The first half of 2024 continued to be dominated by a handful of themes as areas such as tech and Indian equities led the market, FE fundinfo data shows.

Investors have had a decent ride over the past six months, with stock markets around the world moving higher despite the year starting with high interest rates, political uncertainty and worries about the global economy.

Below, Trustnet looks at 2024’s opening half from a range of viewpoints to see the market’s best and worst-performing areas.

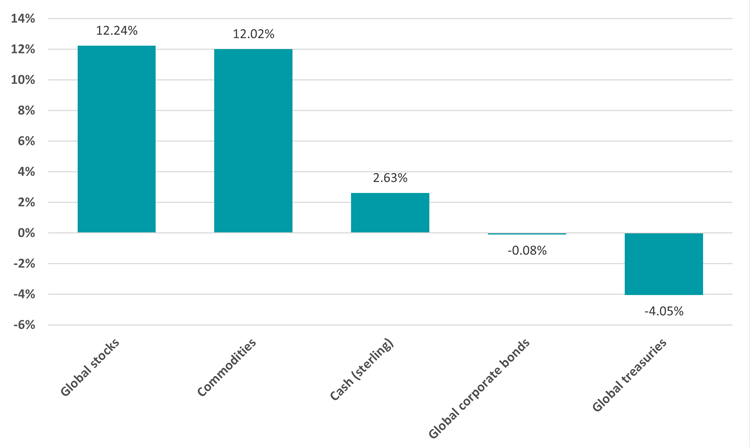

Performance of asset classes in H1 2024

Source: FinXL. Total return in sterling between 1 Jan and 30 Jun 2024.

The past six months have been positive for risk assets, with global equities and a broad basket of commodities gaining more than 12%. However, cash outperformed bonds over the period.

Reasons for stronger equity markets will be looked at below, but the lacklustre returns from bonds come down to stickier than expected inflation and the likelihood that there will be fewer and later interest rate cuts.

Rob Morgan, chief analyst at Charles Stanley, said: “While many parts of the bond market haven’t incurred overall losses year to date once you factor in the relatively healthy income they pay, the muted returns aren’t what many investors would have had in mind at the start of the year.

“Yet, from this point on, they could provide attractive returns and a bonus of capital appreciation if interest rates do end up falling a bit more quickly than factored in, for example in the event of a sudden recession. While that is not necessarily a likely scenario it does mean bonds play a vital role in a diversified investment portfolio.”

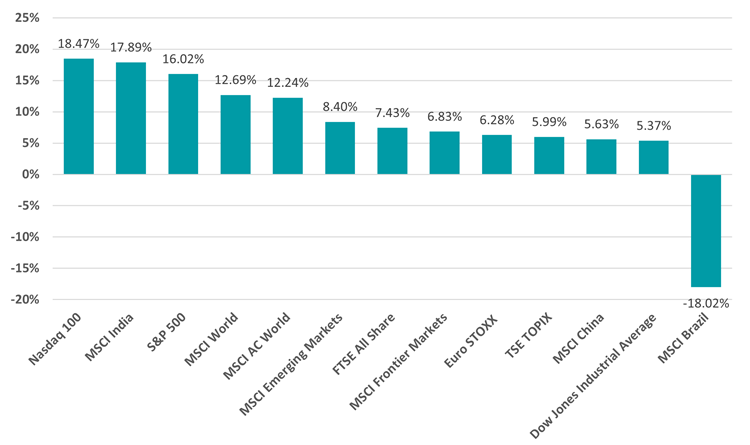

Performance by geography in H1 2024

Source: FinXL. Total return in sterling between 1 Jan and 30 Jun 2024.

Within the major equity markets, the strongest performance came from the Nasdaq 100, with a return of almost 18.5%, as investors continued to back tech stocks such as the ‘Magnificent Seven’ (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla). The 16% return in the S&P 500 was also driven by this theme.

Dan Coatsworth, investment analyst at AJ Bell, said: “A big chunk of the best performers on the S&P 500 in the first six months of 2024 is connected to technology and AI [artificial intelligence]. Interestingly, chips giant Nvidia is not the overall best performer despite it being the stock everyone talks about. The top slot went to Super Micro Computer, which designs and builds servers and storage systems.

“The key risk to these stocks and any company seen as an AI winner is that growth rates could moderate leading into 2025, potentially leaving some investors disappointed and leading to widespread profit-taking in the sector.”

India equities were not too far behind the Nasdaq, thanks to a positive economic backdrop, business-friendly government policies, a growing middle class and strong corporate results.

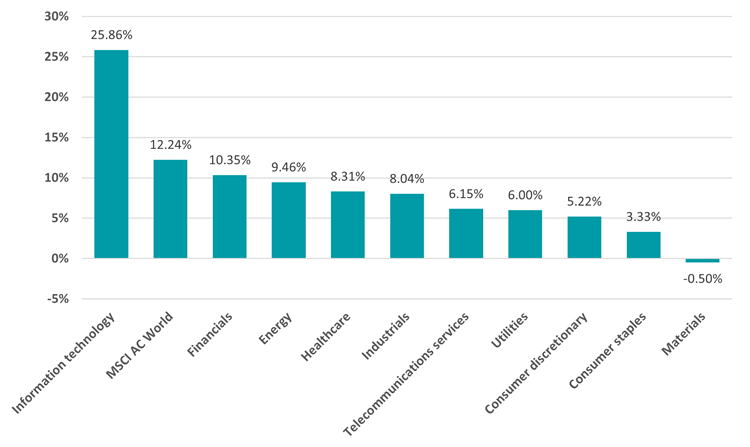

Performance by industry in H1 2024

Source: FinXL. Total return in sterling between 1 Jan and 30 Jun 2024.

