This week will be a decisive one for interest rates domestically and across the pond, with both the US Federal Reserve (Fed) and the Bank of England (BoE) due to meet on Wednesday and Thursday, respectively.

But while the consensus is almost 100% for the Fed to hold rates until September, the decision in the UK will be more of a “coin toss”, according to Peel Hunt’s chief economist Kallum Pickering.

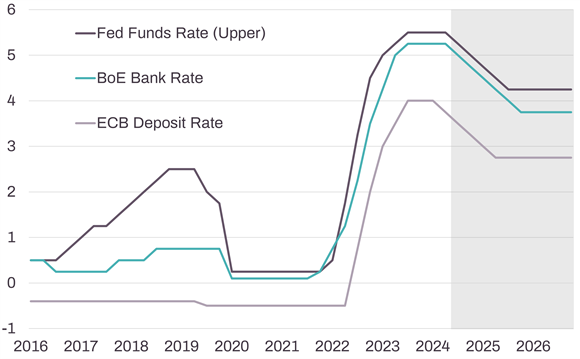

Peel Hunt projections for central bank policy rates

In % YoY. Monthly data. Source: Federal Reserve, ECB, BoE, Peel Hunt

At the previous meeting in June, domestic policymakers voted 7-2 in favour of holding the Bank Rate at 5.25%, but the decision was ‘finely balanced’, which is BoE-speak for ‘we are considering cutting rates soon’, Pickering explained.

The market is torn on whether tomorrow will be that time already. While a rate cut “makes sense”, he said, “it would not be a total surprise if policymakers cautiously held rates this week and waited until the next meeting on 19 September or even the 7 November meeting to begin the rate cutting cycle.”

Overnight index swaps (a derivative mechanism to manage exposure to short-term interest rates) are putting a 60% chance on a 25-basis-points cut and Reuters economists predict a 5-4 split in favour of the same outcome.

Thursday’s decision will hinge on how policymakers balance the risks associated with keeping monetary policy too tight for too long, the recent strength of economic activity versus the modest weakening of labour markets, and the stickiness of some underlying measures of inflation.

“If policymakers get the timing and pace of rate cuts roughly right, they will be able to add a tailwind to the building recovery and stabilise labour markets without restoking inflationary pressures,” Peel Hunt’s economist said.

“But in the end, the final decision this week may come down to Andrew Bailey, who would cast the deciding vote in case of a four-four split between cutting and holding the Bank Rate by the other eight committee members. It will be a coin toss.”

Whatever the policy decision, Pickering expected some repricing of money and currency markets, perhaps with “modest reverberations” across UK equities.

Meanwhile in the US, the path leading to a cut looks much clearer, with the Fed likely to keep the upper rate limit unchanged at 5.5% with a policy statement which “should cement ours and financial markets’ expectations for a first cut at the 17-18 September meeting,” Pickering said.

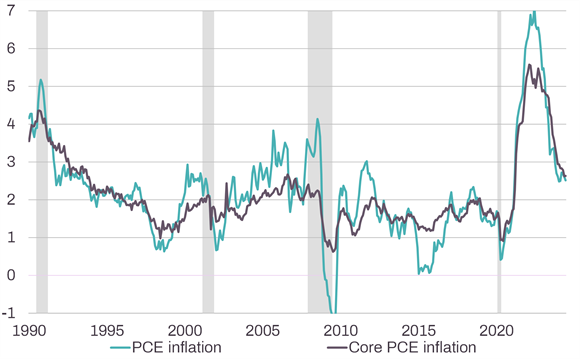

US inflation measures

In % YoY. Inflation based on personal consumption expenditures (PCE), core excludes food and energy. Shaded area shows National Bureau of Economic Research recession periods. Monthly data. Source: BEA, NBER, Peel Hunt

The Fed’s dual mandate to maintain price stability and maximum employment means it can cut rates before inflation fully reaches 2%, which seems even more likely after chair Jerome Powell recently said that “elevated inflation is not the only risk we face”.

The overnight index swaps market is discounting a de-facto 100% probability that the Fed will make the first cut at the September meeting and, while this is in line with Pickering’s forecast, he warned that “it is not a done deal”.

“While a September cut looks likely, it is not a done deal – even if Powell gives a nod this week. Significant upside surprises to inflation, inflation expectations or wages in upcoming data may yet persuade policymakers to hold off in September,” Pickering said.

Looking further out to the rest of the year, he is anticipating two 25-basis-points cuts each from the BoE and the Fed before end of the year, taking the UK rate to 3.75% and the US Rate (upper limit) to 4.25% by the end of 2025.

However, not all agreed. Guy Stear, head of developed markets strategy at the Amundi Investment Institute, was in-line with Pickering on the Fed but different on the UK central bank.

He said investors were “too hawkish” on the BoE, suggesting it could “not only cut this week, but keep doing so through the end of the year. Indeed we think Base Rates could be a full 100bp lower by year end.”

He agreed that the upcoming meeting was a “coin toss” but noted that “irrespective of the exact timing of the first cut”, he continues to expect two rate cuts in 2024.

“Core inflation is likely to fall ahead as pandemic-related effects fade, policy remains tight, and the labour market rebalances. Comments by Rachel Reeves yesterday show that the new government is strongly committed to fiscal discipline, which reduces upside inflation risks in future years,” he said.