As investors prepare for their financial summer and review the versatility and endurance of their portfolios, athletes are training to build up their own stamina and skills ahead of the Paris Olympics, which open this week.

Victoria Hasler, head of fund research at Hargreaves Lansdown, found several similarities between a well-constructed portfolio and the Olympics, and recommended one fund to reflect each of the five pentathlon disciplines.

Fencing: Troy Trojan

For fencing, Hasler picked the defensive Troy Trojan fund, run by FE fundinfo Alpha Manager Sebastian Lyon and Charlotte Yonge.

Performance of fund against sector and index over 5yrs

Source: FE Analytics

Rather than trying to shoot the lights out, the fund aims to grow investors' money steadily over the long run, while limiting losses when markets fall.

“The use of what are essentially swords may make fencing seem like an aggressive sport, but in reality, there is just as much skill in defending,” she said.

“The managers of the fund work with a similar philosophy, aiming to shelter investors' wealth just as much as grow it. Nimble, smart and defensive – all attributes that a good fencer needs.”

Hasler commended this popular £5.2bn strategy for its investment process, which involves four buckets. First, Lyon and Yonge invest in established companies that can grow and endure tough economic conditions. Next, there is an allocation to bonds and US index-linked bonds, which could shelter investors if inflation rises. Troy also holds gold-related investments for to protect giants inflation and market shocks. Finally, cash “provides an important shelter when markets stumble, but also a chance to invest in other assets quickly when opportunities arise,” according to Hasler.

Freestyle swimming: BNY Mellon Multi-Asset Balanced

Freestyle swimmers are able to swim any stroke they wish, just like managers of multi-asset funds have the freedom to invest in the markets and instruments they believe are most likely to succeed.

For this category, Hasler picked the BNY Mellon Multi-Asset Balanced fund, which focuses on companies with good long-term prospects from across the globe – along with some bonds and cash to act as diversifiers.

Performance of fund against sector and index over 5yrs

Source: FE Analytics

“The underlying universe of potential investments for this fund is large and includes emerging markets, smaller companies, high-yield bonds and derivatives,” she said.

In the past five and three years, the fund remained solidly anchored in the first decile of performance against the IA Mixed Investment 40-85% Shares sector; over 10 years, it was in the second.

“For investors who like a freestyle approach but don’t want to have to think about the asset allocation decisions themselves, a fund like this could be a good choice,” Hasler continued.

Equestrian showjumping: Invesco Tactical Bond

Bond markets are full of obstacles such as global economics and geopolitics, but riders (or managers) with “real skills”, such as Stuart Edwards and Julien Eberhardt of Invesco Tactical Bond, can navigate them while appearing calm and totally in control.

Performance of fund against sector and index over 5yrs

Source: FE Analytics

The fund can invest in all types of bonds, with very few constraints.

“The performance of the fund hinges on the team’s ability to interpret the bigger economic picture. Edwards and Eberhardt aim to shelter the portfolio when they see tough times ahead and seek strong returns as more opportunities become available,” Hasler said.

“Depending on the managers’ views, at different times this can be a relatively high-risk bond fund or can be run on a conservative basis. Calm, collected and always in control – a showjumper’s dream.”

The team’s recent performance, as shown above, granted the vehicle an FE fundinfo Crown Rating of five, the highest score.

Pistol Shooting: Rathbone Global Opportunities

A skilled and deliberate skill, pistol shooting “should be used with caution and control”, akin to the skillset of Alpha Manager James Thomson, who is in charge of the Rathbone Global Opportunities fund.

Performance of fund against sector and index over 5yrs

Source: FE Analytics

“Undoubtedly a skilled investor and one of only a few global fund managers to show they can pick great companies and perform better than the broad global stock market over the long term, his success can be put down to a straightforward, skilled but disciplined approach, and a willingness to view the world a little differently,” Hasler said.

“Global equity markets can be a minefield, but Thomson navigates them with ease. He shows all the hallmarks that a great pistol shooter should have – skill, caution and control.”

