Markets are anticipating a victory for Republican presidential candidate Donald Trump in the upcoming general election, according to experts.

The recent assassination attempt, while a horrific episode, has reinvigorated the party at a time when president Joe Biden has come under pressure from fellow Democrats for his seemingly ill health.

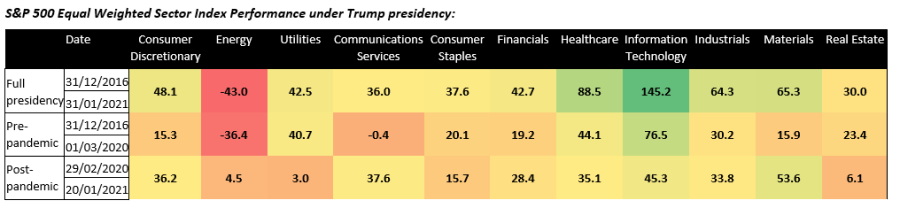

Should Trump regain the presidency, markets could be rocky, but his previous term in power was one that could give investors hope. Indeed, although his first time in office was full of uncertainty, markets performed quite well, with all bar one S&P 500 subsector making gains, as the below chart shows.

Source: Shore Capital

James Yardley, senior research director at Chelsea Financial Services, said defence stocks should thrive under Trump, who is expected to push for increased military spending.

“This focus on bolstering military capabilities, coupled with growing global security concerns, could create a strong tailwind for defence companies,” he said.

While the sector is largely admonished by environmental, social and governance (ESG) strategies, Yardley said the debate around the sector “is evolving”, and more investors “recognise the importance of security and defence in today's geopolitical climate”.

“This shift could lead to broader investment in defence stocks, potentially making them an attractive option in a Trump-led global economy,” he said.

Meanwhile, further down the market capitalisation spectrum, small-caps may do well under Trump as his ‘America First’ policies should encourage more spending on domestic goods.

Any potential increase in tariffs, particularly on goods from China, will likely benefit as a protectionist stance “could shield them from international competition and potentially boost their market share”.

Here, he likes the Artemis US Smaller Companies and T. Rowe Price US Smaller Companies Equity funds, which are “particularly well-positioned to benefit from this trend”.

“Furthermore, small-cap stocks tend to outperform in a falling interest rate environment, which will likely begin early into Trump's term,” Yardley said.

However, stocks that did well last time under Trump may continue to shine if he is re-elected, said Greg Eckel, portfolio manager of Canadian General Investments.

Leading the way during his previous tenure was technology, which gained 145%, with a particular rise during the final year when the Covid pandemic turbocharged online sales.

Eckel said the tech surge should continue

Healthcare names also thrived during his previous term, despite the former president’s efforts to overturn Obamacare and attempts to reduce the cost of pharmaceuticals.

This time around, however, investors should “be wary and expect a volatile environment irrespective of the next administration as the US healthcare industry is extremely complicated and highly prone to changes in government policy,” said Eckel.

Instead, investors may want to consider US industrials, which could benefit from “commitments to infrastructure build”, which seem to have “bipartisan support”.

Not all were convinced that US stocks would shine under Trump, however. Raphael Olszyna-Marzys, international economist at J. Safra Sarasin Sustainable Asset Management, said a possible “erosion of checks and balances” under Trump could hinder long-term economic growth, with bond yields expected to rise higher if there were to be a “Republican clean sweep”.

“The dollar might initially strengthen under Trump but could weaken over time,” he said, while equities “may gain from tax cuts initially but suffer later due to Trump’s broader policies impacting corporate profitability”.

“Overall, we believe Trump’s policies are likely to result in slower economic growth, higher inflation, increased bond yields, and a weaker dollar in the medium to long term,” said Olszyna-Marzys.

“In the short term, a looser fiscal policy stance could temporarily boost the economy, potentially lifting equity prices. Additional tariffs under Trump might initially strengthen the dollar, though this effect would likely diminish over time.”