Annuities have grown in popularity over the past few years as interest rates have risen on the back of rampant inflation.

And with inflation seemingly tamed, for now, and interest rates expected to start coming down over the next six months, some may consider it a good time to buy one before the yields on offer are reduced.

But retirees must remain vigilant to the potential for inflation to rise again, said Helen Morrissey, head of retirement analysis at Hargreaves Lansdown. People who retire at 65 might live for another 20 to 30 years or more, making inflation one of the biggest enemies to their savings.

“Even the most benign of inflationary environments can nibble away at your purchasing power over that time,” she warned, while a period of double-digit inflation “can bite huge chunks out of your plans”.

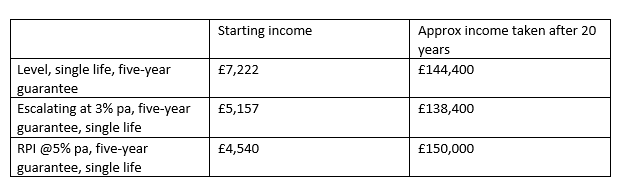

One option is to get an annuity that rises in line with inflation. Hargreaves Lansdown’s research shows that a 65-year-old with a £100,000 pension can get an RPI-linked annuity paying up to £4,540 per year.

They could also get up to £5,157 per year from an annuity that escalates at 3%, meaning the total income will rise by a fixed amount each year.

However, the same 65-year-old with a £100,000 pension can get up to £7,222 per year from a single life level annuity with a five-year guarantee – over £2,000 more per year than they would have got three years ago.

Current annuity rates versus inflation

Source: Hargreaves Lansdown

Both of the latter options are “far lower than you would get with a level annuity”, said Morrissey, but reward those that live longer. As such, retirees need to consider what is best for them.

“You will need to try and work out how long it will take for the income of your escalating annuities to catch up with the starting income from the level one,” she said.

For example, it would take 12 years for the escalating 3% annuity to catch up to the current income, meaning the 65-year-old would have to wait until they are 77 before their income hits £7,222.

“It would also take around 21 years before you had taken the same overall amount of income (approximately £144,000) that you would have taken from the level product,” she calculated.

Meanwhile, the RPI-linked annuity rising at 5% per year would take 10 years to match current payouts and 20 years before a retiree had received the same amount as the level option.

“Of course, if RPI inflation were higher you would make up ground more quickly, but lower inflation means it could take you longer. You need to think carefully about how long you are likely to live to come to the best decision for you,” Morrisey said.

Another option for retirees is to take out part of their pension, rather than their full amount, and annuitise it in slices, rather than all at once. The rest of the pot could then be invested for capital growth.

“This way you also have the benefit of securing higher annuity rates as you age and if you develop a condition where you qualify for an enhanced annuity then you could get a further boost in income that can help you fight the impact of inflation over time,” she said.