BlackRock is upping risk – including by overweighting UK equities – despite macro headwinds such as sticky inflation, higher interest rates, slower growth and elevated debt as it believes “a transformation of a historic scale could be unfolding”.

In its latest note, the BlackRock Investment Institute said it is leaning into risk rather than waiting for clarity as it thinks the current investment opportunities transcend the “unusual macro backdrop”.

The firm, which is the world’s largest asset management house, pointed to the strong performance of US equities in the opening half of 2024, which rallied even as the Federal Reserve failed to deliver interest rate cuts.

Jean Boivin, head of the BlackRock Investment Institute, said: “The strength of US stock gains has been matched by corporate earnings beating expectations, led by a handful of AI [artificial intelligence] names. As a result, we see concentration as a feature, not a flaw, of today’s market environment.

“We expect some volatility ahead as markets grapple with a wide range of outcomes – as shown by last week’s brief retreat in tech shares. Recent low market volatility doesn’t reflect all risks ahead, in our view. We still think the next six to 12 months is a time to lean into risk but we prepare to reassess as new opportunities arise.”

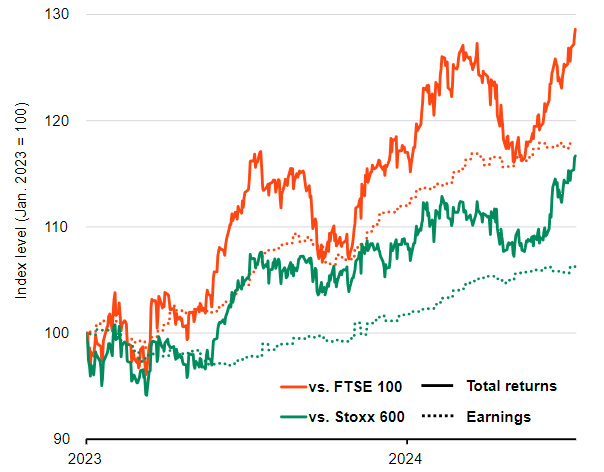

S&P 500 relative performance, 2023-2024

Source: BlackRock Investment Institute, with data from LSEG Datastream, Jul 2024. The chart shows the S&P 500 relative performance of total returns and 12-month forward earnings vs. the UK’s FTSE 100 and Europe’s Stoxx 600 indices

BlackRock highlighted three ways it is leaning into risk, with the first being maintaining an overweight to US stocks and the AI theme. The rationale behind this is the expectation that a concentrated group of AI winners will continue to drive returns.

The fund house believes the AI theme unfolding in three phases. The initial build-out phase is already yielding early winners, including major tech firms, chip producers and suppliers of essential inputs such as energy, utilities, materials and real estate. BlackRock thinks markets and central banks are underestimating the inflationary impact of this early phase.

The next phase could involve broader investment as more companies seek to leverage AI's power. The final phase, characterised by potential economy-wide AI productivity gains, remains highly uncertain and dependent on the full deployment of AI capabilities, a process that could take many years.

BlackRock has also gone overweight UK equities, which have been unloved for an extended period thanks to Brexit, a lacklustre economy and political infighting among multiple Conservative governments. However, attractive valuations, more resilient macroeconomic data and improved political stability have sparked optimism more recently.

“We see the Labour Party’s landslide UK election victory increasing the likelihood of a two-term government. The potential for long-term policy implementation should bring relative political stability, in our view,” Boivin said. “We think perceived stability can help improve sentiment – especially among foreign investors who own more than half of UK shares.”

The third way BlackRock is leaning into risk is by adding to its Japanese equity overweight, which is its highest conviction equity position because of the return of mild inflation, shareholder-friendly corporate reforms and a Bank of Japan that is cautiously normalising policy.

However, the firm added that it is balancing its risk-on stance with selective exposure to fixed income, focusing on quality. It prefers short-term government bonds and credit as they are yielding much higher income than pre-pandemic, following central banks’ interest rate hikes.