Emerging markets have undergone tremendous changes in recent years, as their largest constituent – China – experienced a severe crash and remains plagued by a range of troubles such as government interventions, issues in the property sector and geopolitical tension with the West.

As a result, research from Trustnet shows that several funds with little exposure to the world’s second-largest economy may have struggled over the past decade but fared better over three years.

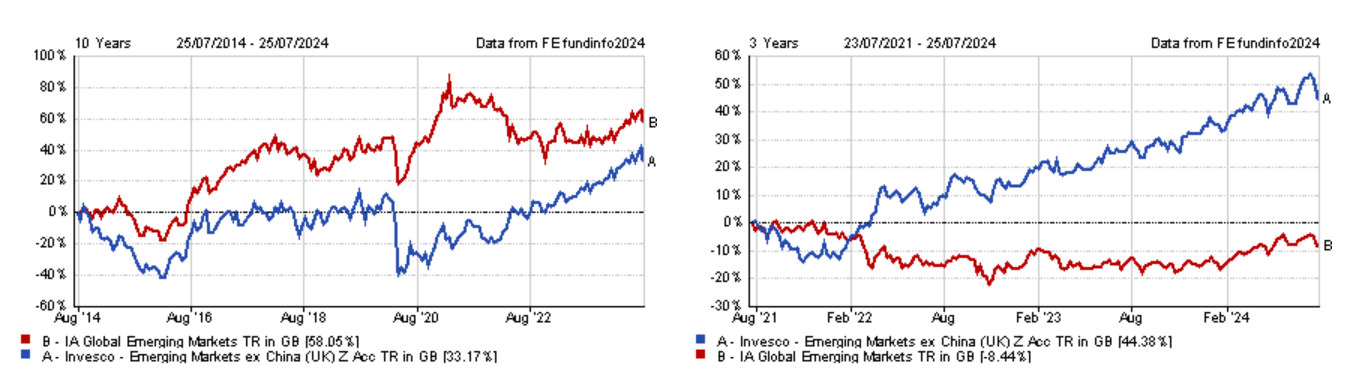

Invesco Emerging Markets ex China (UK) is a case in point, which, as its name suggests, it does not hold equities from mainland China.

The fund sits in the bottom quartile of the IA Global Emerging Markets sector over 10 years, as it previously focused exclusively on Latin American equities, which have struggled over the past decade.

In 2022, the fund changed its mandate to cover emerging markets ex-China. This strategic decision has proven fruitful , as the fund is now the sector’s top performer over the past three years.

Analysts at FE Investments said: “Much of the outperformance was due to favourable country and sector positioning across the portfolio, particularly in maintaining an overweight across Latin America as well as the materials sector. The main driver of outperformance however was positive stock selection across several sectors, most notably technology and financials.”

Performance of fund over 10yrs and 3yrs vs sector

Source: FE Analytics

The fund, managed by FE fundinfo Alpha Managers Charles Bond and James McDermottroe, has a slight value bias, leading it to overweight cheaper markets such as South Korea, Brazil and Thailand. Conversely, the fund is underweight India – a notoriously expensive market – relative to the benchmark.

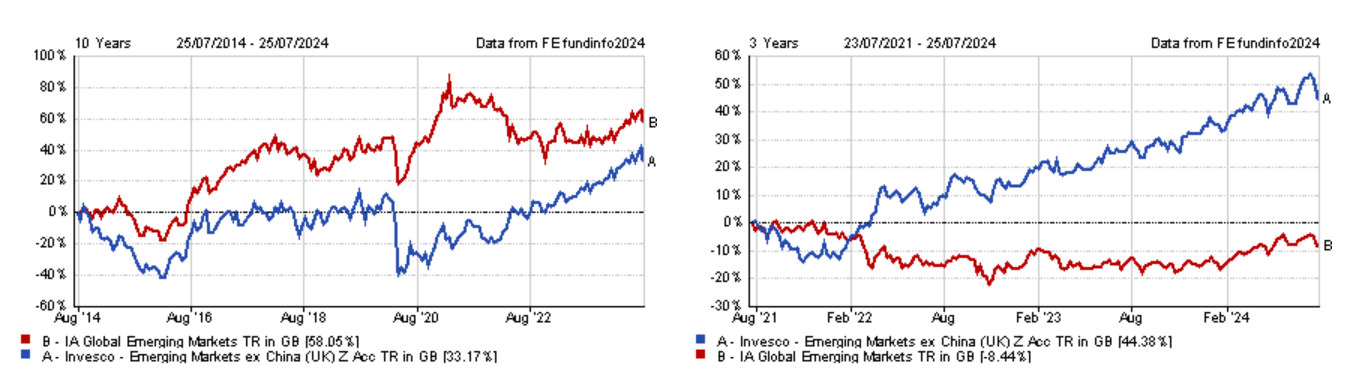

Similarly, in the IA Asia Pacific ex Japan sector, both HSBC MSCI Pacific Ex Japan UCITS ETF and Vanguard Pacific ex-Japan Stock Index have benefited from their lack of exposure to mainland China, even though Hong Kong-listed equities account for 16.5% of the MSCI Pacific ex Japan index.

