Concentrated global markets are a “problem” for active managers, according to veteran stock picker Terry Smith, making outperformance relative to an index tracker “difficult to attain”.

The FE fundinfo Alpha Manager in charge of the £24.6bn Fundsmith Equity fund has had a strong start to the year in absolute terms, up 9%, but has lagged the the MSCI World index.

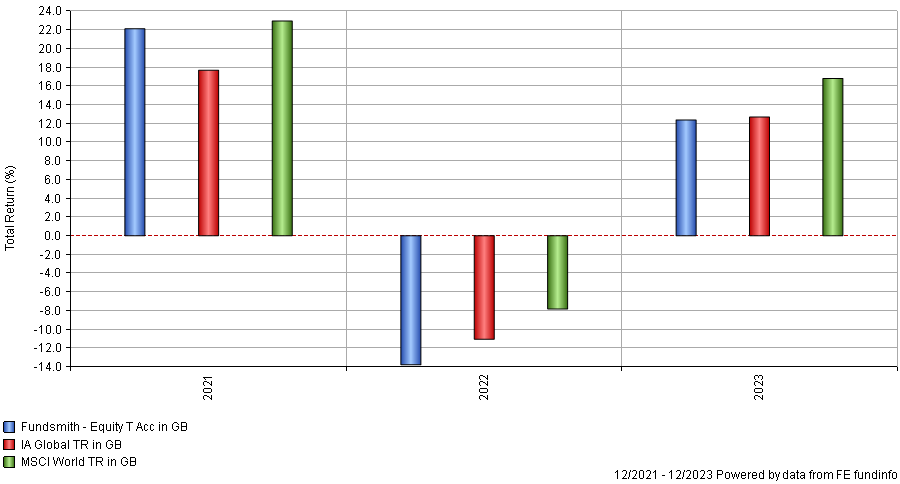

If the trend continues in the second half of the year, it would be the fourth year in a row that the fund has failed to beat the global stock market index, although in 2021 it only lost out by less than one percentage point, as the below chart shows.

Performance of fund vs sector and MSCI World index over 3yrs

Source: FE Analytics

“An increase in value of 9% in a year would be in line with the long-term average for equities, so 9% in a half year would normally be cause for celebration, except of course that it is less than the index,” said Smith.

He explained that “part of the problem” is the concentrated nature of the market, with the S&P 500’s 17% return over the first half of the year predominately generated from just five stocks: Amazon, Apple, Meta, Microsoft and Nvidia. These were responsible for 46% of the returns, said Smith.

Fundsmith Equity owns three of the five stocks mentioned above: Apple, Meta and Microsoft. It has overweight positions in Meta and Microsoft but the Apple stake “remains small as we wait patiently for the stock price to reflect the company’s current trading”, the manager said.

The big detractor was the lack of Nvidia, which alone accounted for some 25% of the S&P 500’s gains in the first half. Smith said he is yet to be convinced that Nvidia’s outlook is as predictable as the market suggests.

“Without owning this stock, and indeed the whole five in at least an index weighting, outperformance was difficult to attain,” he concluded.

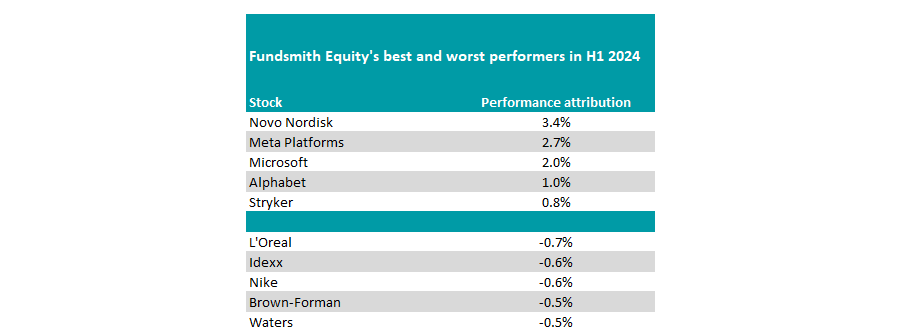

But there were some strong returns from names outside the of the big five. Novo Nordisk was the fund’s biggest performer in the first half of the year, up 3.4%.

It has been a leader in diabetes care for some time, according to Liontrust fund managers Samantha Gleave and James Inglis-Jones, and has found additional uses for its glucagon-like peptide-1 (GLP-1) diabetes treatments in the weight-loss industry.

“Since the US regulator approved injectable drug Wegovy for obesity treatment in 2021, Novo Nordisk has upgraded financial growth targets on multiple occasions as demand for the drug repeatedly outstripped forecasts,” they said.

Meta Platforms, Microsoft and Alphabet were the next three biggest gainers for the Fundsmith Equity portfolio, contributing 2.7%, 2% and 1% respectively.

Source: Fundsmith Equity

On the downside were consumer brands such as make-up company L'Oreal, sports fashion label Nike and US drinks company Brown-Forman. Meanwhile, pet firm Idexx struggled, contributing a 0.6% loss to the overall portfolio.

“A downturn in pet owners visits to vets after the pandemic splurge and troubles in the Chinese economy account for most of the problems and leave us with little concern over the longer-term outlook for most of these companies,” said Smith.

“In at least one case the problem is probably not the business but the management.”

Elsewhere, portfolio turnover in the first half was 3.7% while trading costs added to 0.003%. The fund began accumulating stakes in Texas Instruments, the manufacturer of analogue and embedded semiconductors.

“In April we began buying a new position for the fund, the name of which will be revealed when we have accumulated our desired weighting,” Smith concluded.