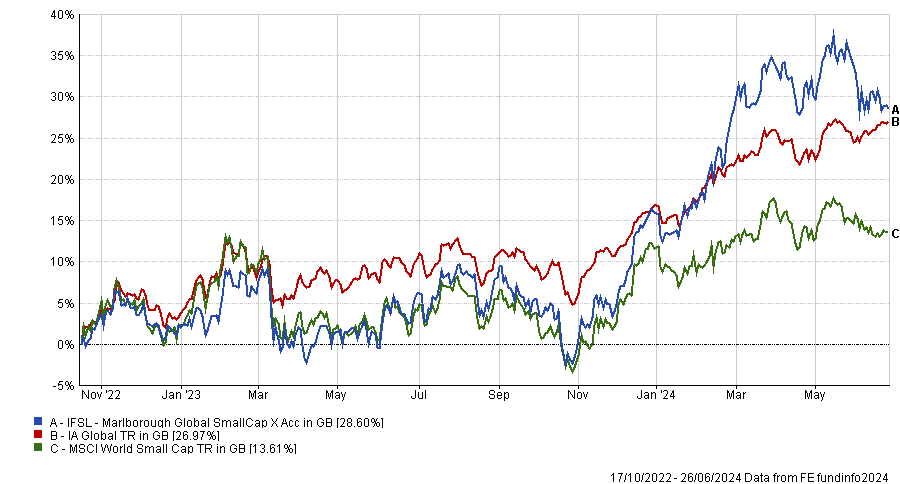

Finally, the £5.3m IFSL Marlborough Global SmallCap charges investors 0.56% to get an exposure to small- and mid-caps across the world.

A smaller fund can be advantageous when investing in small-caps, with experts previously indicating a preferred size range of £60m to £200m for small-cap funds.

However, IFSL Marlborough Global SmallCap is more tilted towards mid-caps, which constitute 60% of the portfolio.

The industrials sector represents more than 50% of the portfolio, making it the largest sector weighting, while the US accounts for 55% of the portfolio (it’s largest country exposure).

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

Since launch, the fund has outperformed both the IA Global sector and its benchmark, despite a period that has favoured more liquid and resilient mega-caps.