The chart above highlights how the tech theme dominated the opening half of 2024, with the MSCI AC World Information Technology index gaining close to 26%; the MSCI AC World was up 12.2% and every other industry made a lower return than this.

Morgan added: “That the largest seven US companies now account for over 20% of the entire value of global stock markets is certainly pause for thought. History may tell us we should be worried about a market concentration last seen in the late 1990s, immediately before the dotcom bust, but today’s conditions have little else in common with that period."

“This group of companies are established, highly profitable and contain some of the potential longer-term winners from artificial intelligence or other avenues of growth. Shares are expensive in relation to their present earnings and are vulnerable to growth falling short of expectations, but it’s hard to argue investors have lost touch with reality.”

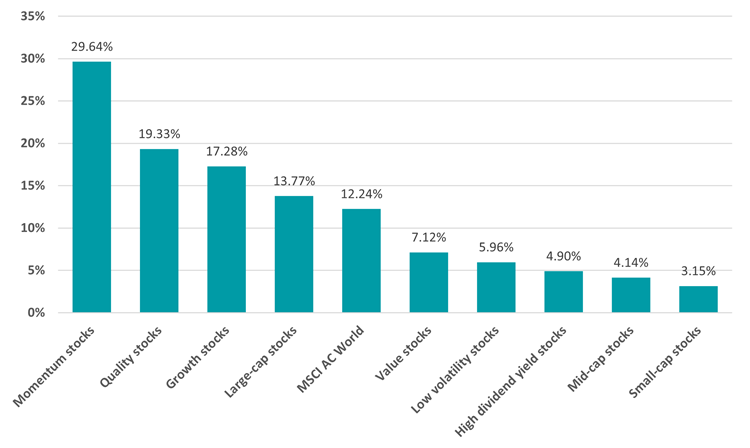

Performance by investment factor in H1 2024

Source: FinXL. Total return in sterling between 1 Jan and 30 Jun 2024.

Putting all of the above together explains how performance by investment factor played out in 2024’s opening half: the momentum, growth, quality and large-cap factors are all applicable to the Magnificent Seven and similar stocks.

The difference between winning and losing investment factors continues to be significant, with more than 20 percentage points between momentum and value stocks while the gap between large-cap and small-cap stocks is in excess of 10 percentage points.

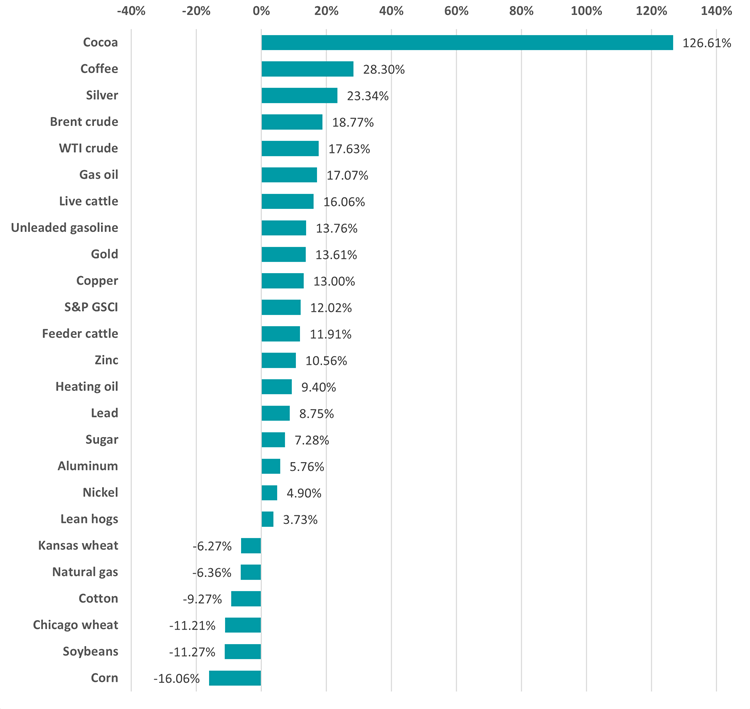

Performance of commodities in H1 2024

Source: FinXL. Total return in sterling between 1 Jan and 30 Jun 2024.

The final chart sheds more light on what was behind the 12% rise in the broad S&P GSCI index. Cocoa prices have jumped 126.6% over the past six months, largely down to a global cocoa shortage: harvests in West Africa, which accounts for about 80% of the world’s cocoa output, were hit by drought.

However, investors are likely to be paying more attention to gold with the yellow metal rising 13.6% despite persistent selling by investors in the West. Charles Stanley noted that central banks, investors and households in the East have become heavy buyers of hold, especially in China.

“In many ways, the renewed popularity of gold is linked to the trend of deglobalisation and heightened international tensions as central banks increasingly crave a non-politicised reserve asset,” Morgan said. “As the world continues to fragment geopolitically this trend could continue.”