Emerging markets can be a prosperous place for investors to put their cash but issues can arise when so-called ‘tourists’ enter the fray, according to Matthews Asia chief investment officer Sean Taylor.

He pointed to Russia’s invasion of Ukraine in 2022 as an example. The Russian stock market immediately became uninvestable, with fund managers having to write down any assets they owned in the country to zero.

While no one could have predicted the war, he noted that “experts didn’t get caught out” in Russian assets because they could see there were issues on the horizon.

He noted that global funds are the ones that end up “catching it”, because they tend not to “worry about valuations if they’ve got growth”.

“The problem for emerging markets is the tourists that go in,” Taylor said, referring to the asset class’ perceived risk.

One area where this has happened again is in Latin America, which soared in recent years on the back of rising commodity prices.

The IA Latin America sector was the second-best in the Investment Association (IA) universe last year behind only the IA Technology & Technology Innovation peer group.

It was second behind the IA Commodity/Natural Resources in 2022, but its strong returns over those two years came off the back of a dismal 2021, when the IA Latin America peer group was the worst in the space, down 11.5%.

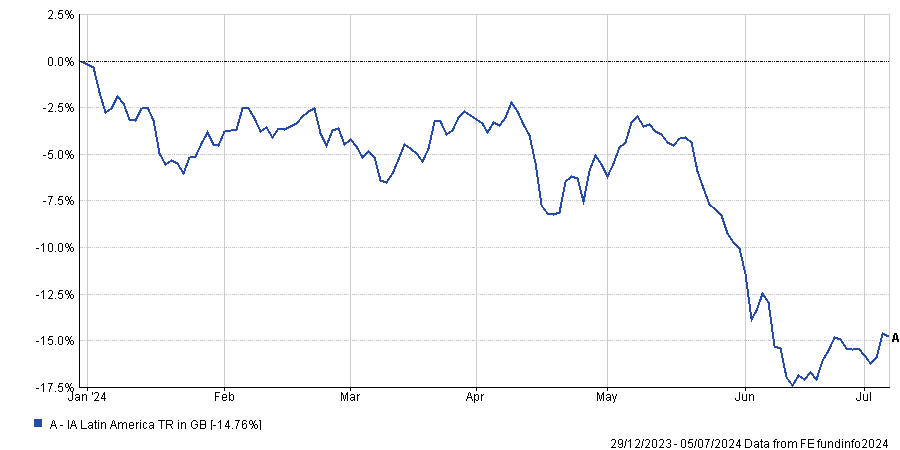

Those still in the LatAm trade this year have been caught out again. The sector has been the worst place investors could have put their money so far in 2024, with the average fund down some 14.8%.

Performance of sector over YTD

Source: FE Analytics

“It was a place where people were hiding last year. It was a good structural story. US growth was working and people moved to Latin America as a result, choosing to underweight bigger Asia markets such as Korea, Taiwan and China,” said Taylor.

“That trade obviously reversed at the beginning of the year when people got more confident on the earnings of the Asian countries.”

Matthews Asia as a firm became more cautious on Latin America towards the end of last year as the region’s strong performance meant valuations were comparatively expensive relative to Asian alternatives.

But valuations are not the only issues. He highlighted two countries in the region as examples for why the asset class as a whole has struggled.

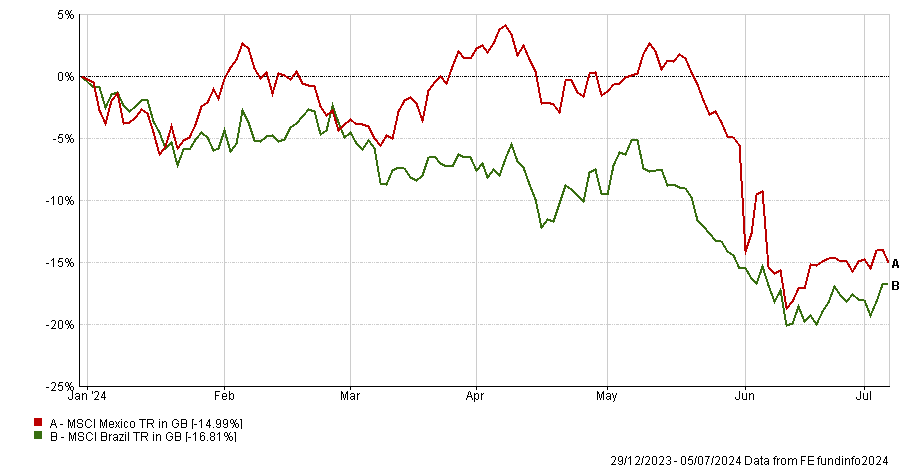

First is Mexico, which is up 36.3% in three years. So far in 2024, however, the market is down 15%.

Performance of sector over YTD

Source: FE Analytics

The country was pushed higher on the back of positive rhetoric from the US, with president Joe Biden noting the need to bring manufacturing closer to home and away from Asia – and in particular China.

“Mexico is one of the best structural stories in emerging markets,” said Taylor, because of its “access to the US”, with exports from the country “taking over the share from China”. Throw in a “low level of digitisation and financial penetration” and the country could be a long-term winner.

But it has its issues. So much so that “investment banks downgraded the currency and the equity market because that structural story is being challenged”, said Taylor.

The market recently sold off due to political instability, namely incoming president Claudia Sheinbaum Pardo, who is set to take over in October with a massive majority.

She follows on from Andrés Manuel López Obrador, also known by his initials AMLO, but Taylor said there are concerns that the new president will be more “radical” than her predecessor.

Additionally, worries over “how much influence AMLO will have over her”, as well as one final cabinet meeting in September under the current administration, instil nervousness.

Lastly, the US election could also cause big issues for the country, with former president Donald Trump likely to run on an anti-Mexico campaign as he did last time he won.

“I don’t think he would do anything to Mexico, but the rhetoric between now and the election is that Trump is going to hammer Mexico,” he said.

The Brazilian market has been on a similar trajectory in recent years to that of Mexico, up in 2022 and 2023 but down in 2024.

Here, he said “the corporate environment in Brazil is great but the overall political and global environment is difficult”.

President Luiz Inácio Lula da Silva has been a divisive figure and there are concerns he could tamper with the central bank, which recently voted to cut interest rates – albeit in a split vote.

“There is going to be a central bank change in January. Who does Lula put in? If he puts one of his friends in you have to downgrade earnings because of the currency,” said Taylor.

But the country “has a better balance sheet” and “is better run” than Mexico and “is really cheap”.

Of the two, Taylor said Brazil “will be an interesting market by the end of the year” based on its low valuations. If Trump returns to the White House later this year, “probably that would favour Brazil over Mexico”, he said.