There is a broad opportunity set across all sections of the UK equity market, with stocks in most sectors trading cheaply compared to their history, according to Ben Mackie, portfolio manager at Hawksmoor Asset Management.

“The valuation opportunity is very broad in the UK, spanning across the market-cap spectrum,” he said. “Every kind of UK portfolio is now cheap relative to its history – unlike Japan, which has re-rated and where value has moved down the market-cap spectrum".

As such, Hawkmoor’s multi-asset portfolios have gone with a 20-30% allocation to the domestic market and to harness all the opportunities available, the managers are opting for portfolios that are “cheap, have lots of marginal safety and a real blend of styles”. They also maintained a bias to smaller companies.

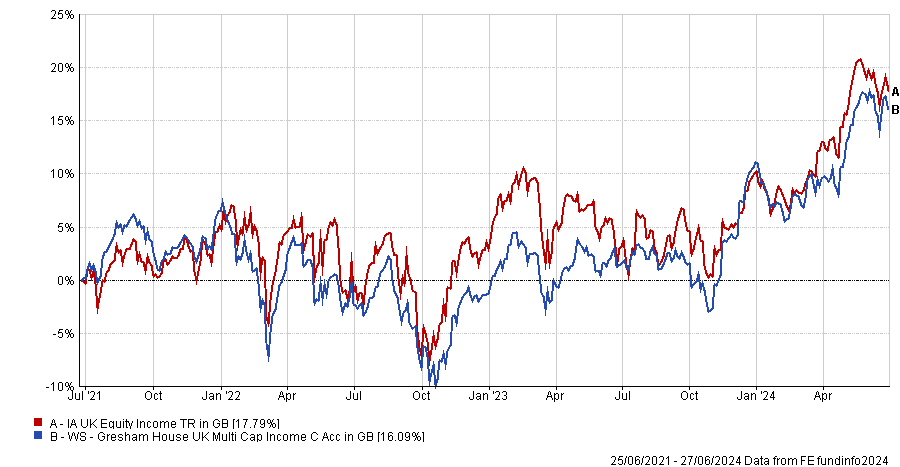

The first fund Mackie highlighted was WS Gresham House UK Multi Cap Income.

“That's a significant position for us. It’s less value-orientated and more looking to buy good-quality businesses,” he said.

Performance of sectors over 3yrs

Source: FE Analytics

It is run by FE fundinfo Alpha Manager Brendan Gulston and Ken Wotton, who focus on profitable small and mid-cap companies that generate high cash levels.

RSMR analysts praised the fund’s underlying income stream, which is “well diversified across industries”, and the “stable and resilient” dividend. It is currently yielding 3.8%.

Mackie balanced out this fund’s open-ended, multi-cap quality approach with several mid and small-cap strategies in different styles.

“While good opportunities are spread across the whole market, small-caps is where we're seeing most value,” he explained.

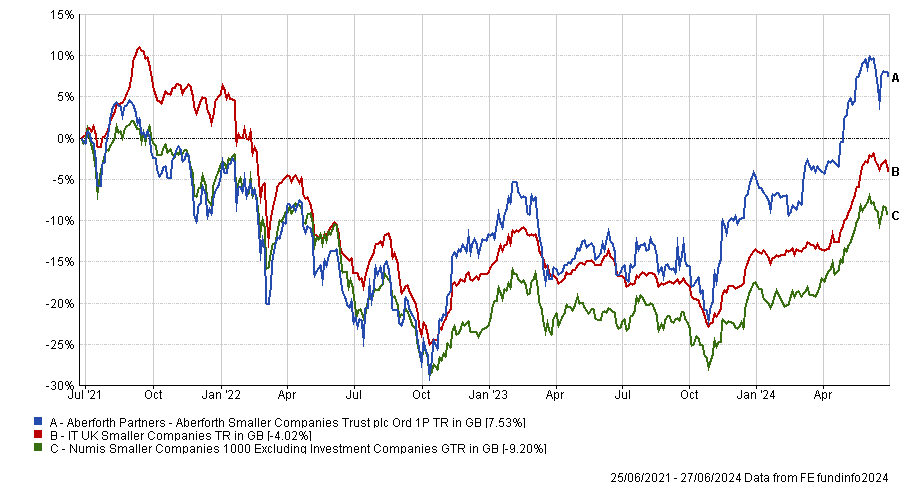

The asset class has been “a painful place to be” in recent years, with the average UK small-cap fund and trust dropping approximately 30% between October 2021 and October 2023, as shown in the chart below.

Performance of sectors over 3yrs

Source: FE Analytics

But the manager maintained his conviction in this space and his first pick here was Aberforth Smaller Companies.

The Aberforth team has “a traditional value approach”, complementing the Gresham House fund.

The trust is trading at a wider-than-usual 10% discount and was recently picked by Tillit’s Sheridan Admans as an ideal strategy to dip your toes back into smaller companies.

Performance of fund against sector and index over 3yrs

Source: FE Analytics

To counter the negative momentum in small caps, Mackie chose two other trusts whose managers build meaningful positions in companies and drive change from within to generate extra value.

“We have some specialist investment trusts that take influential stakes in companies and are very happy to roll their sleeves up and engage,” he said.

Hawksmoor uses Odyssean, which is managed by Stuart Widdowson and Ed Wielechowski, and Wotton’s Strategic Equity Capital. Both have a FE fundinfo Crown Rating of five – the highest score.

Odyssean is a £214.9m strategy and the second-best performer in the IT UK Smaller Companies sector over the past five years.

The trust is proving popular with fund selectors and was recommended by Numis, 7IM, Winterflood and Blyth-Richmond Investment Managers. Several fund pickers said the trust was worth buying even at a premium.

With Strategic Equity Capital, Mackie repeated his conviction in Gresham House’s Wotton.

“Effectively, what we’re doing is looking for talented managers – those who align with us culturally, are talented stock pickers and stick to the process,” he said.

“Ultimately, these portfolios will move around and we're not trying to second-guess their positioning. It's more about how they think and whether they are genuinely skilful.”