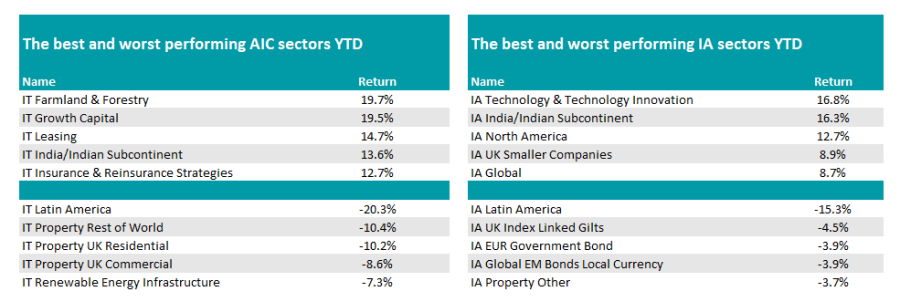

Technology stocks, Indian equities and UK smaller companies have all enjoyed a strong year so far, while Latin American companies and government bond investors have struggled, according to data from FE Analytics.

The first half of 2024 has been dominated by macroeconomics and in particular central banks, who have had to wait a lot longer than was initially expected to cut interest rates.

Indeed, as it stands, only the European Central Bank (ECB) has managed to drop rates so far, with the Federal Reserve and Bank of England both remaining in wait-and-see mode.

This has impacted many asset classes but in particular bonds, where investors had hoped that rate reductions would lead to capital gains for government bonds.

It resulted in both IA UK Index Linked Gilts and IA EUR Government Bond sitting among the worst five performing Investment Association (IA) sectors over the past six months.

Yet it was not all bad news for assets that usually do better when rates fall.

Tech stocks (which should benefit from lower rates as they reduce the discount put on their future growth figures) have continued to soar on the back of the artificial intelligence (AI) boom, with IA Technology & Technology Innovation the top-performing sector of the year so far.

Source: FE Analytics

Here, the average fund has made 16.8% in 2024. The market continues to be dominated by the Magnificent Seven, with Nvidia briefly climbing to become the world’s largest company last month, before it slipped back and returned the crown to fellow tech giant Microsoft.

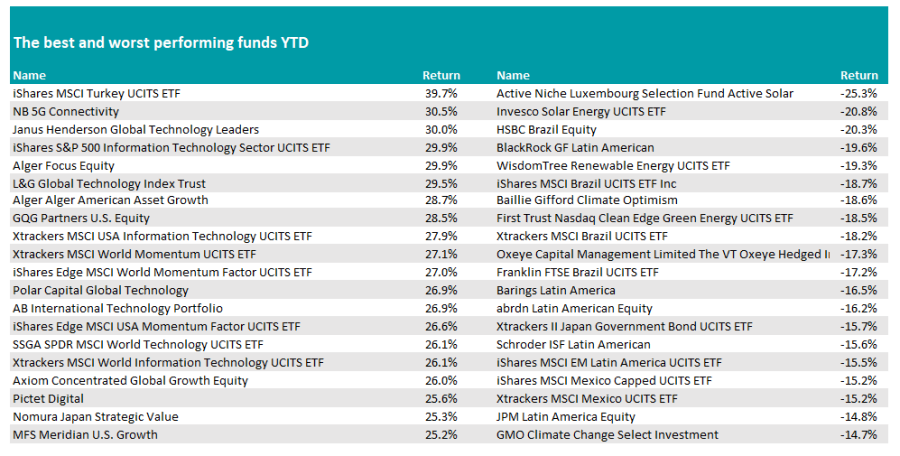

As such, eight of the top 20 funds over the past six months had a technology focus, with the likes of Janus Henderson Global Technology Leaders, iShares S&P 500 Information Technology Sector UCITS ETF and L&G Global Technology Index Trust among the top 10 funds so far in 2024.

