Global asset manager Franklin Templeton has launched the Franklin FTSE Japan UCTIS ETF, to give investors access to more than 500 Japanese companies. Primarily invested in large- and mid-cap stocks in Japan, it will passively track the performance of the FTSE Japan.

It is the first exchange-traded fund (ETF) tracking Japan in the Franklin Templeton range and comes at a time when the market is booming. The Nikkei 225 hit new heights for the first time in 34 years earlier in 2024 and has attracted investors including renowned US stock picker Warren Buffett in recent years.

However, it has not been smooth sailing more recently, with the Nikkei 225 down 3.3% last week led by companies such as Hitachi and Softbank, as tech stocks routed.

Nevertheless, Caroline Baron, head of ETF distribution EMEA at Franklin Templeton, said: “The country’s strong position on the global technology supply chain, including semiconductors, along with a renewed focus on corporate governance and shareholder value should also bode well for the domestic equity market.”

According to Matthew Harrison, head of Americas, Europe and UK at Franklin Templeton, the launch of this Japan-focused ETF reflects the firm's ambition to diversify the portfolios of their European investors.

“With $6trn in market capitalisation and Japanese market returns expected to recover, Japanese equities can be a core equity building block option within an investor’s portfolio”, Harrison said.

This launch comes during a period of strong growth for ETFs, with European ETF revenue rising to $59bn over the past three months, representing a year-on-year increase of 88%, according to Invesco analysts.

Equity assets under management (AUM) dominated inflows in the period, hitting an all-time high of $1.45trn in the second quarter.

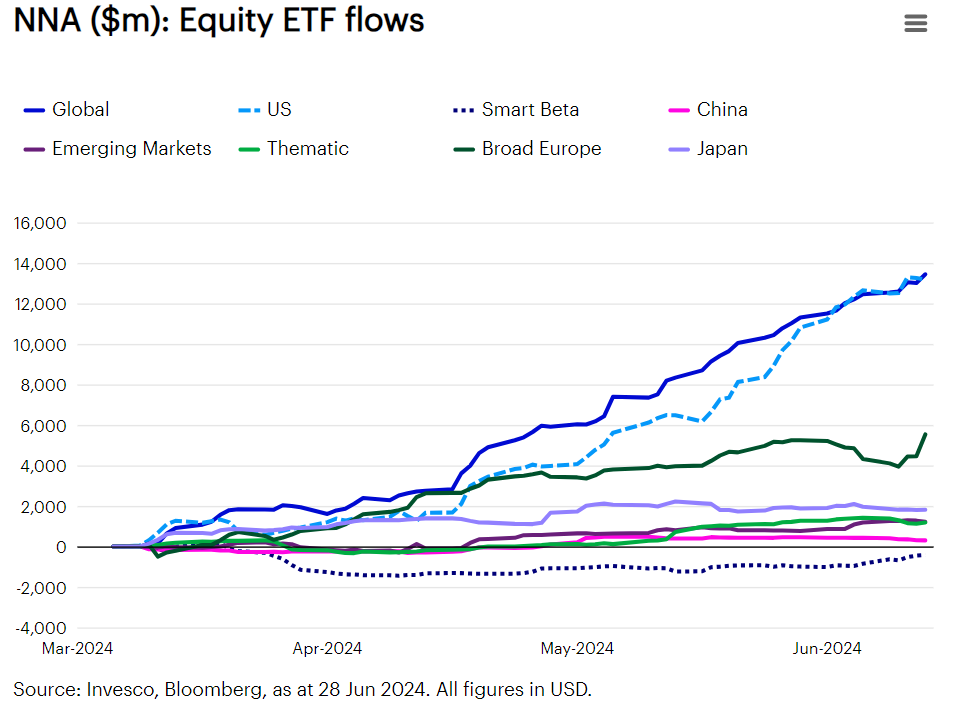

Of this revenue, Invesco found net new assets (NNA) for Japan had risen to almost $2bn over the past four months, reflecting a growing enthusiasm for Japanese equities amongst European investors.

Source: Invesco

Global equities, however remained the largest contributions to inflows in this period at $13.4bn, accounting for a third of the total equity flows year to date, despite a slight decline compared to the first half of the year.

Commenting on the outlook for 2023, Gary Buxton, head of ETF EMEA at Invesco, said: “While the macroeconomic backdrop remains supportive for financial markets generally and should continue to lead strong demand for ETFs in the second half of the year, political and geopolitical risks remain.

“Delivery of easier monetary policy in the second half of the year may prompt investors to look again at some of the other unloved parts of the market with thematic exposures a potential beneficiary.”