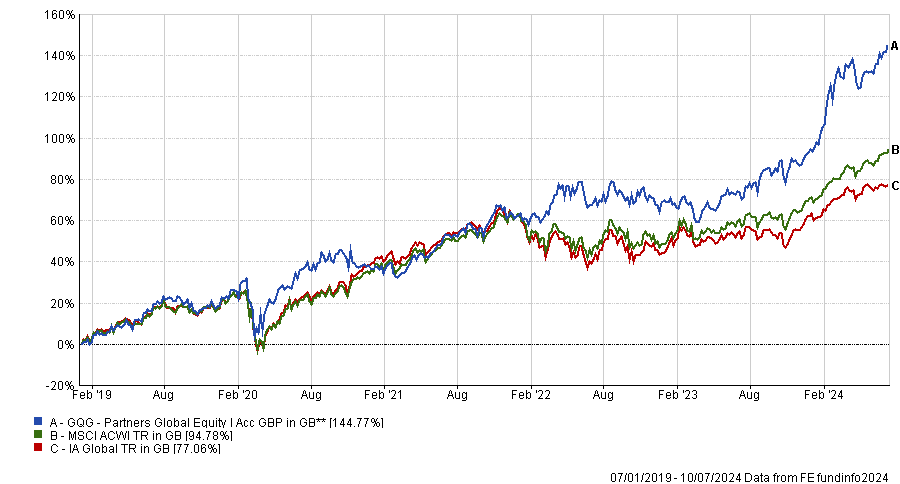

There has been no shortage of crises since the beginning of the decade, with the world grappling with a pandemic, wars in Ukraine and the Middle East, and a resurgence of inflation. While many global equity funds have struggled amidst these paradigm shifts, GQG Partners Global Equity has managed to navigate through the storm relatively unscathed.

The fund is the sixth best performer in the IA Global sector over three years and has not experienced losses in any calendar year since its launch in 2019.

Performance of funds since launch vs sector and benchmark

Source: FE Analytics

Below, FE fundinfo Alpha Manager Brian Kersmanc discusses how the quality of a stock can fluctuate wildly over time and why his portfolio is like a football team.

Could you explain your investment process?

We want to compound capital over the course of time and we want to do it with less risk.

We're more focused on the absolute return and expect 200 to 300 basis points of relative outperformance on an annualised basis over the full market cycle.

Our philosophy is built on three main pillars: a long-term focus, quality bias and capital preservation.

We won’t add any name to the portfolio if we do not have a five-year view on it. That being said, we move the portfolio pretty aggressively at times.

How do you reconcile long-term focus and aggressive turnover?

We try to have the optimal version of the portfolio based on the five-year outlook that we see today. The more the information flow changes over the course of time, the more we adjust and adapt the portfolio.

The analogy I like to use is a sports team. You put the players on the field that you think are going to execute well over the next few quarters.

As the game progresses, players perform differently than you expected, some get injured or tired, the other team makes unexpected moves, the weather changes, etc. You're going to adjust based on those factors.

And just because I put a player on the bench doesn't mean my five-year view of that player is necessarily shattered. It may just not be the optimal time to have that player on the field right now. We substitute our players in and out, which allows us to keep the portfolio as optimal as we can over the course of time.

What is your definition of quality?

Plenty of managers invest for the long run in high-quality names. Where we tend to be different is that we're very open-minded about where quality can come from. We believe quality ebbs and flows over time, so we don't screen out any particular area. Instead, we try to identify where quality is emerging.

For example, if I had asked a room full of people whether Exxon Mobil was a high-quality business two years ago, I might have seen only one hand in the air out of 30. Most people would have said: ‘It’s a commodity business that pumps oil out of the ground, has no differentiation and is subject to the economic sensitivity of oil prices, so it’s a low-quality business.’

But if I had asked the same question 10, 20 or 30 years ago, 29 out of 30 people would have raised their hands, saying: ‘Absolutely, it’s a blue-chip stock, the highest market-cap company in the entire world, with the ability to compound through cycles.’

Why was it considered high quality then? Why was it not considered high quality over the past couple of years? Are the elements in place for this to be a high quality execution story going forward?

We apply this approach across the board to identify where quality is deteriorating, where quality is improving and where the gap in perception between the two of those things is.

Why should investors have your fund in their portfolios?

We have a firm belief in client alignment. At GQG Partners, we have a policy that forbids us from having personal trading accounts. We are only allowed to invest in either GQG strategies or broad-based indexes. Half of my own personal savings are invested alongside our clients.

The reason I bring this up is that both performance and risk management matter to us. If the market goes down 15% and we're only down 10%, I'm still going to have a conversation with my wife at home as she would rightly ask, ‘Brian, why did you lose 10% of our kids' college education savings last year?’

Also, we are the only industry in the world where clients can get average for free. I can't buy an average car or an average mobile phone for free, but if I want an average investment product, I can buy an index tracker for almost nothing. Therefore, there is no reason for us to exist if we don’t deliver outperformance.

Is there anything the market is underestimating?

The market is hyper focused on the US Federal Reserve and the trajectory of interest rates. If the Fed lowers rates, it probably means it is seeing a significant deceleration in economic outlook. We would have bigger problems and I don't know if it's necessarily a good thing.

An underappreciated element of higher rates is that higher cost of capital creates a higher barrier to entry, favouring mega-cap companies.

What do you do outside of fund management?

If you have a passion for something, you end up devoting most of your time in that particular area. So, investment is what I devote a lot of my time and energy toward. When my wife watches the TV, I'll be reading annual reports next to her because that’s what makes me tick.