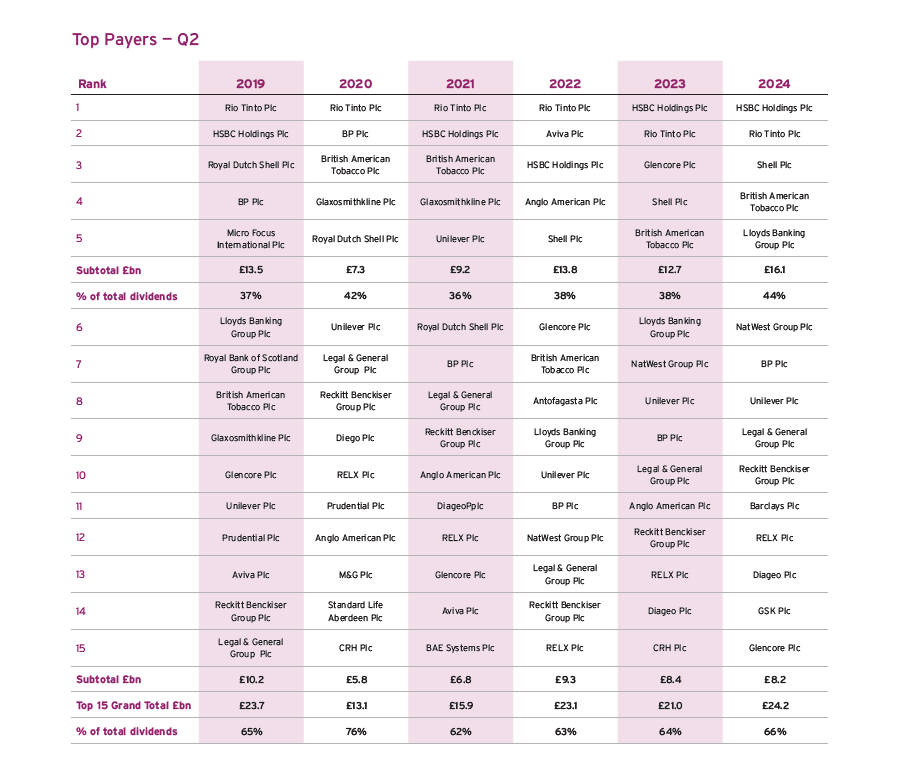

HSBC paid out some £9.3bn in dividends this quarter, representing 25% of all payouts between April and June, according to Computershare’s recent Dividend Monitor Report, but the underlying picture for UK dividends is weaker than expected.

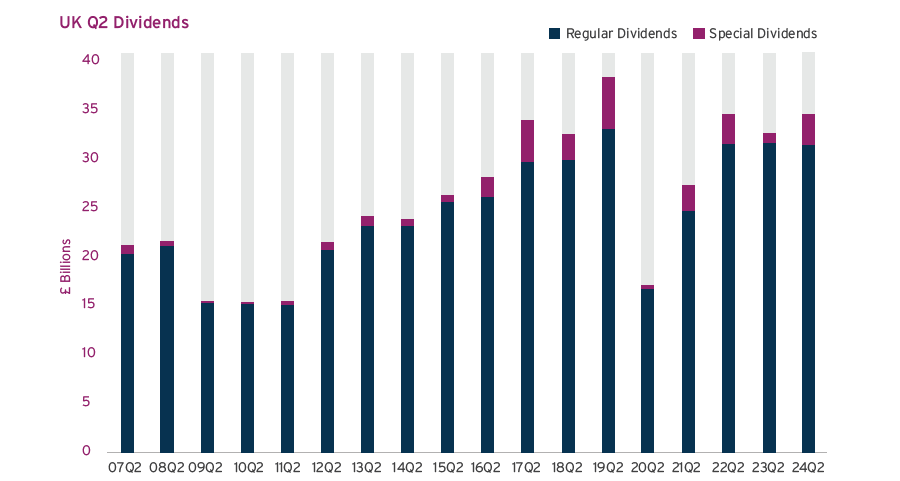

One-off special dividends totalled more than £4.1bn in the second quarter of 2024, more than the previous six quarters combined, headlined by HSBC’s £3.1bn, the fourth highest one-off dividend in 17 years. This majority of this payment came from sales proceeds of HSBC’s Canadian branch.

Other big specials between April and June included software company Ascential, which paid out £450m, and Pinewood Technologies (£358m).

Source: Computershare

As seen above, this payment made HSBC the leading dividend payer this quarter, beating out companies such as Rio Tinto, Shell and NatWest.

