Investors often allocate to emerging markets to benefit from the higher economic growth prospects in those regions.

However, moving into emerging markets based on top-down views often misleads investors, according to FE fundinfo Alpha Manager Douglas Ledingham, portfolio manager of Pacific Assets Trust.

He said: “Many investors confuse top-down trends with the potential for long-term returns. There's a real dichotomy between that top-down view of wonderful levels of economic growth, educational attainments or healthcare outcomes and investment returns.”

China serves as a case in point to illustrate that impressive economic growth does not always translate into stock market returns. Despite the Chinese economy regularly delivering double-digit GDP growth over the past 30 years, its stock market has not rewarded investors.

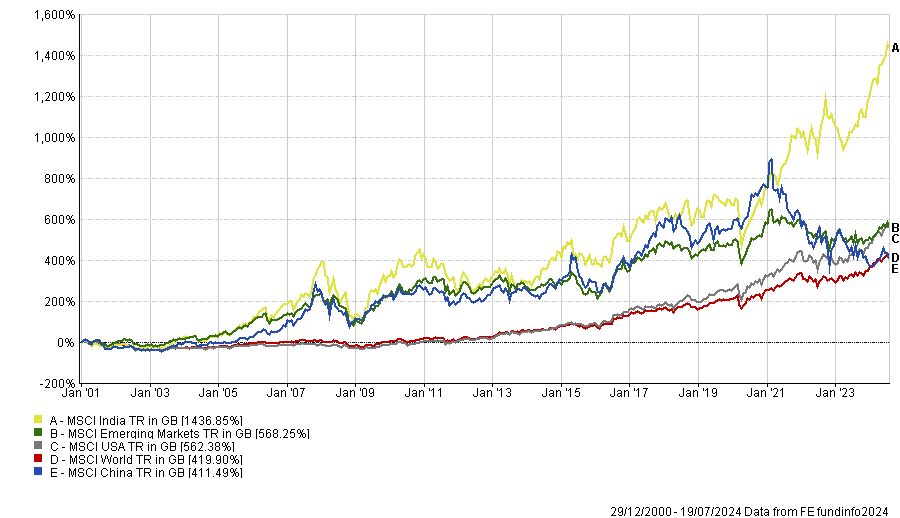

The MSCI China index has failed to outperform the MSCI World, MSCI Emerging Markets or MSCI USA indices and has severely lagged its emerging markets rival, the MSCI India index, over the past 23 years.

Performance of indices since 1 Jan 2001

Source: FE Analytics

Ledingham added: “You can lose a lot of money by simply assuming that a country or a thematic is going to grow very quickly and choose to get an exposure to those based on a top-down view.

“The focus should be on the companies, not on a country’s economic prospects or thematic trends.”

Despite Chinese equities now trading on very low valuations following a multi-year rout, Ledingham and his colleagues at Stewart Investors have not been tempted by the cheap prices. Indeed, Chinese equities account for a modest 7.4% of the Asia Pacific investment trust’s portfolio.

This is because a large number of Chinese companies are either state-controlled or state-owned.

“As stewards of other people's capital, we're uncomfortable handing their hard-earned savings to the state. A distinction must be made between the best interests of the economy or the country on the one hand and the best interests of minority shareholders on the other. We know that state-owned companies will always pick the former,” he explained.

“We much prefer to be handing our clients’ capital to management teams and stewards who are very much aligned with our time horizon and our view of risk and are making decisions today that will make their business better in 10 years’ time.”

Unlike the managers of Pacific Assets Trust, Chris Tennant, manager of Fidelity Emerging Markets, has taken advantage of the low valuations in China to top up his high-conviction ideas.

He said: “Sentiment towards China is the worst it’s been in the past 15 years. International investors have thrown in the towel, so there are a lot of very compelling value opportunities.”

While the crisis in the real estate sector has plagued China in recent years, Tennant believes that the worst of this “painful, but necessary adjustment process” is now behind us.

As a result, he has been allocation to consumer names, as an improvement in the real estate sector could boost consumer confidence.

“I think once the government sets a floor on house prices, we could see a recovery in consumption,” Tennant said.

“There’s been a similar level of excess savings relative to GDP built up in China through the Covid period as we saw in the rest of the world. The difference is that the Chinese consumer didn't go out and spend once the economy reopened because of what was going on in the housing market.”

Yet, Tennant warned that there are still “massive problems” in China, making many sectors “completely uninvestable” because of their supply and demand dynamics.

One such sector is banking, which has been “encouraged or forced” to lend to real estate developers to prevent insolvency.

Additionally, the government has been decreasing interest rates to support the property sector, adding pressure on margins in the banking sector.

However, Tennant stressed that this does not mean China is facing the risk of a banking crisis, but rather that banks will likely see bad debts appear on their balance sheets in the coming years, which will lower the quality of their books.

Another sector Tennant avoids is industrials, as China has built up significant capacity over the past decade and is now facing overcapacity issues in several areas, including solar and automotive.

“That excess capacity is now being exported to the rest of the world. That's one of the reasons why you're seeing tariffs being increased on China,” he said.