Investors took more money out UK bond funds than they added during the first half of the year, according to data from FE Analytics.

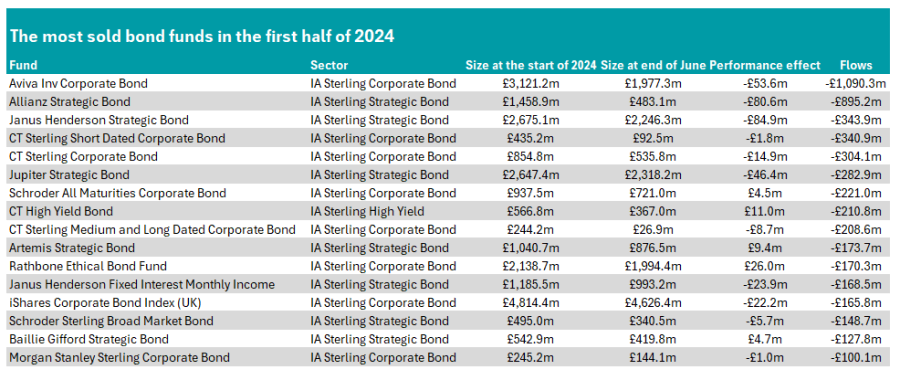

In all, there were 16 funds focused on fixed income in the IA Sterling Corporate Bond, Strategic Bond or High Yield sectors where investors withdrew more than £100m over the first six months of the year. Conversely, there were just 10 that were bolstered by more than £100m.

The unfortunate fund with the highest withdrawals was Aviva Inv Corporate Bond, where investors took out more than £1bn, the majority of which came in the second quarter of the year.

It has been among the worst funds in the IA Sterling Corporate Bond sector over three, five and 10 years, where it sits in the bottom quartile among its peers, although it climbed to the third quartile over one year. The fund failed the firm’s value assessment earlier this year, with performance cited as the main factor.

The second-most sold fund in the bond space came from the IA Sterling Strategic Bond, where investors have pulled £895m from Allianz Strategic Bond so far in 2024. Again performance has been poor, with the fund in the bottom quartile of the sector over one, three, five and 10 years.

However, much of the outflows may be explained by the announcement in May that manager Mike Riddell is leaving Allianz this month to join rival Fidelity.

Source: FE Analytics

It is a stark drop down to the next fund, where Janus Henderson Strategic Bond sits. Investors pulled £344m from the fund in the first half of the year. There were a trio of funds with outflows of more than £300m, with the other two – CT Sterling Short Dated Corporate Bond and CT Sterling Corporate Bond – both residing in the IA Sterling Corporate Bond sector.

The only constituent of the IA Sterling High Yield sector on the list was the CT High Yield Bond, with investors taking out £211m over the past six months. Columbia Threadneedle dominated the list with four funds out of 16.

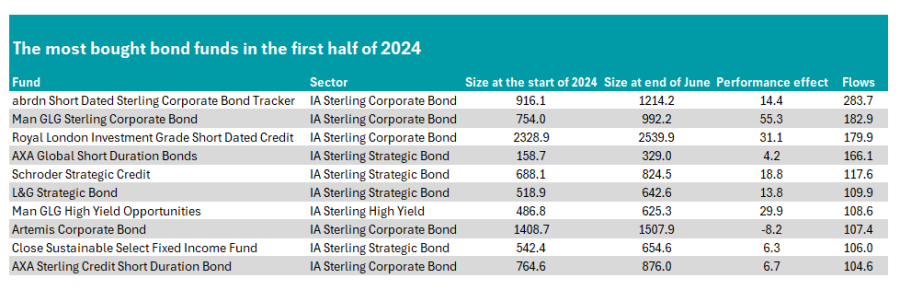

In cheerier news for bond fund managers, there were 10 that achieved inflows of more than £100m, with the most bought being a passive fund.

Abrdn Short Dated Sterling Corporate Bond Tracker took in the most money (£284m) over the first half of 2024, taking its assets under management from £916m to £1.2bn.

This is despite poor performance over the past year, in which the fund sits in the bottom quartile of the IA Sterling Corporate Bond sector. However, it is in the top quartile of its peer group over three years.

Overall inflows were lower than the outflows, however, with no other funds on the list taking in more than £200m.

The next best was FE fundinfo Alpha Manager Jonathan Golan’s Man GLG Sterling Corporate Bond fund, which raked in £183m in new money. The fund has been the best performer in the IA Sterling Corporate Bond sector over the past year.

Royal London Investment Grade Short Dated Credit rounded out the top three, which all came from the IA Sterling Corporate Bond sector. Another top-quartile performer over three years, it also boasts some of the highest returns over five years, despite making a modest 7.4% during this time.

Source: FE Analytics

Man GLG had two entrants on the list, including the only member of the IA Sterling High Yield sector: Man GLG High Yield Opportunities. Managed by Alpha Manager Michael Scott, it has been the best performer in the sector over five years and has been in the top quartile among its peers over one and three years as well.

The other firm with two on the list was AXA, with both the AXA Global Short Duration Bonds and AXA Sterling Credit Short Duration Bond funds taking in more than £100m over the first half of 2024.