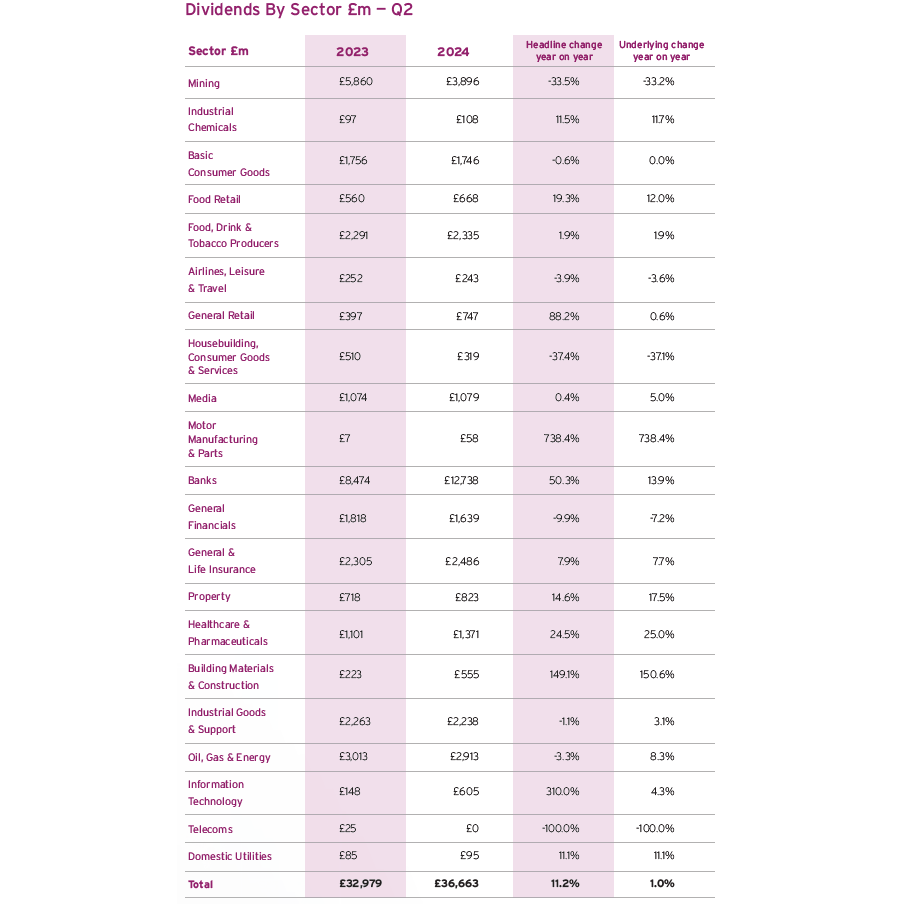

More widely, Computershare’s research indicates that most sectors also had great success in this period, with 16 out of 21 industries increasing their dividend payouts over the three months.

This surge in special dividends, has contributed to an 11% rise in dividend payouts from last year, with the market paying out a total of £36.7bn, the third highest second quarter in the report’s history.

Source: Computershare

The banking sector as a whole was one of the strongest contributors to dividend growth last quarter. Banks distributed a total of £12.7bn in the three months, 50% more than last year, with banks such as Lloyds and NatWest among of the top 10 payees in the period.

The insurance sector also contributed to a positive picture in the quarter. Businesses such as Direct Line restored payouts after the 2023 cancellation, and Aviva and L&G also made “healthy increases” the report noted.

Other sectors such as healthcare also improved notably in this period, with payouts rising by 25%, due to significant increases and for companies such as Haleon.

Mark Cleland, chief executive of issuer services for the United Kingdom, Channel Islands, Ireland and Africa (UCIA) at Computershare noted the UK economy has started to pick up, resulting in higher profits. Consequently, sectors are paying more in dividends and spending more cash on share buybacks, resulting in greater optimism towards the market.

Despite these positive results, Computershare’s underlying growth forecast for the rest of the year has settled at just 0.1%, well below the initial estimate of 1.5%.

Cleland attributed this to large cuts in other sectors, which masked the wider market strength. These cuts were so significant that the combined contribution of some of the biggest sectors such as banks, oil and healthcare was necessary just to offset the drag.

As an example, the decision by Vistry to scrap dividends in favour of share buybacks had an impact, as did cuts from companies such as Barratt Developments, which suffered from a tough housing market. In total, housebuilding dividends fell by 37% year-on-year.

Easily the most influential sector shaping this lower forecast for underlying growth, however, was the mining sector, which faced a difficult quarter characterised by a second year of consecutive spending cuts.

Despite making up £1 of every £11 of UK dividends since 2015, the mining sector was responsible for a third of the market’s volatility, with dividend payouts dropping by £2bn to just £3.8bn in total last quarter.

This decline was attributed primarily to companies such as Glencore, whose total payout was £1.5bn lower than the second quarter of last year.

“The mining sector has helped drive faster growth for UK dividends over the longer term, but the highly cyclical nature of the industry means it has introduced much more volatility into each year's overall UK dividend picture” Cleland said. “The gravitational pull of mining companies on UK dividends is hard to escape”.

Moving into the rest of the year, Cleland noted that the volatility of the mining sector will act as the major obstacle to further progress.

Dividend payouts in the mining sector are expected to decline by $3bn in total by 2025. Mining is still the second largest sector in terms of dividends, meaning this will have a big impact on the wider dividend picture.

This largely offsets the underlying growth of the wider market, but Cleland noted that this is not currently cause for concern. Overemphasising the mining sector obscures the significant progress made by many other sectors.

Source: Computershare

Indeed, if the 'mining effect' were removed from the dividend report, underlying dividend growth for the period would have reached 8.6%, a much more impressive figure.

Cleland concluded: “The second quarter figures show that most sectors are delivering growth, and we expect that to continue in the second half of the year”, with banking, insurance and oil expected to be the drivers of further growth.