This small basket of stocks also helped to propel the IA North America and IA Global sectors to among the top five best-performing peer groups in the first half of the year.

While much of the global equity market’s performance has become more concentrated in recent months, other areas also shone.

Indian funds continued their meteoric rise, with the average fund in the IA India/Indian Subcontinent sector up 16.3%, just behind the tech sector.

The country has been the beneficiary of investors turning away from China, which has been under pressure for the past two years, with India becoming something of an emerging market darling of late.

The recent general election result, in which prime minister Narendra Modi won in a less convincing style than expected, did little to dissuade investors. However, no India funds appeared in the top 20 funds of the year so far, as the below table shows.

Source: FE Analytics

China was not the only emerging market region navigating difficult waters. The IA Latin America sector was the worst performer over the first six months of the year, down 15.3%.

Part of the fall could be the sector giving up its gains over the past two years. In 2022 the average Latin America fund made 16.4% while in 2023 it made 23.2%.

Another potential reason is the disappointing performance of Brazil, where president Luiz Inácio Lula da Silva’s plan to reduce spending, along with a surprise cut to rates from a divided central bank, has caused turmoil in markets.

Yet Brazil’s underperformance does come as a surprise, considering the market is often viewed as a barometer for commodities, which have performed well in 2024 so far.

Four Brazil funds and six broader Latin America funds appeared in the 20 worst performers list, which also featured several funds investing in specific renewable energy sectors, such as Active Niche Luxembourg Selection Fund Active Solar and Invesco Solar Energy UCITS ETF, which have been the two worst performers of the year so far.

Renewable energy companies tend to be highly leveraged and the postponement of interest rate cuts is likely to have hurt performance.

There were some positives closer to home, where UK small-caps have flourished. The IA UK Smaller Companies sector was the fourth-best performer over the year-to-date, up 8.9%.

The sector has been under the cosh for the past few years as interest rates have risen, but has come back to the fore this year as investors forecast lower rates. It has also been given a lift from both the Conservative and Labour parties, who have committed to encouraging cash into UK companies, with proposals ranging from a UK ISA to encouraging pension funds to invest more in domestic stocks.

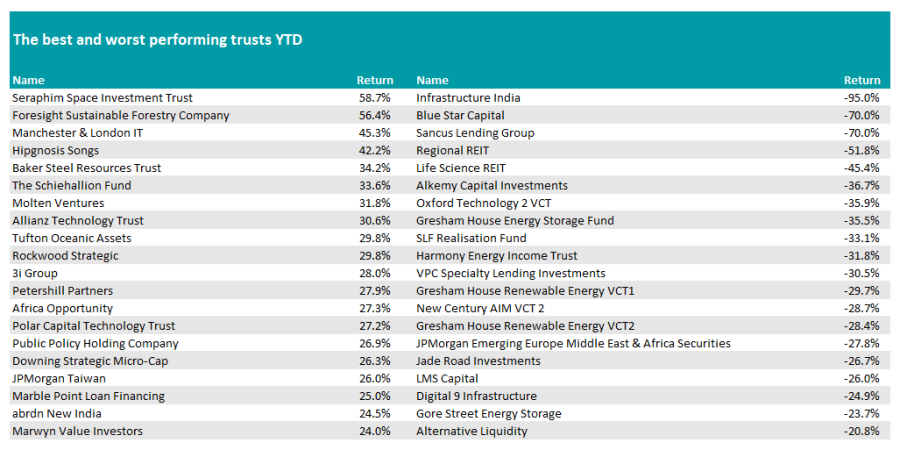

Turning to investment trusts, they have been a real mixed bag so far this year, with some niche sectors such as IT Farmland & Forestry, IT Growth Capital and IT Leasing leading the way, while property has been the main area investors would have wanted to avoid.

Source: FE Analytics

In terms of individual trusts, technology and UK smaller companies investment companies dominate the top 20, while on the downside, trusts investing in real estate and renewable energy have dropped off, as have a number of venture capital trusts.