The fund’s performance against its IA Global peers was first-quartile over the past 10 years, but has been declining in the mid-term, falling to the second and third quartile over five and three years. It recovered recently with a second-quartile position over the past 12 months.

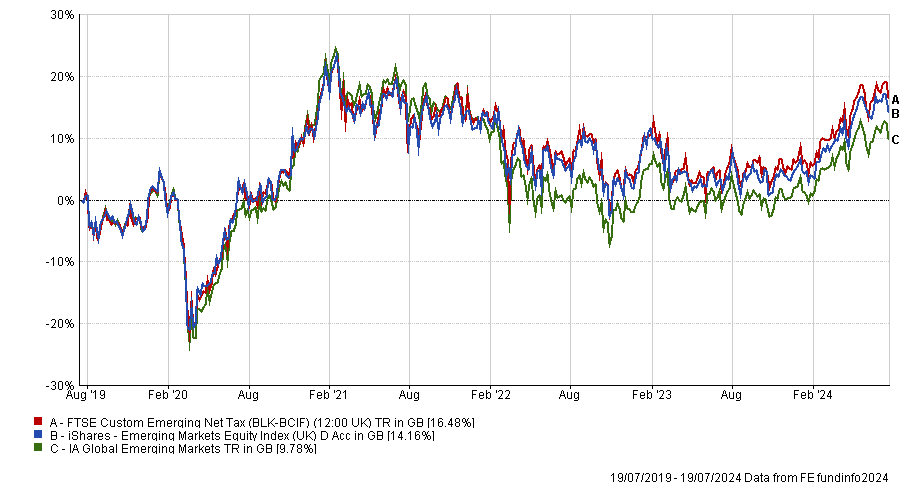

Cross Country Running: iShares Emerging Markets Equity Index

Emerging markets funds offer “a lot of potential as part of a portfolio for investors looking for long-term growth opportunities”, according to Hasler. They can be volatile, however, and require investors to stay the course and be adaptable, like cross-country runners.

The iShares Emerging Markets Equity Index fund aims to track the performance of the broader emerging stock market and is one of the lowest-cost options available to investors in this area, charging only 0.19%.

Performance of fund against sector and index over 5yrs

Source: FE Analytics

Hasler described the fund as a convenient way to invest in a broad spread of companies in a wide range of emerging countries.

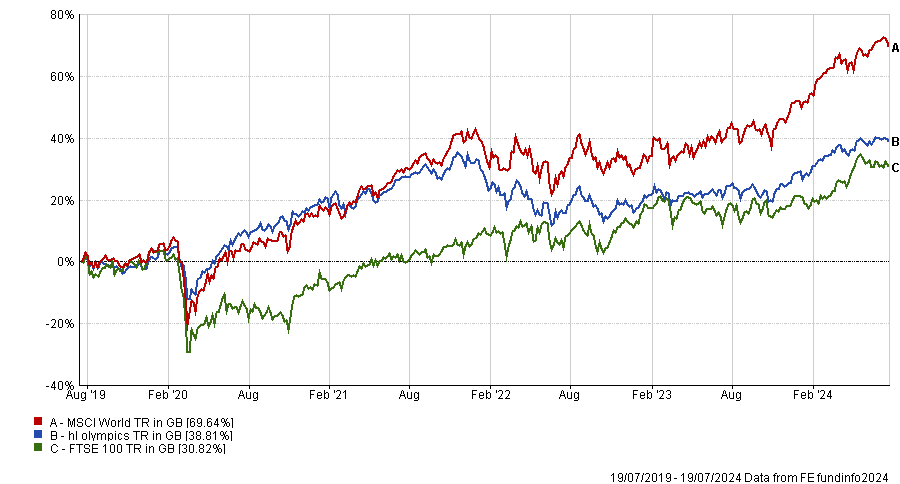

Back-tested performance of portfolio against indices over 5yrs

Source: FE Analytics