The UK market will continue to shrink this year if a new government does not get to grips with rampant merger and acquisition (M&A) activity, according to Peel Hunt’s Charles Hall.

The head of research has previously warned that the UK small-cap market may cease to exist in a decade if the current pace of deals keeps up and remains concerned heading into the second half of 2024.

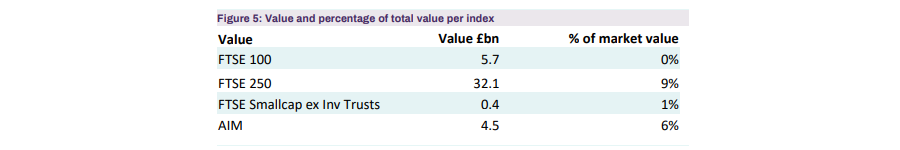

In the first half of the year alone, bids were made for UK companies worth some £43.1bn. The table below shows the split between the FTSE 100, FTSE 250 and the FTSE Small-Cap index.

Source: Peel Hunt

Some 9% of the FTSE 250 in monetary terms has been bid for, although this includes the approach for UK fund platform Hargreaves Lansdown, which has since been promoted back to the FTSE 100.

“It has been particularly noticeable in recent months that corporates have been the main acquirers. This suggests to us greater confidence in the economic outlook and the interest rate environment,” said Hall.

“It also shows the attractiveness of UK companies and the potential for synergies in a low-growth environment.”

However, he noted it was “surprising” to see relatively low activity from private equity, where he estimated there was some $4trn of cash waiting on the sidelines for new deals.

“We expect this to change as financing conditions improve, which means that private equity is likely to be a more active acquirer going forward,” he said.

As such he sees no signs of UK M&A slowing down in the second half of the year.

What is behind this?

Hall suggested the big catalyst has been the consistent withdrawals from UK equity funds, with investors pulling money out of domestic-market portfolios for 36 consecutive months.

This has left many domestic companies languishing on low valuations, making them ideal targets for overseas or private equity bids.

Additionally, when these bids come in, shareholders are “more readily agreeing” to a deal as they have performance targets and liquidity issues to meet, he said.

A third potential reason is boards are more likely to agree to an offer as well, increasing the chances of deal completion, with a key catalyst for this being that scale is becoming increasingly important.

What about new launches?

Hall noted there has been a “limited appetite” for initial public offerings (IPOs) as management teams have been “questioning the rationale of being quoted”, although added there have signs of life more recently.

“The IPO market has reopened with the recent listings of Raspberry Pi and Aoti. However, the scale of departures dwarfs the new entrants and we are continuing to see the smaller company sector diminish rapidly,” he said.

What can be done about it?

Hall said it was “vital” for UK economic growth that these trends are reversed and the UK market remains well stocked, particularly at the smaller end. He said small-caps are the “lifeblood of economic activity”.

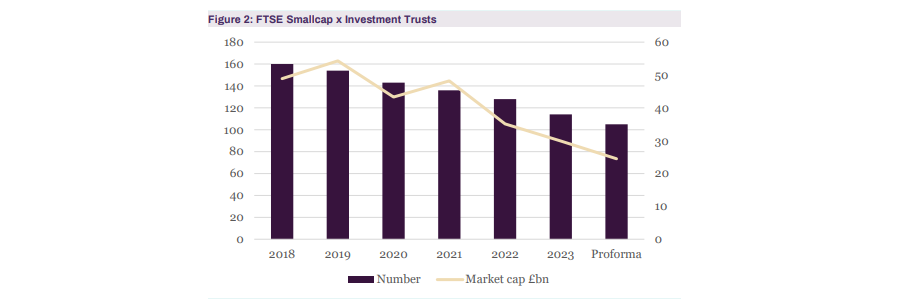

Yet the market is shrinking, sas the below chart shows, both in market capitalisation terms as well as the number of options available to investors.

Source: Peel Hunt

Hall said there were a number of measures that could be put in place to counteract some of the demand-side problems caused by fund flows away from UK funds.

Increased UK allocation by pension funds and insurance companies and the proposed UK ISA to encourage domestic investment by retail investors were two that have been well covered for some time.

In addition, he suggested removing stamp duty to ensure that “the UK is competitive with the US” as well as reducing cost of ownership and improving liquidity.

Lastly, he suggested developing a UK wealth fund, perhaps through reinvesting the investment in NatWest.

“Enacting all of these measures would require a small initial investment from the government but we anticipate would deliver a material long-term improvement in the UK equity market, economic growth and tax take,” he said.

“The demand side requires urgent attention by the new government if we are to retain our growth companies and to ensure that the equity market can provide long-term growth capital.”