The FTSE 100 has reached record highs this year but remains attractively valued and offers higher dividend payouts than elsewhere, according to RBC Brewin Dolphin.

Although the UK is unlikely to match the growth prospects of the tech-heavy US stock market, Rob Burgeman, senior investment manager at RBC Brewin Dolphin, thinks that income-focussed strategies are the best way to play to the UK’s strengths.

“The real value is in the dividends some of the market’s biggest companies are paying out and, almost more importantly, the cashflow they are generating, which is increasingly being used to buy back their own shares,” he argued.

With a forecasted price-to-earnings (P/E) ratio of 12x, the UK has generally been cheaper than its international counterparts, and this year is proving no different. For example, the MSCI Europe index has a P/E ratio of almost 14.4x this year, with the S&P 500 at 18.8x. Burgeman attributed this relative affordability to the FTSE 100’s composition, with almost 40% of the index comprised of energy, resources and financial firms.

For investors seeing exposure to UK-listed stocks with ample cashflows and dividends, Burgeman recommended three funds and three stocks, below.

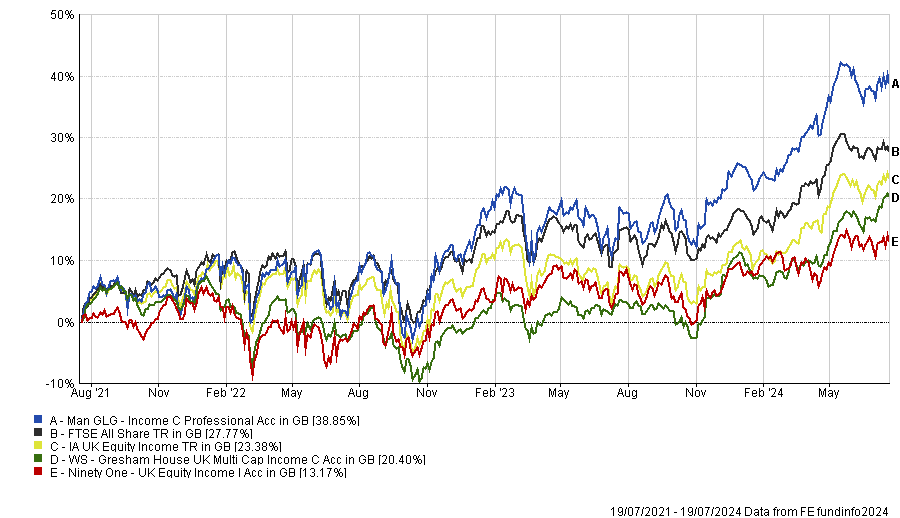

Man GLG Income

Led by FE fundinfo Alpha Manager Henry Dixon, Man GLG Income aims to invest in under-valued assets. The fund offers a strong level of income and the prospect of further capital growth, Burgeman said.

While many of the fund's top holdings are in established businesses like HSBC, smaller companies such as Lancashire Holdings are also featured.

The £1.2bn strategy has consistently ranked in the top quartile over the past five years. During this period, Man GLG regularly featured amongst the sector's top 10 performing funds and was one of the most bought funds in the first half of 2024.

WS Gresham House UK Multi Cap Income

Burgeman also suggested the WS Gresham House Multi Cap Income fund, which he believes has strong growth opportunities.

Led by Brendan Gulston and Ken Wotton, the fund invests in 41 companies across the UK, including major names such as the investment trust 3i Group and the discount retailer B&M.

The fund holds almost 40% of its assets in financial services and 22% in consumer businesses.

With £874m under management, the fund has ranked in the top quartile over both a one-year and five-year period.

Ninety One UK Equity Income

Burgeman also drew attention to smaller funds such as the £81.5m Ninety One UK Equity Income fund, led by fund managers Ben Needham and Anna Farmbrough.

As a more traditional strategy, it offers a comparatively lower yield of 2.19% and only ranks in the third quartile over the past three years.

It is far less volatile than some of its competitors, with most of its top holdings being in market-leading companies such as the London Stock Exchange Group.

This lack of volatility is demonstrated in the table below, which shows how the Ninety-One UK Equity fund generally matches or slightly exceeds the benchmark over three years, but rarely sees large shifts away from the benchmark.

Performance of funds vs benchmark over 3yrs

Source: FE Analytics

Dividend payers worth backing

Equity income funds are not the only way to benefit from attractive valuations and high dividends. Investing directly in individual companies such as Unilever also has the potential to deliver strong returns and can add significant diversification to an investor’s portfolio, Burgeman said.

Despite selling its underperforming ice cream business, Unilever still operates in over 190 countries with over 3.4 billion customers.

With an average P/E ratio of 18.2x, shares in Unilever are reasonably valued, he said.

Burgeman also highlighted the insurer Legal & General. Although insurance companies have increasingly fallen out of favour, Legal & General’s shares are relatively cheap, trading on a P/E ratio of 10.7x, and they are yielding more than 8%.

“By international standards, Legal & General is a relatively small insurance group and, given it is rated so cheaply and is almost entirely UK-focussed, you wouldn’t be surprised to see a larger overseas peer take an interest in the company,” Burgeman concluded.

The business with the greatest opportunities for equity investors, however, is Barclays, Burgeman argued. Despite the recent rise in its share price, the bank trades at just 7.8x and benefits from a strong balance sheet and a diverse business portfolio.

Crucially, the firm has committed to returning nearly a third of its value to shareholders in share buybacks and dividends, predicted to reach a total of almost £10bn over the next three years.

“Whatever you think of the prospects of UK banking, that is a lot of capital to return to shareholders and, all things being equal, should make for reasonable returns,” Burgeman said.

The UK may never be where investors hunt for the “next big thing”, but there are several businesses and funds which are taking advantage of the current market conditions to offer opportunities for further growth, he said.