Dramatic changes in the macroeconomic environment have reversed the fortunes of several funds.

Although these funds have been laggards for most of the past decade, higher inflation and rising interest rates propelled them from zero to hero.

Below, Trustnet examines the funds in the IA UK All Companies sector with bottom-quartile performance over the past decade but which sit in the top quartile over the past three years, highlighting a significant turnaround in performance.

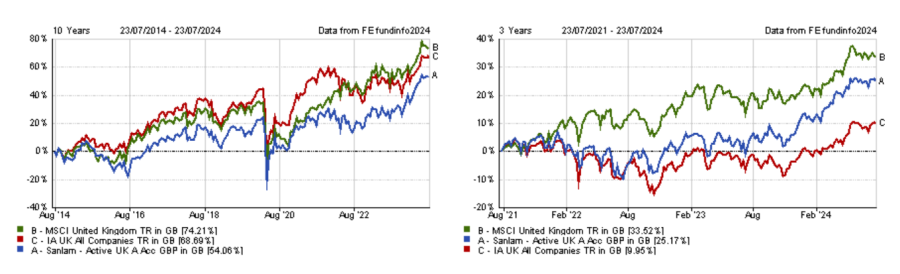

One such fund is Sanlam Active UK, which ranks 154th out of 184 over 10 years, but has improved to 40th out of 224 over three years. It should be noted that, while it has outperformed its sector and the FTSE All-Share in recent years, it has trailed the MSCI United Kingdom index, which it benchmarks itself against.

This fund, managed by Andrew Evans since September 2018, follows a fundamental bottom-up, buy-and-hold approach, focusing on attractively priced quality companies with competitive franchises and strong cash generation.

The outcome of this process is a concentrated portfolio, with the top 10 holdings accounting for 51.6% of the overall portfolio and the top 20 holdings comprising 84.8%.

The fund’s largest sector weighting is in financials, which have benefited from a higher interest rate environment.

Performance of fund over 10yrs and 3yrs vs sector and benchmark

Source: FE Analytics

For example, UK banks have outperformed the tech-heavy S&P 500 over the past three years. They have been able to charge customers higher interest rates and receive more interest income on their deposits at central banks, while passing on very little to current accounts, resulting in an increase in net interest income.

Sanlam Active UK holds Barclays and Lloyds Banking Group among its top 10 positions.

The fund has also capitalised on the recovery of its largest holding, Rolls Royce. Under the leadership of its new chief executive officer, Tufan Erginbilgic, the company has embarked on a series of aggressive cost-cutting and profit-maximization initiatives.

Additionally, Rolls Royce has benefited from renewed interest in the defence sector following the outbreak of the war in Ukraine and conflicts in the Middle East.

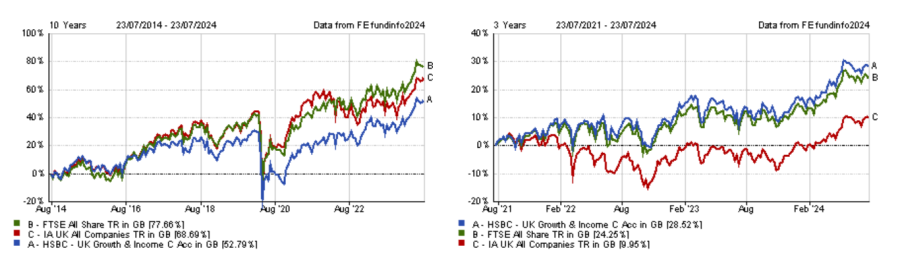

HSBC UK Growth & Income, managed by Paul Denham and Ed Gurung since 2021 and 2023 respectively, has also turned the tide in recent years.

While it ranks 156th out of 184 over the past decade, it has been the 29th best-performing fund out of 223 over three years.

Similarly to Sanlam Active UK, it is exposed to the UK banking sector via HSBC and Barclays and to the defence industry through BAE Systems.

However, its two top holdings are Shell and BP from the energy sector, which has been dominating markets since the Covid lows of mid-March 2020.

Commodity prices have been driven up by rising inflation and interest rates, ongoing conflicts in Eastern Europe and the Middle East and various supply chain issues.

Performance of fund over 10yrs and 3yrs vs sector and benchmark

Source: FE Analytics

In terms of strategy, HSBC UK Growth & Income follows a benchmark-aware approach and typically holds between 40 and 70 companies.

It measures itself against the FTSE All-Share index, which is rich in ‘old economy’ sectors such as oil and gas, financials and mining, and has proven to be well-equipped in a more challenging macroeconomic environment, after being a perennial laggard during the low inflation and interest rate era following the global financial crisis of 2008.

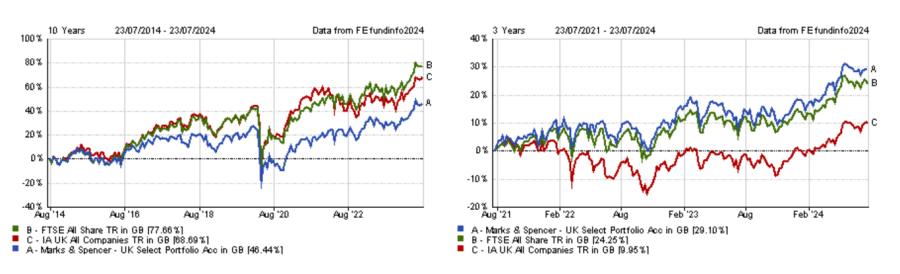

Marks & Spencer UK Select Portfolio also had a return to form in the past three years, ranking 27th out of 224, compared to 167th out of 184 over the past decade.

It is managed by HSBC Global Asset Management and has the same top two stocks as HSBC UK Growth & Income – Shell and BP, which have enabled the fund to benefit from the rebound in the oil price.

It also holds BAE Systems and HSBC, giving it exposure to the defence and banking sectors.

Performance of fund over 10yrs and 3yrs vs sector and benchmark

Source: FE Analytics

Finally, the Halifax UK Large Company Tracker has also experienced a turnaround in the past three years.

Unlike most passive funds, this tracker aims to replicate a customised version of the FTSE 100, excluding coal, tobacco and manufacturers of controversial weapons, as well as companies that do not meet one or more of the 10 United Nations Global Compact principles.

Despite these exclusions, this passive fund still has significant exposure to oil & gas and banks, with holdings such as Shell, BP and HSBC.