The two passive funds have been laggards over the past decade, sitting in the bottom quartile of the IA Pacific ex-Japan sector. However, they have fared better over the past three years, achieving top-quartile performance.

Performance of funds over 10yrs and 3yrs vs sector and benchmark

Source: FE Analytics

The two funds’ largest country weight is Australia, which makes up 61.8% of the portfolio. Jason Pidcock, manager of Jupiter Asian Income, recently told Trustnet that Australia is “ridiculously” under investors’ radar, in spite of its large, liquid companies, good corporate governance and attractive dividends.

For similar reasons, iShares Asia Pacific Dividend UCITS ETF, which benchmarks itself against the Dow Jones Asia/Pacific Select Dividend 50 Index, has performed better in recent years.

The IA Asia Pacific Including Japan fund’s index also has its largest country weight in Australia and holds slightly more in Hong Kong.

Back in the IA Global Emerging Markets sector, SPDR S&P Emerging Markets Dividend Aristocrats UCITS ETF has also moved from the bottom quartile over 10 years to the top quartile over three years, despite China being its largest country weight.

In a challenging period for Chinese equities, dividend payers have fared better than their low-yielding counterparts. As a result, Goldman Sachs believes they will remain the most attractive and defensive opportunity in the Chinese equity market.

“Given macroeconomic uncertainties, we think companies with more stable free cash flows and good shareholder returns look attractive,” Goldman Sachs said.

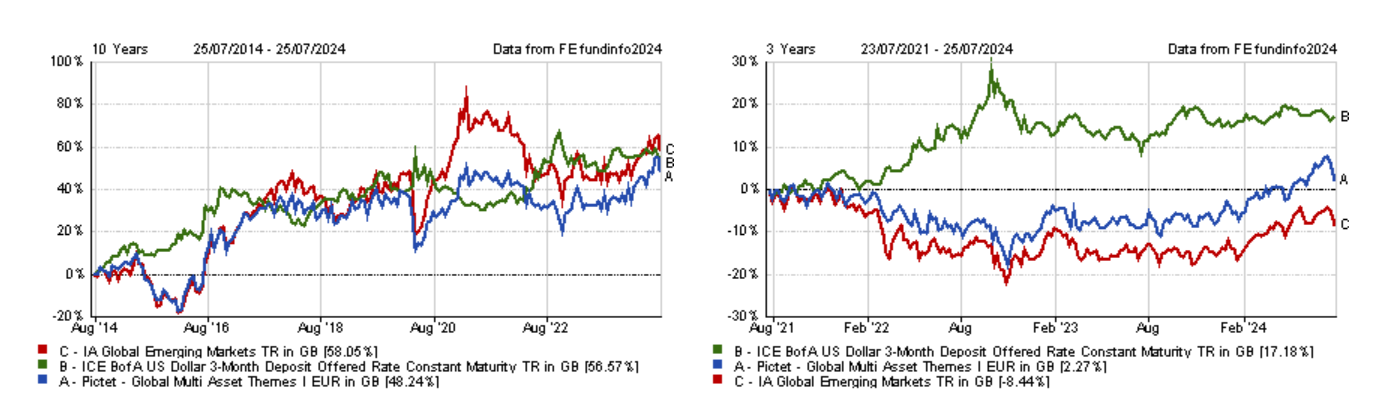

Pictet Global Multi Asset Themes is another emerging markets fund to have seen improved performance relative to its peers in recent years, following a difficult decade.

Performance of fund over 10yrs and 3yrs vs sector and benchmark

Source: FE Analytics

Although a constituent of the IA Global Emerging Markets sector, the fund's largest allocation is to North American equities.

The manager, Laurent Nguyen, aims to capture diverse investment themes through various asset classes, including alternatives, and maintains a benchmark-agnostic approach.

No fund in the IA Latin America sector has experienced a similar turnaround in performance.